Share the post "The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage"This is the eighth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. The Efficient Market Hypothesis says that all available information will get priced into assets efficiently. This means that more information will help us better arrive at efficient prices for financial assets. I’ve expressed my dislike of this idea in the past because, well, I just don’t find it that helpful. After all, it says nothing about whether these prices are “right” or “wrong”. It merely says that prices include all available information. In other news, water is wet. Alright, I’m being a little schmucky, but hear me out.I would rephrase the EMH to include a temporal caveat – price efficiency is inversely proportional to time. In the long-term markets tend to be efficient, but in the short-term markets tend to be inefficient. Take a really simple instrument like a 10 year T-Bond paying 2%. This instrument will pay out its cash flows of 2% per year every year for 10 years.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage"

This is the eighth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important.

The Efficient Market Hypothesis says that all available information will get priced into assets efficiently. This means that more information will help us better arrive at efficient prices for financial assets. I’ve expressed my dislike of this idea in the past because, well, I just don’t find it that helpful. After all, it says nothing about whether these prices are “right” or “wrong”. It merely says that prices include all available information. In other news, water is wet. Alright, I’m being a little schmucky, but hear me out.

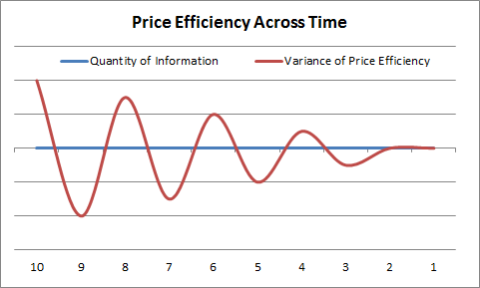

I would rephrase the EMH to include a temporal caveat – price efficiency is inversely proportional to time. In the long-term markets tend to be efficient, but in the short-term markets tend to be inefficient. Take a really simple instrument like a 10 year T-Bond paying 2%. This instrument will pay out its cash flows of 2% per year every year for 10 years. Of course, there’s a slight chance of credit risk and there’s always interest rate risk. So the bond’s price will fluctuate over its lifetime to reflect these risks. In the short-term, no matter how much information we have it will be very difficult to predict the interest rate risk. When you own the 10 year bond you are essentially buying an instrument in which the market will try to guess the 10 year interest rate risk. As a result its price is always jumping around like no one knows what it’s worth. As I like to say, price is the equilibrium of liquidity where two willing parties agree to disagree.

Although no one knows the 10 year interest rate risk this bond is exposed to we increasingly know the interest rate risk as this bond matures. And by the time this 10 year bond matures we know that its interest rate risk becomes zero like cash. Said differently, as its maturity decreases its price becomes clearer. So, let’s revisit the EMH again. At 10 years we have imperfect information which results in a wide array of opinions about the right price. The information might be priced in, but that doesn’t mean it’s “right” or “wrong”. However, when that bond matures we have perfect information which results in a perfect opinion about the price of the bond. So, over the entire 10 years the pricing mechanism is quite efficient, however, in the period inside of 10 years the pricing is inherently less efficient because our information is imperfect. As I said earlier, price efficiency is inversely proportional to time. You can visualize this pricing battle across time as such:

Now, this creates the interesting illusion that, since short-term prices are rather inefficient for long-term instruments then that creates more opportunity for alpha. While this is true it also exposes you to the paradox of activity – being more active in an attempt to capture alpha due to inefficient prices exposes you to higher taxes and fees which reduces your ability to capture alpha. In other words, there are more short-term opportunities in long-term instruments, but there are also more costs in long-term instruments that are used as short-term instruments. And the evidence clearly shows that active managers who incur these higher costs tend to underperform. In other words, the costs of trying to achieve alpha tend to counteract any alpha earned.

The information age is giving us the impression that we’re better informed and therefore better equipped to take advantage of market inefficiencies, but the reality is that all of this information is feeding our short-term biases and inducing activity that is potentially hurting our performance. While it’s certainly better to be informed we have to be informed across the proper time horizons. When we treat long-term instruments as short-term instruments we are actually acting in a misinformed manner as we are fundamentally misusing the instrument across the time horizon for which it is designed. And no matter how much information you have about that instrument it’s highly unlikely that more information is going to give you an immediate advantage as to its long-term price. More information doesn’t give you an immediate advantage, however, when used across the proper time horizon it can give you a long-term advantage.

Share the post "The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage"