Share the post "The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice"This is the seventh instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. I’m not gonna tip toe around this topic. My career in finance has convinced me that most financial firms charge way too much in exchange for the value they provide. The financial industry has gotten away with this for a long time because the average investor is woefully uninformed about financial matters, but as the Internet has democratized information and helped firms scale their businesses the high fee financial firms have come under fire. This is a fantastic development.Unfortunately, there’s a lot of work to be done here. There are still trillions of dollars captured by hedge funds, closet indexing funds, high fee 401K plans and high fee investment advisors. What’s the damage? Tremendous. So let’s put it in perspective.When we think about our retirement goals and how much money we need we should think in terms of our real, real returns.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice"

This is the seventh instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important.

I’m not gonna tip toe around this topic. My career in finance has convinced me that most financial firms charge way too much in exchange for the value they provide. The financial industry has gotten away with this for a long time because the average investor is woefully uninformed about financial matters, but as the Internet has democratized information and helped firms scale their businesses the high fee financial firms have come under fire. This is a fantastic development.

Unfortunately, there’s a lot of work to be done here. There are still trillions of dollars captured by hedge funds, closet indexing funds, high fee 401K plans and high fee investment advisors. What’s the damage? Tremendous. So let’s put it in perspective.

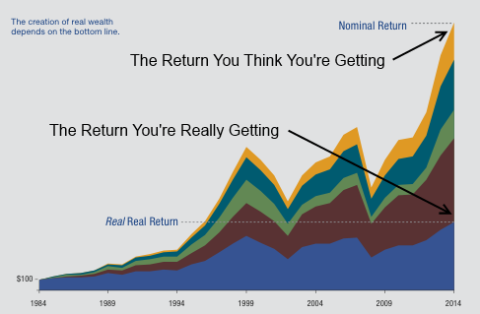

When we think about our retirement goals and how much money we need we should think in terms of our real, real returns. This is the real amount of money in your pocket after inflation, taxes, fees, etc. Most of us hear about inflated stock market returns like 10-12% historical and tend to assume that nominal figure is what we’re shooting for. But along the way we incur so many frictions that we don’t consider the other factors eating into those nominal returns. For instance, here’s a visual showing the difference between a 6% compound growth rate versus 10%:

To put this in perspective consider this. If $100,000 compounds at 6% it grows to $575,000. But if it compounds at 10% it grows to $1,750,000. That’s a huge difference so every dollar you can leave in your account compounding for you is a dollar that will improve the odds that you meet your financial goals. In today’s world of low cost indexing options the most controllable of these frictions is the fee impact.

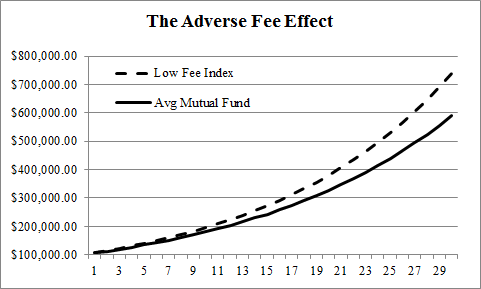

To put things in perspective consider that the average mutual fund charges 0.9% relative to the average low fee index which charges 0.1%. That’s a 0.8% difference. It doesn’t sound like much, but take a 7% compound annual growth rate on $100,000 and extend that over 30 years. Just how much of an impact does it make? The high fee mutual fund ends up with a balance that is 21% lower than the index. In other words, the mutual fund could just mimic the return of the index and reduce your return by $125,000 solely because of the high fees.

This is even crazier when we consider that 85% or more of professional investors can’t beat an index. In other words, the vast majority of professional investors are just closet index funds charging high fees. They aren’t just failing to add value. They are actually negative value.

Sadly, the problem isn’t going away as much as it’s morphing. As index funds have garnered attention for their low fees and better performance more and more advisors are changing the way they charge their high fees. And so more advisors are using low fee index funds but then charging a 1% management fee on top of the low index fund fee. This, sadly, is no better than the closet indexing mutual fund that charges you 1% for index returns. The only difference is that they’re selling you the management fee with the better sounding sales pitch of the low cost index funds.

In finance you could probably say that the only certainties in the long-term are inflation and taxes. You can’t control inflation, but you can control how much you pay in taxes and fees. Although many people can probably benefit from professional help allocating and maintaining their investment strategies over time don’t be lured into the high fee sales pitch thinking that you get more for what you pay for. In today’s world there are so many wonderful low fee options that you often get more for what you DON’T pay for.

Share the post "The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice"