Trumped up expectations coming off only slowly. Actual business conditions havenot yet responded: Not much optimism here: Trumped up expectations reversed more quickly here: Indicates active selling of US equities and buying of euro equities. This could be part of the process of portfolio managers selling $US to buy euro, reversing shifting in the other direction for the last several years as portfolios shifted out of euro due to political fears and fears of ‘money printing’ by the ECB, which have failed to be of expected consequence. Meanwhile, at current fx prices, the massive euro area trade surplus continues, which is by identity a ‘rest of world’ deficit, ‘draining’ that many net euro from the global economy: This was yesterday’s news and has already been

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

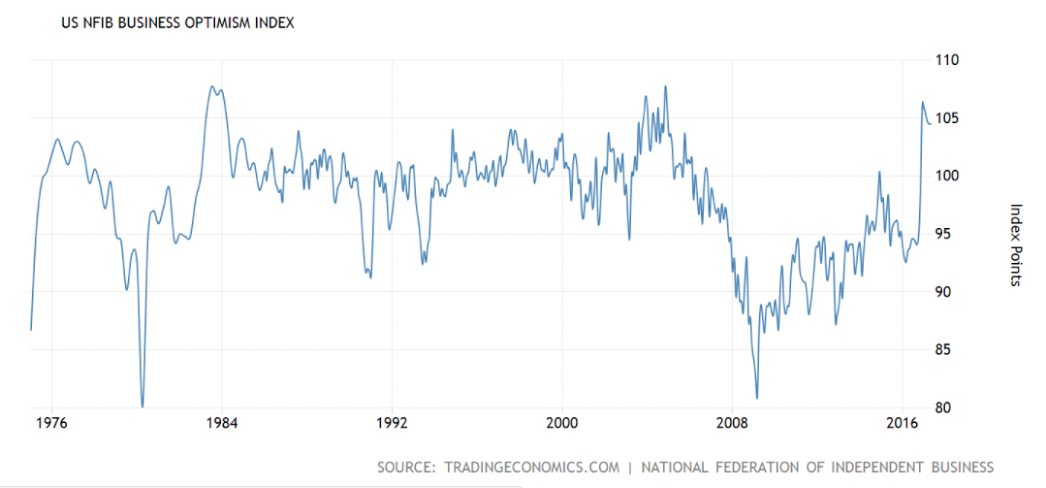

Trumped up expectations coming off only slowly. Actual business conditions have

not yet responded:

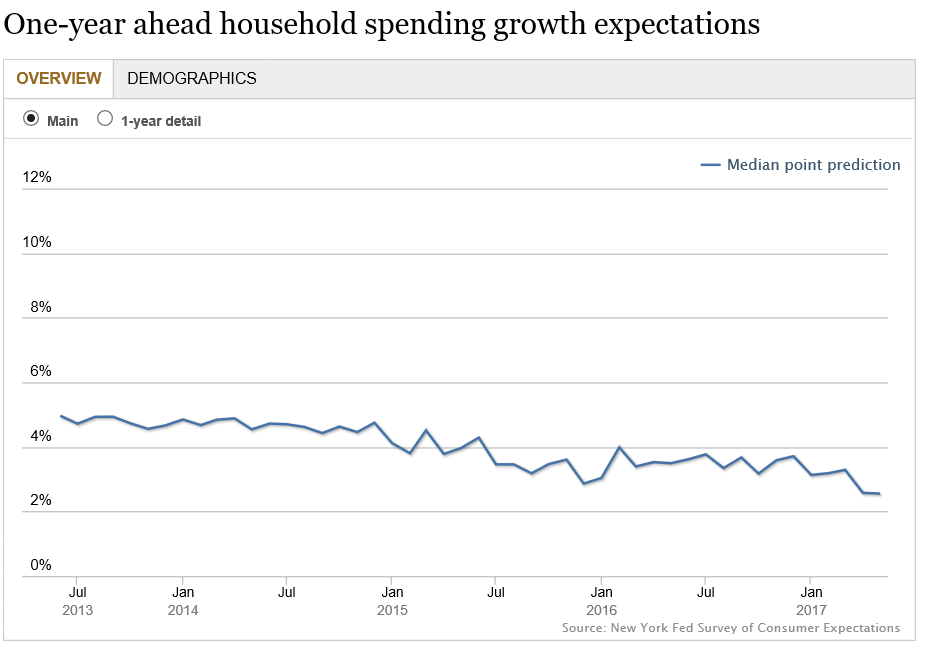

Not much optimism here:

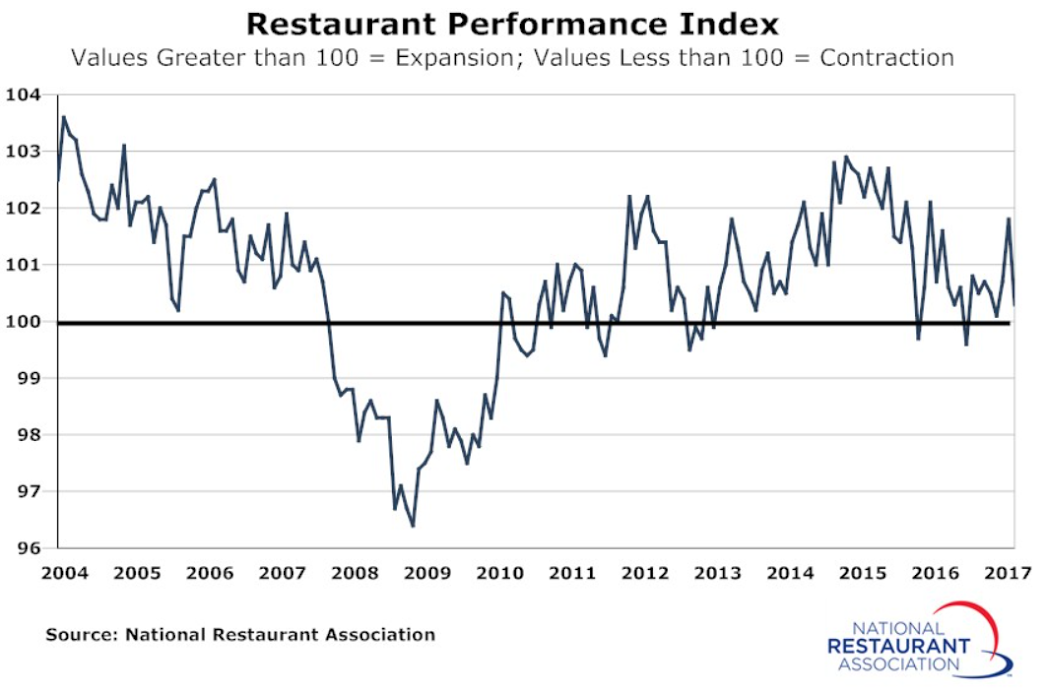

Trumped up expectations reversed more quickly here:

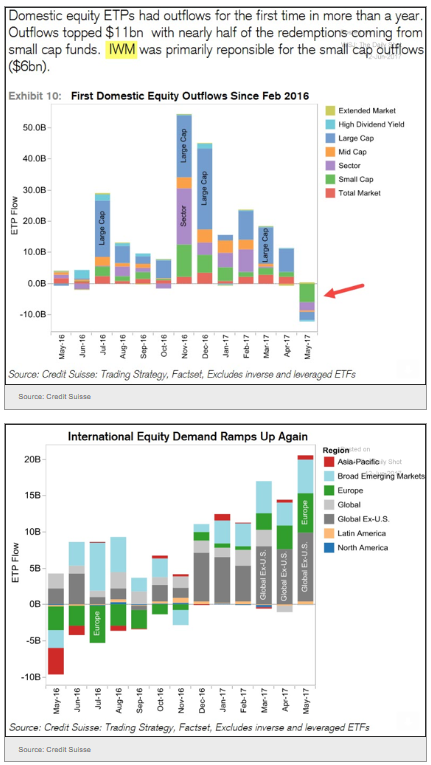

Indicates active selling of US equities and buying of euro equities. This could be part of the process of portfolio managers selling $US to buy euro, reversing shifting in the other direction for the last several years as portfolios shifted out of euro due to political fears and fears of ‘money printing’ by the ECB, which have failed to be of expected consequence.

Meanwhile, at current fx prices, the massive euro area trade surplus continues, which is by identity a ‘rest of world’ deficit, ‘draining’ that many net euro from the global economy:

This was yesterday’s news and has already been replaced by today’s stories as this type of thing seems to be growing exponentially:

“Never has there been a president, with few exceptions … who has passed more legislation, done more things,” Trump declared, even though Congress, which is controlled by his party, hasn’t passed any major legislation.

He hailed his plan for the “single biggest tax cut in American history,” even though he hasn’t proposed a plan and Congress hasn’t acted on one.

He said “no one would have believed” his election could have created so many new jobs over the past seven months (1.1 million), even though more jobs (1.3 million) were created in the previous seven months.