Dan here….Steve Roth in 2014 How Do Households Build Wealth? Probably Not the Way You Think. Three Graphs Steve Roth | October 28, 2014 12:52 pm US/GLOBAL ECONOMICS Work hard. Save your money. Spend less than you earn. That’s how you become wealthy, right? That’s not totally wrong, but if you think that’s the whole story — or even a large part of the story – you may be surprised by this graph: (Note: these are not realized capital gains, which really only matter for tax purposes. If the value of your stock portfolio or house goes up for twenty or thirty years, you’ve made cap gains even if you haven’t “realized” them by selling.) Household “saving” — households spending less than they “earn” – contributes a remarkably small amount to increasing household net

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Dan here….Steve Roth in 2014

How Do Households Build Wealth? Probably Not the Way You Think. Three Graphs

Steve Roth | October 28, 2014 12:52 pm

US/GLOBAL ECONOMICS

Work hard. Save your money. Spend less than you earn. That’s how you become wealthy, right?

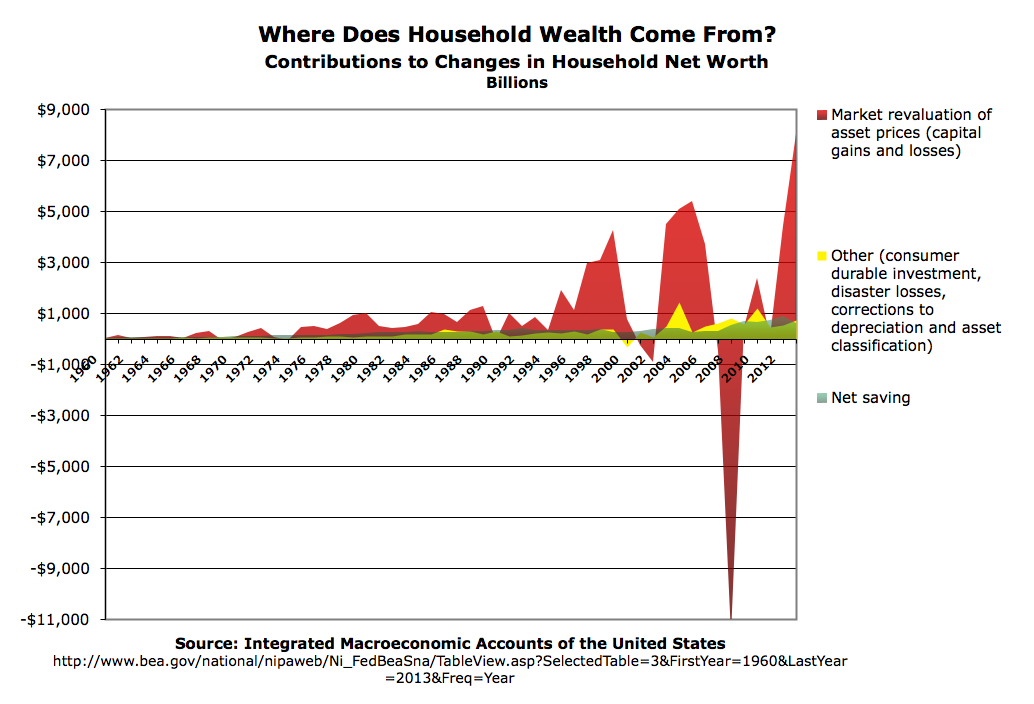

That’s not totally wrong, but if you think that’s the whole story — or even a large part of the story – you may be surprised by this graph:

(Note: these are not realized capital gains, which really only matter for tax purposes. If the value of your stock portfolio or house goes up for twenty or thirty years, you’ve made cap gains even if you haven’t “realized” them by selling.)

Household “saving” — households spending less than they “earn” – contributes a remarkably small amount to increasing household net worth. And that contribution has shrunk a lot since the 90s.

The accounting explanation is simple: “Income” doesn’t include capital gains; it comprises all household income except capital gains. So capital gains are also absent from “Saving” — Income minus (Consumption) Expenditures. (This is why HouseholdSavings1 + HouseholdSaving ≠ HouseholdSavings2 — not even vaguely close.)

The capital gains mechanism appears to dominate the ultimate, net delivery of rewards to household economic actors. Earning more and spending less is weak beer by comparison.

What does this say about our understandings of how the economy works? Does economists’ fixation with “saving” provide a useful picture of macro flows in the economy? Since asset ownership is hugely concentrated among the wealthy (even real estate), can we think about the economy’s workings at all without looking at distribution? Does this dominant mechanism allocate resources “efficiently,” or deliver the kind of incentives that make us all better off? And etc.

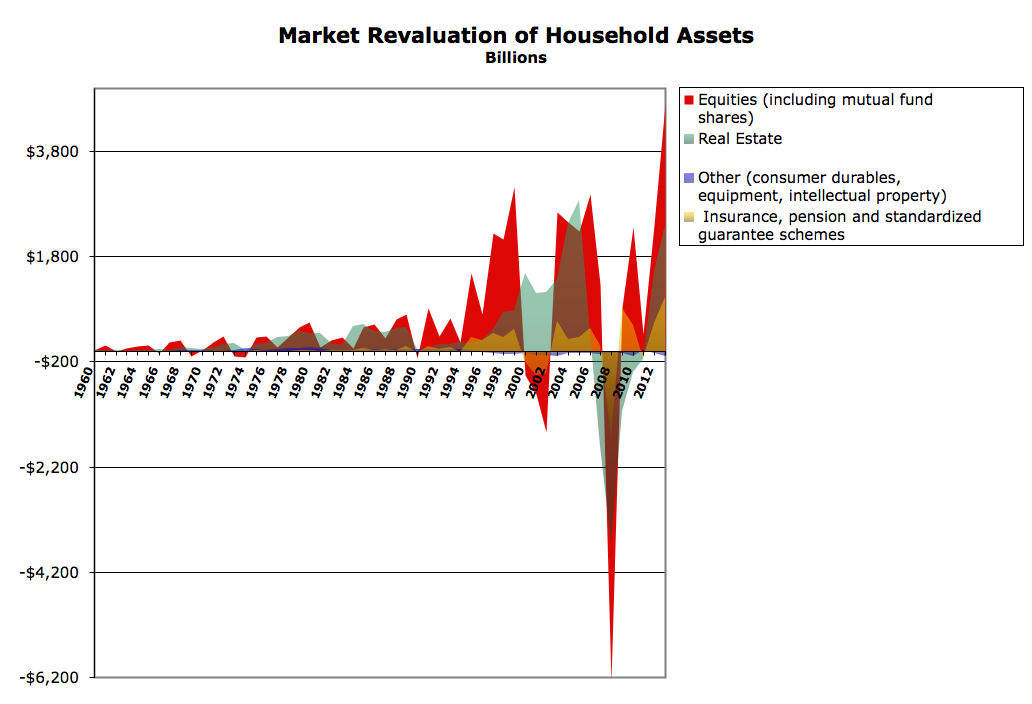

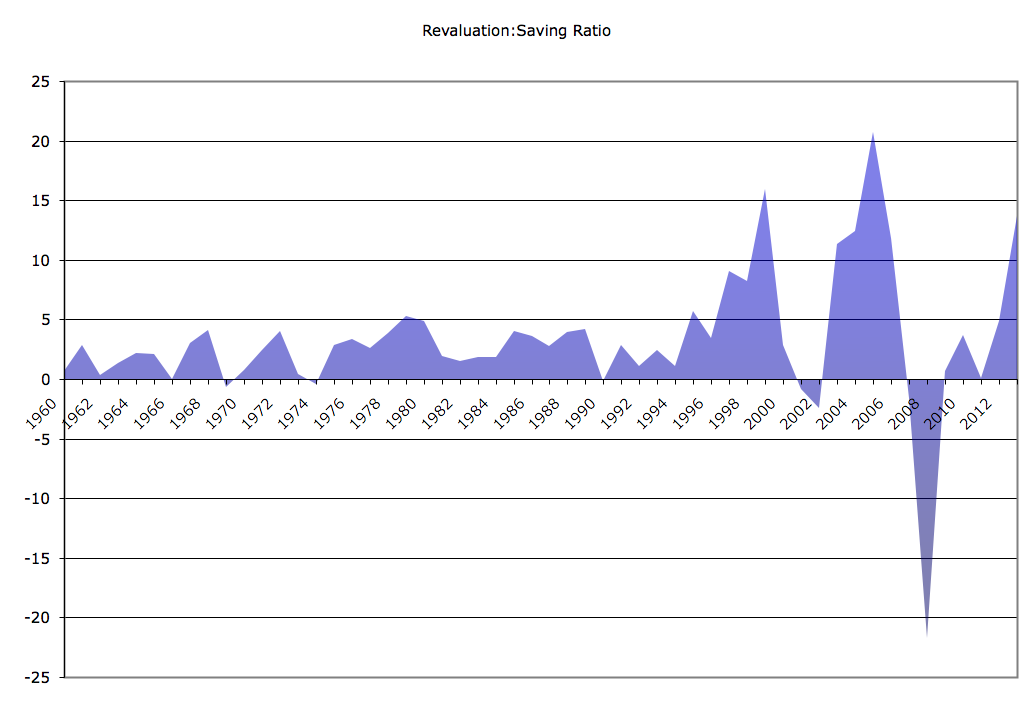

There’s much more I’d like to say about this reality, but I’ll just provide one more graph for the time being and let my gentle readers ponder the bare facts.

The spreadsheet’s here. Have your way with it. (It’s kind of messy; drop a line with questions).

Cross-posted at Asymptosis.