« Back I am reposting this at Dan’s suggestion as it relates to the recent post by Steve Roth. I have edited it slightly along with a retitle to clean up some wording and hopefully have made it easier to read. For those new here, my posts started with income inequality and a thought ...

Topics:

Daniel Becker considers the following as important: economic policy, income inequality, politics, share of income, Uncategorized, US/Global Economics

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

I am reposting this at Dan’s suggestion as it relates to the recent post by Steve Roth. I have edited it slightly along with a retitle to clean up some wording and hopefully have made it easier to read. For those new here, my posts started with income inequality and a thought that we changed our economy as to how we would make money starting in the 80′s. My one new thought is that the obvious political party to promote policy that addresses the issue noted in this post and it’s links still don’t fully get it. Yes, Sanders, Warren etc are talking policy, but even they are not discussing the philosophy and processes of an economy that allows the massed to “get it”. In simple terms it is the difference of references when talking about team work. The apparent accepted reference being sports…competition, win. The truth as I see it however, is that the appropriate reference for team work in a democratic society’s economy is that of a barn raising. When is the last time you heard anyone use that reference. Hell, even in my other outlet for relaxation, music, the concept of an orchestra or large band is dying and competition models are being applied. In Trump’s words “Sad”.

But then again, we’ve lost the idea of the rat race.

Income distribution and GDP, it matters

Daniel Becker | December 28, 2008 9:00 am

US/GLOBAL ECONOMICS

I should title this: Yeah, it is just like 1929 you freak’n see, hear and speak no inequality monkeys.

I have this pile of income data sorted out from Saez’s work (the GDP is BEA). My thoughts regarding our economy is that income inequality (or equality) matters. It matters so much, that it is the all defining focus of government in a democracy. Every policy made should be judged against this goal of ever greater equality as we use the tool called “economy” for the betterment of our lives.

For most (even the tippy-top earners), the biggest share of income is not earned from money, but from labor, whether physical or cognitive. Because of this, there must be effort as reflected in our policy toward regulation and initiatives that continually work to equalize the share of income. I am confident, that just as Mike Kimel showed there is a low and high to top marginal rates correlating with GDP growth rates, the same is true for share of income. That’s my thoughts.

I sorted out the share of income in dollars and percentages in the past and have posted them. This time I look at per capita income and compare them to GDP.

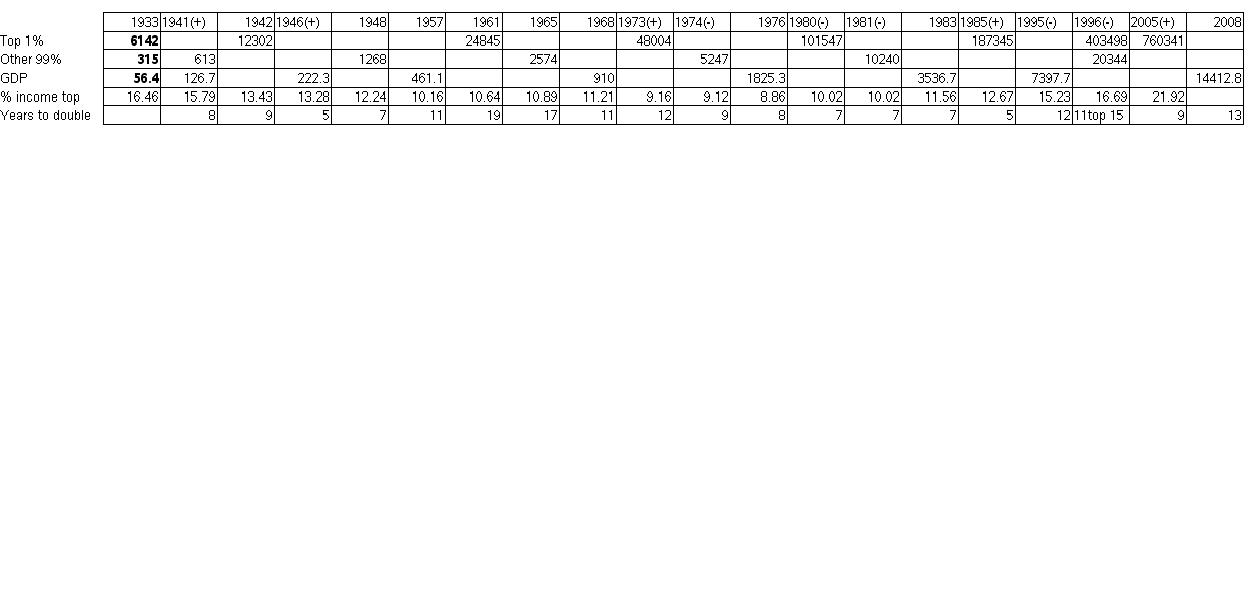

Starting at the low point for both groups in 1933, we see $6142/person (16.46% of the total personal income) for the top 1% and $315/person for the rest. The following chart shows the years of income and GDP doubling along with the top’s percentage share. I took the starting income and kept doubling it to find the year closest. A + or – means the actual income of doubling is before or after the year (between 2 years).

For the top, the number of years to doubling are: 9,19, 12, 7, 5, 11, 9

For the bottom 99 the number of years to doubling are: 8, 7, 17, 9, 7, 15,

For GDP the number of years to doubling are: 8, 5, 11, 11, 8, 7, 12, 13

The bold number is the last doubling before 1976.

If we look at 2005 incomes, it is clear the trend for number of years to income doubling was increasing for the 99%. For this group, 9 years past the last doubling, there has only been a 34.5% increase where as the top’s income has doubled. It appears that the best income percentage for both the top and the rest is around 10 to 12%. Based on my prior posting, I will say with confidence that once the 1%’ers increase their share to 16% of the income we are screwed. That is because, as the 1%’ers passed down through the 16% mark as their share declined (the income low point in 1933) the post 1929 economy started its turn upward. On the other end of this time span, it was 1996 that the 1%’ers passed through the 16% point as their share increased. 1996 is the year that the 99%ers income fell below the personal consumption line and has stayed there since. Can you say deficit spending? Another funny thing about the 1930′s and the second recession, the top 1% hit 19.26% of the income in 1936. The WW2 turn around? The top 1%’ers share finally went below 16% in 1941 and never turned back.

However, here is the meat. Using 1976 as the center point of the range because it is the low point of the share of income for the top 1%, there are 5 times prior to 1976 that GDP doubled for an average of 8.6 years per doubling. This during the time that income share was becoming more equal. As income became less equal over the next 32 years, there are only 3 doublings of GDP or once every 10.6 years. Also, the time between doubling is increasing to more than during the prior 43 years.

Now, for the class war aspect. In the first 43 years, the top 1% saw their income double only 3 times (1 every 14.3 yrs) compared to the bottom 99% seeing theirs double 4 times (1 every 10.75 yrs). During the next 32 years, the top 1% has experienced 4 doublings, one every 8 years compared to the 99% experiencing this only twice, one every 11 years.

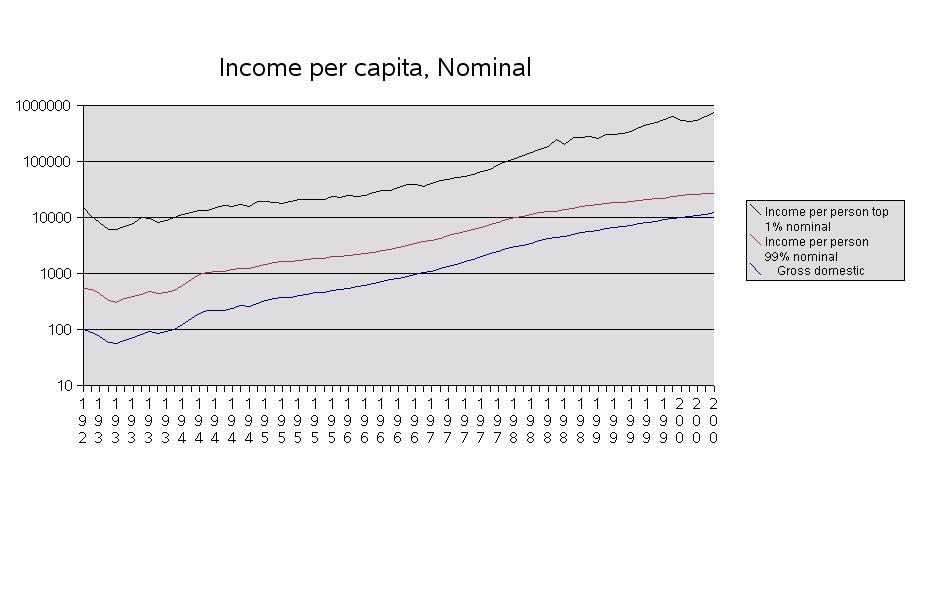

Here is the graph that illustrates the relationship of shifting income share and GDP growth. Following Spencer’s past suggestion, the graph is a logarithmic scale.

Basically, increasing of income was more equal and the economy grew more as the top was losing share. The post 1976 economic policy we have been following has quite frankly been killing our economy. Yeah, it sure benefited the top 1%, they got their’s. But, it could not last because, you can not have one group taking more out of the economic growth faster than it can grow. That, boy’s and girls is the lesson of the first 43 year compared to the last 32 years. For the first 43 years, GDP doubling was always ahead of the income doubling. For the next 32 years, GDP growth was always behind the 1%er’s income doubling which was do to the top 1%’s share. Their’s is the only income that increased faster than the economy. In chart form it looks like this:

First 43 years doubling: GDP 8.6 yrs, 99%’ers 10.75 yrs, 1%’ers 14.3 yrs.

Next 32 years doubling: GDP 10.6 yrs, 99%’ers 11 yrs, 1%’ers 8 yrs.

You know what else this is? It is the difference between reducing debt or increasing debt: Saving or spending tomorrow’s money. Unified budget (illegal) or general budget.

So, what should economic policy in a democracy strive to do? Promote more equality in the nation’s income which everyone helps to produce thus giving everybody a more equitable rise in their standard of living or promote the top 1%’s growth and the hell with all the rest? The rest being 99% of the population, the overall economic growth, the deficit, quality of life (retirement, health care, free time, better life for future generations) and just plain happier people who don’t find a need to fight with everyone else on the planet.

Personally, between this info and my post titled “It’s the big one honey, I know it…”, I think it’s rather clear exactly what needs to be promoted with policy. In case it’s not clear, there is this post “In the Beginning there was Income”.

Such policy if implemented will also act as the stop gap for this current downward trend better than anything proposed so far because it will be returning to the true purpose of an economy in a democracy like ours. Or, we can keep talking in quintiles hiding the truth and pretending that it’s just a housing bubble, and people spending to0 much, and a credit freeze and bad regulation and oil and lack of stimulus spending and it is not really like 1929 and…