Summary:

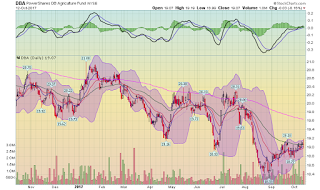

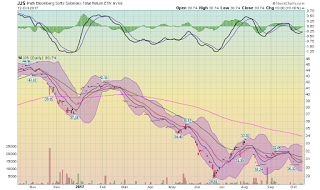

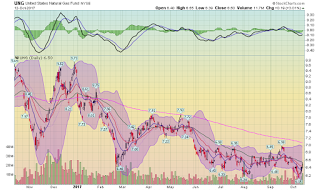

By Hale Stewart (originally published at Bonddad blog) There Is No Commodity Based Inflation Consider the following charts (the top three area daily; the bottom is weekly): All prices are either declining or stable. The only major ETF that is showing strength is the industrial metals ETF (this is a weekly chart): This explains why non-food and energy prices are subtracting from prices: This is one reason why overall inflation is so weak globally.

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

By Hale Stewart (originally published at Bonddad blog) There Is No Commodity Based Inflation Consider the following charts (the top three area daily; the bottom is weekly): All prices are either declining or stable. The only major ETF that is showing strength is the industrial metals ETF (this is a weekly chart): This explains why non-food and energy prices are subtracting from prices: This is one reason why overall inflation is so weak globally.

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by Hale Stewart (originally published at Bonddad blog)

There Is No Commodity Based Inflation

Consider the following charts (the top three area daily; the bottom is weekly):

All prices are either declining or stable.

The only major ETF that is showing strength is the industrial metals ETF (this is a weekly chart):

This explains why non-food and energy prices are subtracting from prices:

This is one reason why overall inflation is so weak globally.