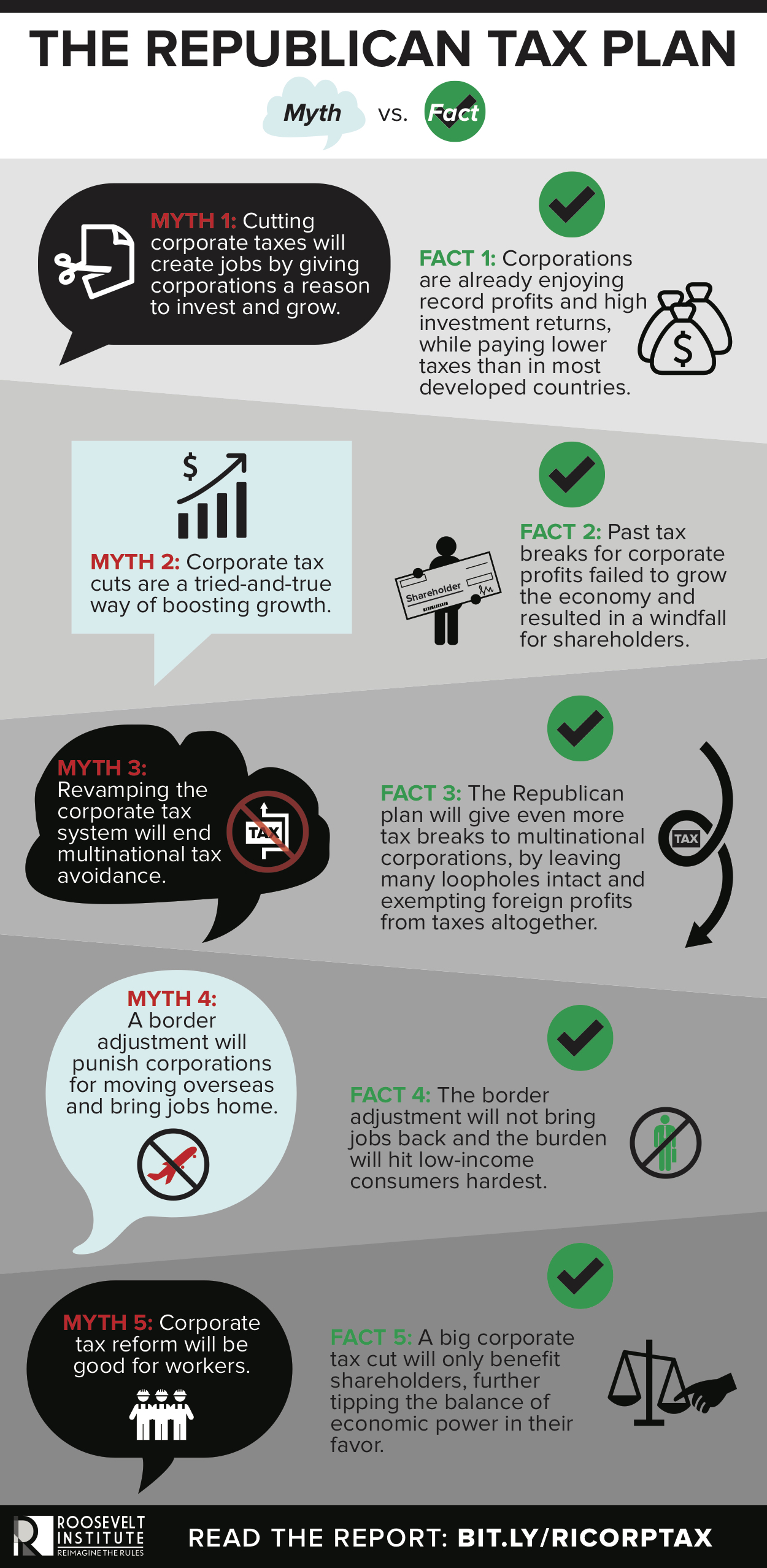

From the Roosevelt Institute comes this graphic on the overall reality of macro policies: The Republicans’ underlying assumption—that corporations invest more and create more jobs only when they are relieved of burdensome tax rates—is false. American businesses already enjoy a historically low cost of capital, and they have more than enough cash on hand to invest, raise wages, and create jobs. Corporations are choosing to make dividend payments and stock buybacks instead of investing because they face a lack of competitive pressure—itself the result of power and wealth shifting toward rich shareholders. Another tax cut for the rich will only make the problem worse.

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

From the Roosevelt Institute comes this graphic on the overall reality of macro policies:

The Republicans’ underlying assumption—that corporations invest more and create more jobs only when they are relieved of burdensome tax rates—is false. American businesses already enjoy a historically low cost of capital, and they have more than enough cash on hand to invest, raise wages, and create jobs. Corporations are choosing to make dividend payments and stock buybacks instead of investing because they face a lack of competitive pressure—itself the result of power and wealth shifting toward rich shareholders. Another tax cut for the rich will only make the problem worse.