By New Deal democrat Two hits and a miss on GDP and wages We got two pieces of good news from the GDP report this morning, and one piece of bad news for workers. First, from the important long leading housing sector, real private fixed residential investment rose again to a new post-recession high: This adds to the generally positive data coming out of that sector. Second, proprietors income increased: This is a good proxy for corporate profits, which won’t be reported until next month. It isn’t quite as reliable an indicator, but the two generally move in the same direction so the two long leading aspects of the GDP report were hits. This miss was in the Employment Cost Index. Since this is a median measure, it is not distorted by out sized gains at the top of the distribution. While this measure rose +0.8% in the quarter, inflation increased at least as much, meaning that median real earnings were stagnant: Had I used personal consumption expenditures as my deflator, real wages would actually show a decline. That inflation has been more than eating up nominal gains in wages for the last three quarters is not good news.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Two hits and a miss on GDP and wages

We got two pieces of good news from the GDP report this morning, and one piece of bad news for workers.

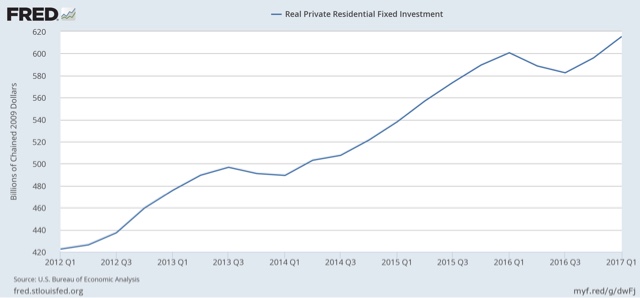

First, from the important long leading housing sector, real private fixed residential investment rose again to a new post-recession high:

This adds to the generally positive data coming out of that sector.

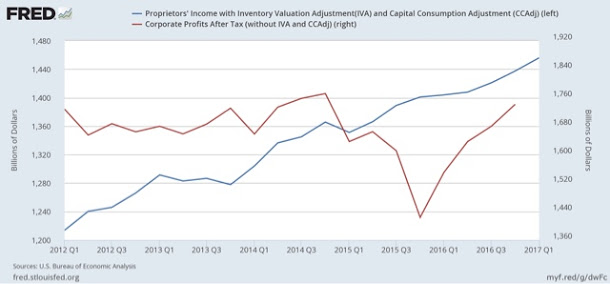

Second, proprietors income increased:

This is a good proxy for corporate profits, which won’t be reported until next month. It isn’t quite as reliable an indicator, but the two generally move in the same direction so the two long leading aspects of the GDP report were hits.

This miss was in the Employment Cost Index.

Since this is a median measure, it is not distorted by out sized gains at the top of the distribution. While this measure rose +0.8% in the quarter, inflation increased at least as much, meaning that median real earnings were stagnant:

Had I used personal consumption expenditures as my deflator, real wages would actually show a decline.

That inflation has been more than eating up nominal gains in wages for the last three quarters is not good news.