Via New York Times comes this information on flood insurance, which I believe is the predominate cause of storm damage in the Houston area and beyond: Private homeowners’ policies generally cover wind damage and, in certain cases, water damage from storm surges. But for almost half a century, all other homeowners’ flood coverage has been underwritten by the National Flood Insurance Program, a federal program that itself faces financial uncertainty. Flooding has dealt the hurricane’s biggest blow. And in areas where it is prudent — or even obligatory — to buy it, having flood coverage is the exception rather than the norm. … People without coverage will have to apply for grants or low-cost loans from other branches of the federal government, said Loretta

Topics:

Dan Crawford considers the following as important: Journalism, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

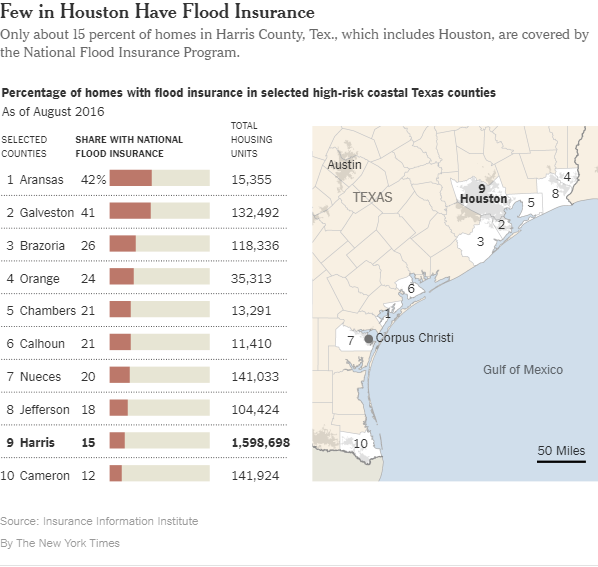

Via New York Times comes this information on flood insurance, which I believe is the predominate cause of storm damage in the Houston area and beyond:

Private homeowners’ policies generally cover wind damage and, in certain cases, water damage from storm surges. But for almost half a century, all other homeowners’ flood coverage has been underwritten by the National Flood Insurance Program, a federal program that itself faces financial uncertainty.

Flooding has dealt the hurricane’s biggest blow. And in areas where it is prudent — or even obligatory — to buy it, having flood coverage is the exception rather than the norm.

…

People without coverage will have to apply for grants or low-cost loans from other branches of the federal government, said Loretta Worters, a spokeswoman for the Insurance Information Institute. That means delays in receiving funds, if such requests are even approved.

…

The National Flood Insurance Program was created in 1968, after most private insurance companies stopped writing homeowners’ flood coverage because they could not charge premiums high enough to cover the potentially catastrophic costs. (In addition to wind and limited storm-surge damage, private insurers cover vehicles caught in flooding.)

The 49-year-old program is now run by FEMA. Its coverage has caps: $250,000 for a house and $100,000 for its contents, and $500,000 apiece for a business building and its contents. Larger companies can still buy flood coverage through commercial insurers.