By New Deal democrat The shallow industrial recession is fading in the rear view mirror A year ago the “shallow industrial recession” induced by the strong US$ and imploding oil patch was bottoming. At that time I described the historical pattern: Typically new orders turn positive first (red, left scale in the graph below), followed by sales (green, right scale), and finally inventories (blue, right scale): At that time I concluded: If this is an incipient recession, then I would expect inventories to follow sales, which means that ISM new orders are giving a false signal. On the other hand, if this is simply a slowdown, like 1998 (far left in the first graph), then sales should turn positive, and like 1998 inventories will not decline, in which case it is elevated inventories that are giving the false signal. Since then, ISM has withdrawn permission for the St. Louis FRED to republish its data. Fortunately, the overall ISM index tends to follow the new orders component with a slight lag, and Doug Short keeps track of that: And Doug’s 3 month trailing average of the regional Fed indexes shows the same thing: So, what has happened with total business sales (including manufacturer, wholesaler, and retailer) and inventories? Here’s the graph: Exactly like 1998, sales have taken off again, while inventories did not decline.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

The shallow industrial recession is fading in the rear view mirror

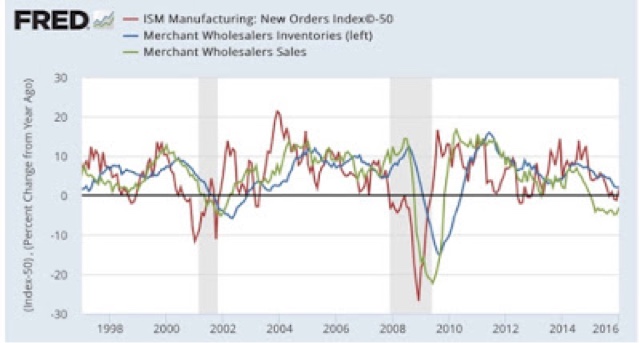

A year ago the “shallow industrial recession” induced by the strong US$ and imploding oil patch was bottoming. At that time I described the historical pattern:

Typically new orders turn positive first (red, left scale in the graph below), followed by sales (green, right scale), and finally inventories (blue, right scale):

If this is an incipient recession, then I would expect inventories to follow sales, which means that ISM new orders are giving a false signal. On the other hand, if this is simply a slowdown, like 1998 (far left in the first graph), then sales should turn positive, and like 1998 inventories will not decline, in which case it is elevated inventories that are giving the false signal.

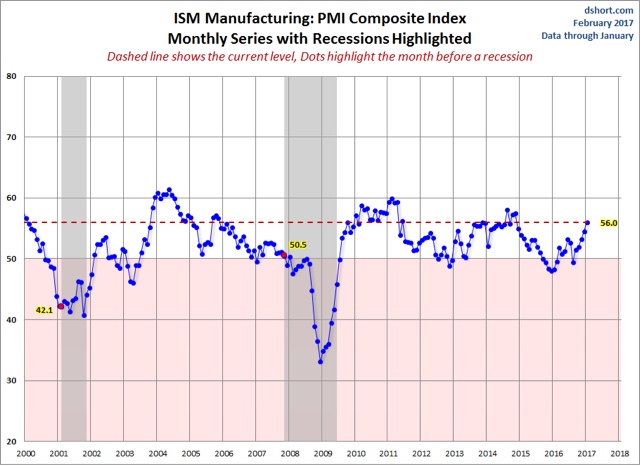

Since then, ISM has withdrawn permission for the St. Louis FRED to republish its data. Fortunately, the overall ISM index tends to follow the new orders component with a slight lag, and Doug Short keeps track of that:

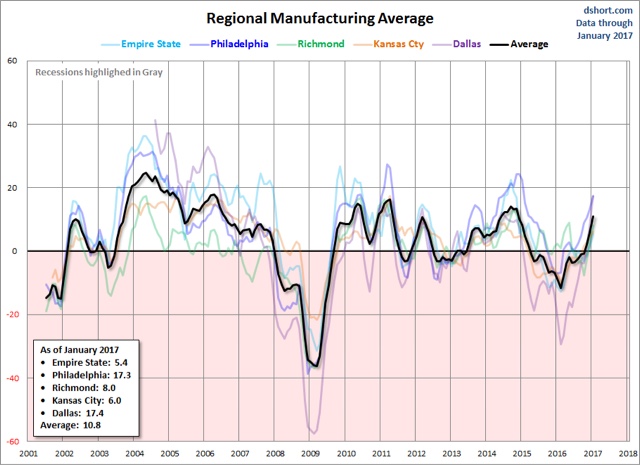

And Doug’s 3 month trailing average of the regional Fed indexes shows the same thing:

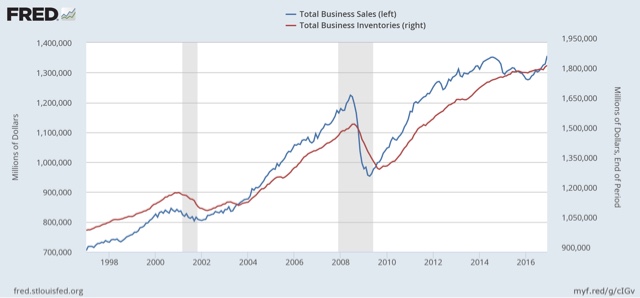

So, what has happened with total business sales (including manufacturer, wholesaler, and retailer) and inventories? Here’s the graph:

Exactly like 1998, sales have taken off again, while inventories did not decline. Since one year ago, they have risen, but slightly.

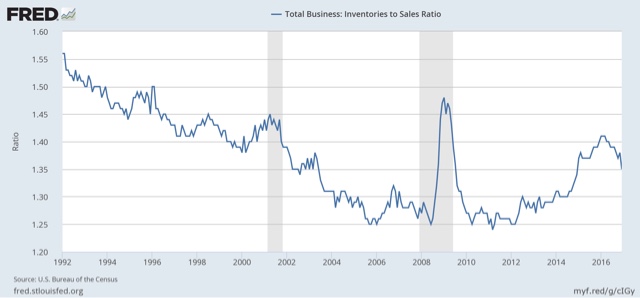

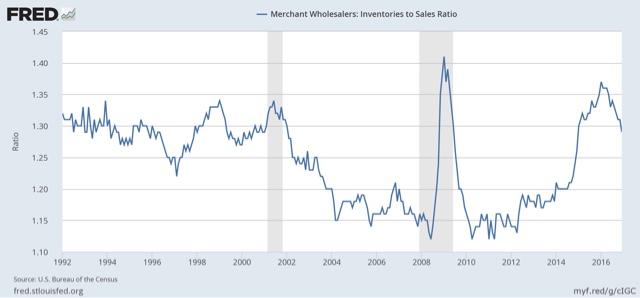

As a matter of course, the total business and wholesaler inventory to sales ratios have declined. (I include the latter because it has been less influenced by secular “just in time” inventory issues):

The model worked just as I expected. The shallow industrial recession is fading in the rear view mirror.