Summary:

By Hale Stewart (originally published at Bonddad blog) Labor Market Slack and Weak Wage Growth From the IMF’s latest World Economic Outlook: Sluggishness in core inflation in advanced economies—a surprise in view of stronger than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6). As shown in Chapter 2, muted growth in nominal wages in recent years partly reflects sluggishness in labor productivity.1 However, the analysis also reveals continued spare capacity in labor markets as a key drag: wage growth has been particularly soft

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

By Hale Stewart (originally published at Bonddad blog) Labor Market Slack and Weak Wage Growth From the IMF’s latest World Economic Outlook: Sluggishness in core inflation in advanced economies—a surprise in view of stronger than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6). As shown in Chapter 2, muted growth in nominal wages in recent years partly reflects sluggishness in labor productivity.1 However, the analysis also reveals continued spare capacity in labor markets as a key drag: wage growth has been particularly soft

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by Hale Stewart (originally published at Bonddad blog)

Labor Market Slack and Weak Wage Growth

From the IMF’s latest World Economic Outlook:

Sluggishness in core inflation in advanced economies—a surprise in view of stronger than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6). As shown in Chapter 2, muted growth in nominal wages in recent years partly reflects sluggishness in labor productivity.1 However, the analysis also reveals continued spare capacity in labor markets as a key drag: wage growth has been particularly soft where unemployment and the share of workers involuntarily working part-time remain high. The corollary of this finding is that, once firms and workers become more confident in the outlook, and labor markets tighten, wages should accelerate. In the short term, higher wages should feed into higher unit labor costs (unless productivity picks up), and higher Sluggishness in core inflation in advanced economies—a surprise in view of stronger-than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6).

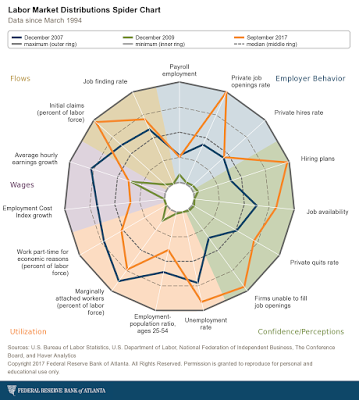

Consider the following chart from the Atlanta Fed:

Sluggishness in core inflation in advanced economies—a surprise in view of stronger than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6). As shown in Chapter 2, muted growth in nominal wages in recent years partly reflects sluggishness in labor productivity.1 However, the analysis also reveals continued spare capacity in labor markets as a key drag: wage growth has been particularly soft where unemployment and the share of workers involuntarily working part-time remain high. The corollary of this finding is that, once firms and workers become more confident in the outlook, and labor markets tighten, wages should accelerate. In the short term, higher wages should feed into higher unit labor costs (unless productivity picks up), and higher Sluggishness in core inflation in advanced economies—a surprise in view of stronger-than expected activity—has coincided with slow transmission of declining unemployment rates into faster wage growth. Real wages in most large advanced economies have moved broadly with labor productivity in recent years, as indicated by flat labor income shares (Figure 1.4, panel 6).

Consider the following chart from the Atlanta Fed:

For the longest time, I’ve been staring at the lower left-hand corner of that chart and thinking, “weak wages are really about low utilization.” Let’s place that data into context:

The above chart shows the absolute number of employees working part-time for economic reasons. The total number — after 8 years of economic growth — is only now returning to the heights of the previous expansion.

Here’s another chart of the data:

This chart (better known as the U-6 unemployment rate) presents the information in a percentage format. This statistic was 10% at the beginning of 2016, which was the highest level of the previous recession. But during this expansion, we hit this level a full seven years after the recession ended. That’s quite a delay.

The excerpt from the IMF report adds two key pieces to this puzzle: First, the US is not the only country experiencing weak labor utilization and a corresponding weak wage growth. In fact, The IMF strongly implies this also seems to go hand-in-hand with the weak pace of global inflation. Second, the IMF has research that links these two concepts.