By Sandwichman The “Cutz & Putz” Bezzle, Graphed by FRED anne at Economist’s View has retrieved a FRED graph that perfectly illustrates the divergence, since the mid-1990s of net worth from GDP: The empty spaces between the red line and the blue line that open up after around 1995 is what John Kenneth Galbraith called “the bezzle” — summarized by John Kay as “that increment to wealth that occurs during the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.” In Chapter 8 of The Great Crash, 1929, Galbraith wrote: “In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by Sandwichman

The “Cutz & Putz” Bezzle, Graphed by FRED

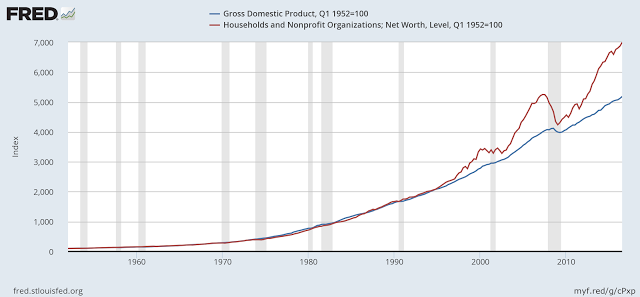

anne at Economist’s View has retrieved a FRED graph that perfectly illustrates the divergence, since the mid-1990s of net worth from GDP:

The empty spaces between the red line and the blue line that open up after around 1995 is what John Kenneth Galbraith called “the bezzle” — summarized by John Kay as “that increment to wealth that occurs during the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.”

In Chapter 8 of The Great Crash, 1929, Galbraith wrote:

“In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle. In good times people are relaxed, trusting, and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly. In depression all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.”

In the present case, the bezzle has resulted from an economic policy two step: tax cuts and Greenspan puts: cuts and puts.

crossposted with Econospeak