By New Deal democrat Bad news: real nonsupervisory wages have actually DECLINED over the last year This morning’s inflation news was even worse than I expected based on the increase in gas prices. On a monthly basis prices rose +0.6%. Core prices rose +0.3%. More importantly, YoY CPI was up +2.5%. Core YoY CPI was up+2.3%: This means real nonsupervisory wages are now actually *down* -0.1% YoY for the last year. Here is the actual level of real nonsupervisory wages for the last 3 years: Note that real wages rose due to the steep declined in gas prices in 2014-15, and have actually fallen -0.6% since their peak half a year ago. Meanwhile even though nominal retail sales had their a good month, up +0.4%, and December waas revised higher, due to the jump in inflation, real retail sales declined slightly: How is it possible that people are spending more even though they are earning less, and interest rates are up since last July? They are saving less: The personal savings rate has been declining slightly for nearly a year. It’s not bad compared with the last 25 years, so there’s no danger sign at this point. In any event, inflation has already blown past the Fed’s anticipated trajectory. Now we see if 2% is a target, or actually a ceiling. I say ceiling. One thing to watch over the next week is how short and long term bonds react.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Bad news: real nonsupervisory wages have actually DECLINED over the last year

This morning’s inflation news was even worse than I expected based on the increase in gas prices.

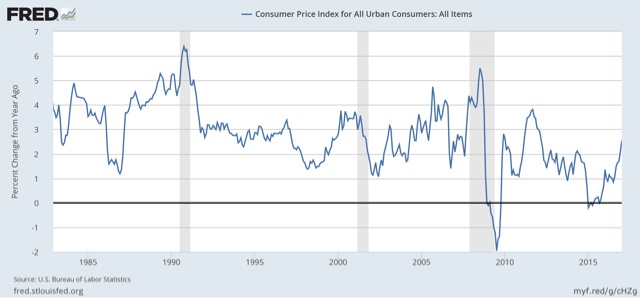

On a monthly basis prices rose +0.6%. Core prices rose +0.3%.

More importantly, YoY CPI was up +2.5%. Core YoY CPI was up+2.3%:

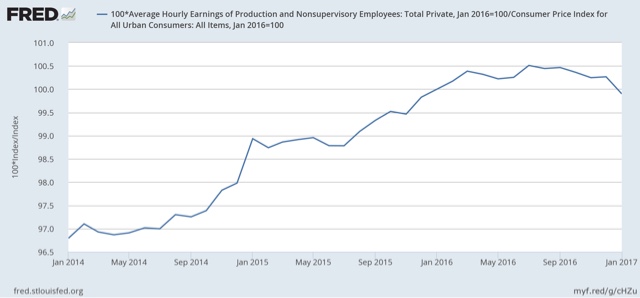

This means real nonsupervisory wages are now actually *down* -0.1% YoY for the last year.

Here is the actual level of real nonsupervisory wages for the last 3 years:

Note that real wages rose due to the steep declined in gas prices in 2014-15, and have actually fallen -0.6% since their peak half a year ago.

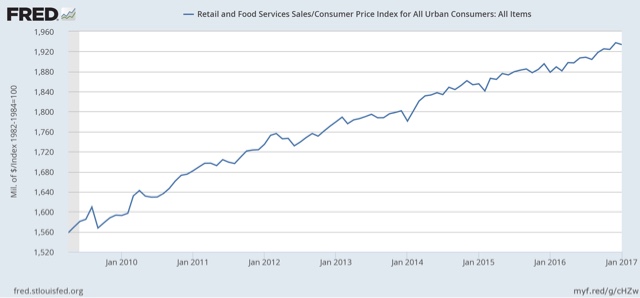

Meanwhile even though nominal retail sales had their a good month, up +0.4%, and December waas revised higher, due to the jump in inflation, real retail sales declined slightly:

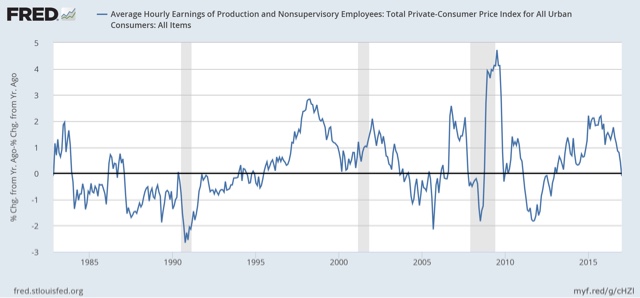

How is it possible that people are spending more even though they are earning less, and interest rates are up since last July? They are saving less:

The personal savings rate has been declining slightly for nearly a year. It’s not bad compared with the last 25 years, so there’s no danger sign at this point.

In any event, inflation has already blown past the Fed’s anticipated trajectory. Now we see if 2% is a target, or actually a ceiling. I say ceiling.

One thing to watch over the next week is how short and long term bonds react. Do long bond yields go up? (relatively good news) or down (bad news). Does the yield curve remain intact or start to compress?