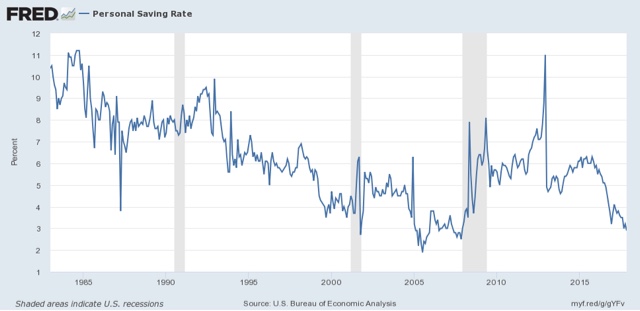

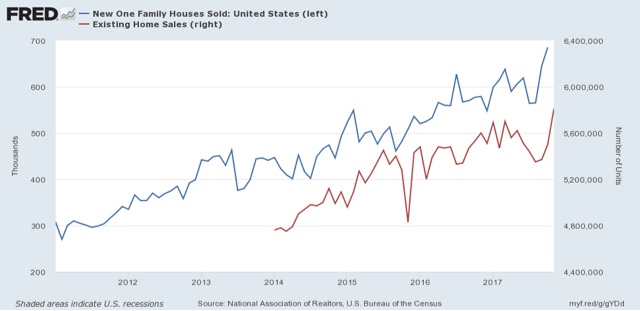

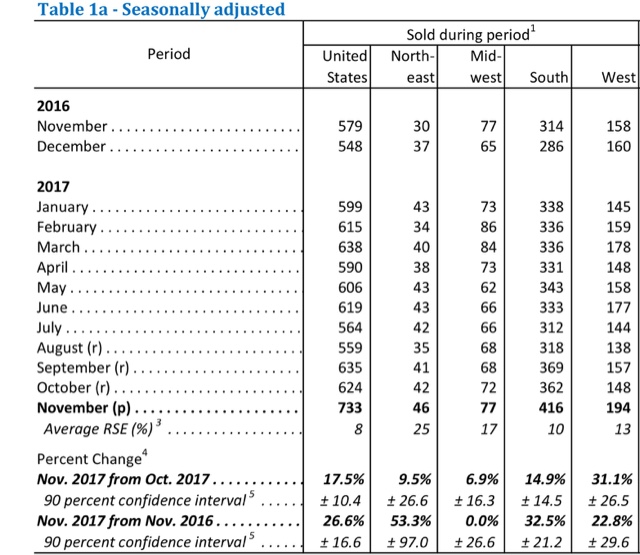

By New Deal democrat Personal spending and new home sales: restrain your enthusiasm! We got the last two significant data points of the year this morning: personal spending and new home sales. Both rose significantly. BUT there are big drawbacks to each. First of all, take a look at the personal savings rate: It just made a new low, at 2.9%, for this expansion. On the one hand, this is a concrete measure of consumer confidence, in that consumers are comfortable spending more of their income. But at the same time, a big decrease in the savings rate, such as we have had over the last 16 months, tends to happen later in expansions, and makes consumers more vulnerable to any inflationary shock. Similarly, new home sales had a big +17.5% monthly

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Personal spending and new home sales: restrain your enthusiasm!

Look at the huge, ~50,000 jumps for the South and the West. The South might make sense if it is still a post-hurricanes rebound. But does anyone seriously think there was a 30% jump in a single month in the West?!? So I strongly suspect we’re going to get another big downward revision next month.

Next week I’ll post a final update on my “Five graphs for 2017” along with a review of the 2017 forecast I made one year ago. After that, in the new year, I’ll consider whether or not the US economy is actually entering a Boom. See you th