By New Deal democrat Do “high pressure” low unemployment economies lead to more capitalinvestment? The Atlanta Fed’s Macroblog has an interesting article today on whether a “high pressure” low unemployment economy leads to more capital investment. At least based on surveys, they answer in the negative, with companies pulling out the old chestnut of being unable to find qualified help “(at the wage we want to pay”). But the article reports on one survey only, and does not delve into any long term historical data. So of cuorse I did. Here’s what I found. Annual data on real private fixed nonresidential data, and U-3 unemployment, can both be found back to 1948. The first graph compares the YoY% change in investment vs. the YoY% change in the unemployment rate: There is a high correlation, but there is no apparent leading relationship. In fact they look coincident. At best it appears that investment continues to expand even as the unemployment rate holds steady in mature expansions.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Do “high pressure” low unemployment economies lead to more capitalinvestment?

The Atlanta Fed’s Macroblog has an interesting article today on whether a “high pressure” low unemployment economy leads to more capital investment. At least based on surveys, they answer in the negative, with companies pulling out the old chestnut of being unable to find qualified help “(at the wage we want to pay”).

But the article reports on one survey only, and does not delve into any long term historical data. So of cuorse I did.

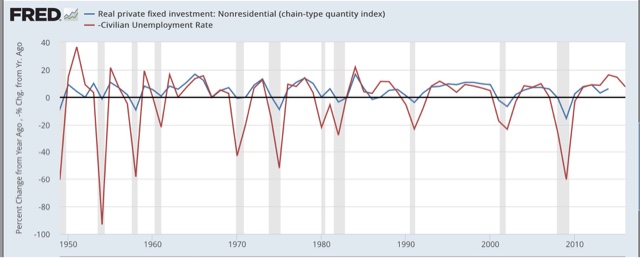

Here’s what I found. Annual data on real private fixed nonresidential data, and U-3 unemployment, can both be found back to 1948.

The first graph compares the YoY% change in investment vs. the YoY% change in the unemployment rate:

There is a high correlation, but there is no apparent leading relationship. In fact they look coincident. At best it appears that investment continues to expand even as the unemployment rate holds steady in mature expansions.

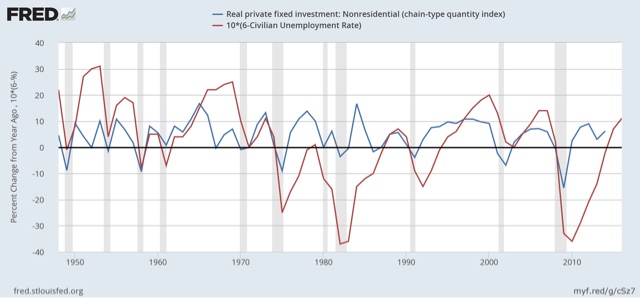

So how about when we measure by how “high pressure” the job market is? In the below graph I subtracted the unemployment rate from 6%, meaning that only unemployment rates lower than 6% show as positive numbers, with the lower the unemployment rate showing as the higher the number:

Lo and behold, it seems pretty clear that the unemployment rate doesn’t lead capital investment at all. In fact, it appears that the reverse is true! Correlation is not causation, but one thing that seems obvious is that low unemployment does not cause higher capital investment.

This is just a preliminary look. If I can find quarterly data going back a long enough time, obviously that would be better than annual data.

I suspect that both investment and unemployment are primarily reacting to a third thing: namely, interest rates. So what we should be looking for is a sustained period of a “high pressure” economy with relatively low interest rates. Of the two possible “sustained high pressure” periods, the 1960s and 1990s, only the latter has relatively low interest rates. And there we do find that capital investment remained robust for a lengthy period of time. So the best case scenario appears to be that a sustained “high pressure” low unemployment economy with relatively low interest rates, will have relatively higher sustained capital investment.

cross posted with Bonddadd blog