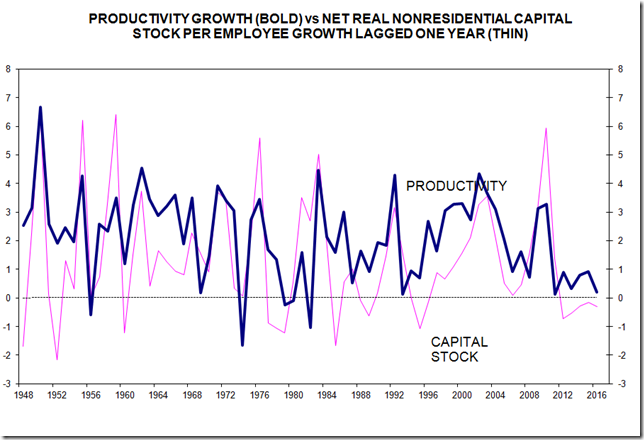

Last week Timothy Taylor at Convertible Economist did a very good post on gross vs net capital spending. http://conversableeconomist.blogspot.com/2017/02/declining-us-investment-gross-and-net. He showed that in recent years the more rapid growth of high tech spending has had an unanticipated impact. The new high tech equipment has a much shorter life span that more traditional equipment. Consequently, more and more of gross capital spending is just being used to replace old equipment ( depreciation). Before the 1980s net investment was about 40% of gross investment but now it is only about 20% of gross investment. We are having to run faster and faster just to stay even. As he points out investment in capital is a major driver of productivity growth and is a major factor behind the stagnation in US economic growth. I’ve taken his analysis one more step to show the relation between productivity growth and the change in real capital stock per employee. As the chart shows, there is a very tight relationship between productivity growth and the growth of the real capital stock per employee. I am convinced that this is a real and important factor behind the weak productivity and the stagnant economy in recent years. Real GDP growth is essentially the growth of productivity plus the growth of the labor force.

Topics:

Spencer England considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Last week Timothy Taylor at Convertible Economist did a very good post on gross vs net capital spending.

http://conversableeconomist.blogspot.com/2017/02/declining-us-investment-gross-and-net.

He showed that in recent years the more rapid growth of high tech spending has had an unanticipated impact. The new high tech equipment has a much shorter life span that more traditional equipment. Consequently, more and more of gross capital spending is just being used to replace old equipment ( depreciation). Before the 1980s net investment was about 40% of gross investment but now it is only about 20% of gross investment. We are having to run faster and faster just to stay even. As he points out investment in capital is a major driver of productivity growth and is a major factor behind the stagnation in US economic growth.

I’ve taken his analysis one more step to show the relation between productivity growth and the change in real capital stock per employee.

As the chart shows, there is a very tight relationship between productivity growth and the growth of the real capital stock per employee. I am convinced that this is a real and important factor behind the weak productivity and the stagnant economy in recent years. Real GDP growth is essentially the growth of productivity plus the growth of the labor force. You should be able to tell that the trend growth of both economic series have a significant downward slope.

What I’m showing in this chart is not unusual and would fit in with most versions of mainstream economics. But I’m going to take the analysis a step further and suggest that the underlying problem is cheap labor. If labor is cheap, business has little or no incentive to make large scale investments to raise the productivity of labor. Rather, the two dominant factor explaining much of business investment over the past few decades has been the shift of factories from the north to the south of the US and if this is not enough to shift production abroad.