CBPP has this pictorial analysis of the increased premiums resulting from the Senate version of the AHCA for a 60 year old at 350% FPL with an ACA Silver plan. “For a 60-year-old with income of 350 percent of the poverty level (about ,000 today) facing the average premium on HealthCare.gov, out-of-pocket premiums would jump by an estimated ,994. Premiums would rise by $ 2,022 for a 45-year-old at this income level, and fall by for a 30-year-old. Premiums would rise by ,694 for a 60-year old with income of 300 percent of the poverty line, and by ,903 for a 60-year old with income of 150 percent of the poverty line.” The Senate AHCA Bill increases Premium Costs . A sixty year old slightly above 350% FPL would face the loss of thousands of dollars

Topics:

run75441 considers the following as important: Featured Stories, Healthcare, Hot Topics, Journalism, politics, run75441

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

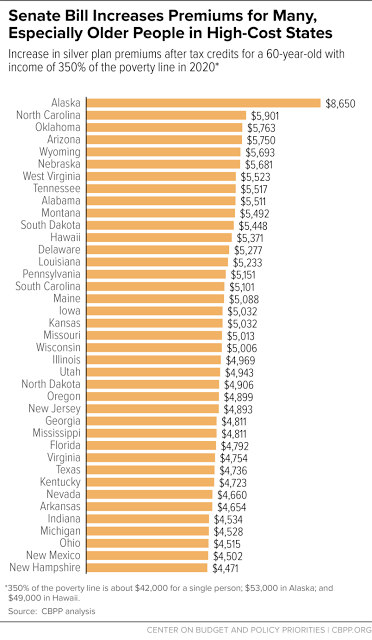

CBPP has this pictorial analysis of the increased premiums resulting from the Senate version of the AHCA for a 60 year old at 350% FPL with an ACA Silver plan. “For a 60-year-old with income of 350 percent of the poverty level (about $42 ,000 today) facing the average premium on HealthCare.gov, out-of-pocket premiums would jump by an estimated $4,994. Premiums would rise by $ 2,022 for a 45-year-old at this income level, and fall by $75 for a 30-year-old. Premiums would rise by $2,694 for a 60-year old with income of 300 percent of the poverty line, and by $1,903 for a 60-year old with income of 150 percent of the poverty line.”

The Senate AHCA Bill increases Premium Costs .

The Senate AHCA Bill increases Premium Costs .

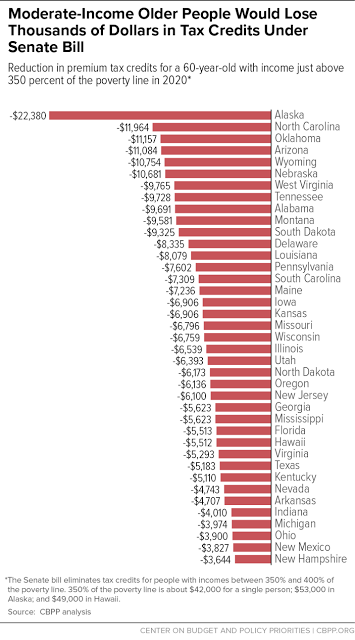

A sixty year old slightly above 350% FPL would face the loss of thousands of dollars in tax credits. Presently, the ACA covers up to 400% FPL and limits how much can be charged for age to 300%. The AHCA goes to 500% and reduces the subsidy coverage to 350% FPL.

Senate AHCA eliminates subsidies (difference between total cost of the plan and a percentage of income) for those between 350% and 400% FPL resulting in $thousand of dollars in cost for those in the Individuals Market. Tax-credit subsidies would cover only 58 percent of health care costs, rather than 70 percent as under current law a decrease in actuarial value. People in higher healthcare cost states would have to pay more as depicted in the CBPP chart.

Senate AHCA eliminates subsidies (difference between total cost of the plan and a percentage of income) for those between 350% and 400% FPL resulting in $thousand of dollars in cost for those in the Individuals Market. Tax-credit subsidies would cover only 58 percent of health care costs, rather than 70 percent as under current law a decrease in actuarial value. People in higher healthcare cost states would have to pay more as depicted in the CBPP chart.

Under either Republican Plan, higher premiums and deductibles would force people into lower level plans covering less at greater cost. Why do this and incite anger amongst constituents when you can just keep on doing what you have done in the past and undermine the ACA with blocking the Risk Corridor program and cut deductible subsidies by killing the CSR? I believe McConnell is thinking along these lines and can shift the blame of the resulting ACA failure to Dems. Dems would take the blame as no one would understand how it came to be and little would be explained by the press.

Senate Bill Still Cuts Tax Credits, Increases Premiums and Deductibles for Marketplace Consumers CBPP, Aviva Aron-Dine and Tara Straw, June 25, 2017