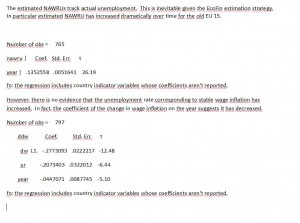

Robert Waldmann | January 25, 2017 6:46 am First note strong evidence that the rate of wage inflation is mean reverting. This is a pooled regression with data from the Old EU 15 from 1960 through 2015. Indicator variables for countries are included but the coefficients aren’t reported. dw is the percent rate of wage inflation. ddw is the change of dw. The coefficient of ddw on lagged wage inflation is negative. Since wage inflation is not stationary, inference based on the conventional t-statistic is misleading, but it is very hard to defend excluding lagged wage inflation from regressions. ....... In all pooled regressions of the 15 countries, country indicators are included, but the coefficients aren’t reported.Table 2 shows a simple wage Phillips curve regression in which an equal slope for all countries is imposed. ur is the unemployment rate. ...... Table 3 adds EcoFin’s estimate of the non wage inflatin accelerting rate of unemployment (nawru). It provides almost exactly zero evidence that the estimated NAWRU is useful when forecasting the acceleration of the rate of wage inflation. .......

Topics:

Robert Waldmann considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

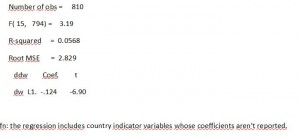

First note strong evidence that the rate of wage inflation is mean reverting. This is a pooled regression with data from the Old EU 15 from 1960 through 2015. Indicator variables for countries are included but the coefficients aren’t reported. dw is the percent rate of wage inflation. ddw is the change of dw. The coefficient of ddw on lagged wage inflation is negative. Since wage inflation is not stationary, inference based on the conventional t-statistic is misleading, but it is very hard to defend excluding lagged wage inflation from regressions.

.

.

.

.

.

.

.

In all pooled regressions of the 15 countries, country indicators are included, but the coefficients aren’t reported.

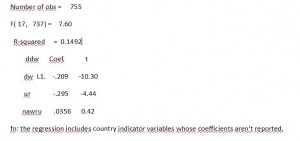

Table 2 shows a simple wage Phillips curve regression in which an equal slope for all countries is imposed. ur is the unemployment rate.

.

.

.

.

.

.

Table 3 adds EcoFin’s estimate of the non wage inflatin accelerting rate of unemployment (nawru). It provides almost exactly zero evidence that the estimated NAWRU is useful when forecasting the acceleration of the rate of wage inflation.

.

.

.

.

.

.

.

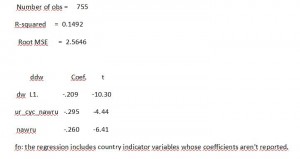

Another way to present this is to regress the change of the rate of wage inflation on lagged wage inflation, the NAWRU and the difference between the unemployment rate and the NAWRU (ur_cyc_nawru). If the ewstimated nawru is the rate of unemployment corresponding to non accelerating wage inflation, its coefficient should be zero.

.

.

.

.

.

.

.

.

.

.

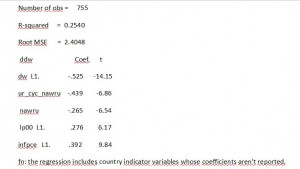

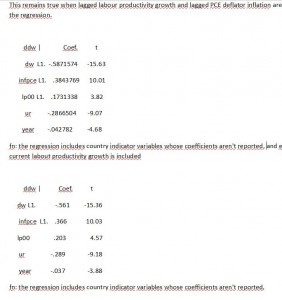

Results are fairly similar if lagged productivity growth in percent (lp00) and lagged personal consumption deflator inflation in percent (infpce) are included in the regression. When these variables are included, there is statistically signficant evidence that the EcoFin estimates of the NAWRU are of some use, but also very strong evidence that their estimate of cyclical unemployment is not correct.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.