By Steve Roth (originally published at Evonomics) Four Definitions of Money. All Correct Money makes the world go round. That may well be true, but money certainly makes the economics world go round. It’s the discipline’s special purview, the numeric linchpin that gives economics its dominant role and voice in our affairs. It’s what makes economics seem so “objective” compared to other social sciences. Given that, it’s remarkable that economists don’t have an agreed-upon definition of the word. Sure, there’s the three- or sometimes four-part “money serves as…” non-definition that you learn in Econ 101. But in practice, what you see is a hodge-podge of unstated and shifting meanings in economic discussions. The problem is, there are multiple, perfectly

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

By Steve Roth (originally published at Evonomics)

Four Definitions of Money. All Correct

Money makes the world go round. That may well be true, but money certainly makes the economics world go round. It’s the discipline’s special purview, the numeric linchpin that gives economics its dominant role and voice in our affairs. It’s what makes economics seem so “objective” compared to other social sciences.

Given that, it’s remarkable that economists don’t have an agreed-upon definition of the word. Sure, there’s the three- or sometimes four-part “money serves as…” non-definition that you learn in Econ 101. But in practice, what you see is a hodge-podge of unstated and shifting meanings in economic discussions.

The problem is, there are multiple, perfectly valid, widely-used meanings for the word. They’re all “correct.” The challenge is to be clear on each of those meanings, and on which ones are being used in a discussion.

Here’s a shot at that defining those commonly-used meanings, and the relationships between them:

money. n.

1. A technology invented ca. fourth-millenium BCE for tallying up the value of diverse ownership claims, and designating prices, numerated in arbitrary units of account. “What’s the summed-up value of two goats plus three chickens?”

2. Wealth: the sum of tallied balance-sheet assets (see #1). Ask a real-estate tycoon or mutual-fund investor, “How much money do you have?”

3. Financial instruments whose market prices are institutionally pegged to a unit of account. Fixed-price instruments: physical cash, checking and money-market balances, etc. (The price of a dollar bill or a one-dollar checking-account balance is always one dollar.) A subset of #2. “How much ‘cash’ do you have in your portfolio, on your balance sheet — assets/instruments whose prices never change?”

4. Coins and currency. Physical tokens representing balance-sheet assets, which make it easy to transfer those assets from one balance sheet to another. A subset of #3. “How much money do you have in your pocket?”

The second definition bears examination: does this widespread usage fit with another intuitive, vernacular sense of the word — “Stuff I can use to buy stuff”? It doesn’t seem to; you can’t buy a car with shares of stock (much less the reverse).

“You can only buy stuff with #3 and #4 money. That’s my definition of money. So by (my) definition, #2 money isn’t money.” But in practice, in our liquid financial system, you can easily swap some of your Apple shares for “cash” (#3 money), and swap the cash for a car.

“Do you have enough money to buy that car?” is obviously not asking how much #3 money you have. It’s about #2 money. Someone with a big stock portfolio has a lot more money (actually, effectively), so can buy a lot more cars.

As long as the financial system is working smoothly, #2 money is a perfectly sensible meaning for the word. That’s why people use that meaning of the word, all the time.

The third definition also deserves scrutiny. Is this how people or economists talk about money? Yes. Go through the monetarist-dominated literature, and you’ll see: It’s the unstated definition of what we might call “monetarists’ money.” It’s what they mean when they use the word.

This makes sense, because #3 money is basically the same as “stuff I can use to buy stuff.” People accept #3 instruments in payment because prices are designated in the unit of account, and these instruments have fixed prices relative to the unit of account. There’s no uncertainty about what they’re getting, at least in nominal UofA terms.

Are these definitions useful? Do they make it easier to discuss and clearly understand economic issues, to talk and think together about money?

Let’s start with the “where money came from” conversation. What kind of money is it asking about? Coins weren’t invented until circa 8th century CE. But tally sheets using arbitrary units of account, #2 money, go back thousands and maybe tens of thousands of years. Writings referring explicitly to monetary units — long-divorced from their possible linguistic roots as physical commodity measures — are extremely widespread, and also go back millennia.

Whatever the merits of these four definitions, they at least let us be clear when we ask what kind of “money” invention we’re talking about.

Next: what do economists today mean by the “money supply”? Let’s assume they’re talking about a “money stock,” not a flow measure. They’ll point you to monetary aggregates (M0, M2, MZM, MB or monetary base, etc.), which are all tallies of #3 money, fixed-price instruments. Different aggregates tally up different sets of instruments, but the general sense is clear: the money supply equals the outstanding stock of fixed-price instruments.

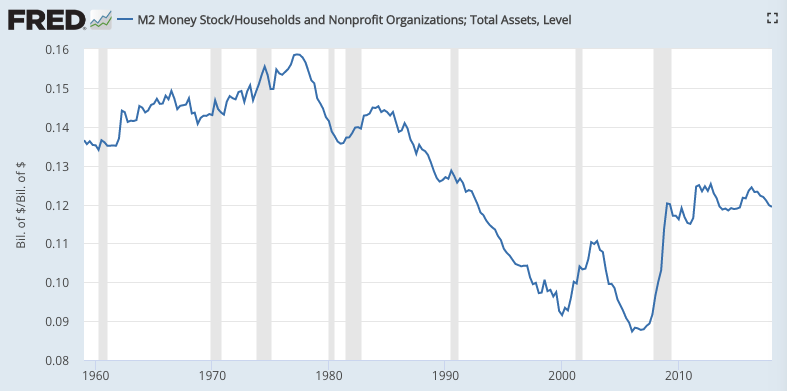

But these fixed-price instruments are a pretty small subset of the larger definition, #2 money, “how much money do you have?” Only ten to fifteen percent of U. S. households’ wealth/assets, for instance, consist of fixed-price instruments. Variable-priced instruments (bonds, equity shares, land titles, etc.) dominate this larger pool of money. That seems like a useful hard-line distinction when thinking about money and how it works.

Next, “demand for money.” What does this mean? It always refers to demand for #3 money, fixed-price instruments. So it’s talking about portfolio preferences — how much of their portfolios do wealthholders want to hold in “cash”? You can get a sense of this here:

(Note that household total assets includes the market value of all firms, because households ultimately own all equity shares, at zero or more removes. Firms don’t own households — at least not yet; households don’t issue equity shares. So household assets/wealth is a good “telescoped” measure of total private-sector assets/wealth, the #2 money stock.)

This “demand for money” in today’s economy is not about main-streeters needing more “cash” so they can spend and buy stuff, so driving up the “price of money” (an oxymoron, since these #3 money instruments have fixed prices). It’s easy to swap enough assets for cash, when necessary for purchases. It’s about the wealthholders wanting to hold a higher proportion their assets in #3 “cash.”

Next, how about “velocity of money”? For monetarists, this means the velocity of #3 money, as measured in various monetary aggregates. How much do those money stocks turn over in spending each year? Do those velocity ratios yield useful economic insights — especially about people’s propensity to spend?

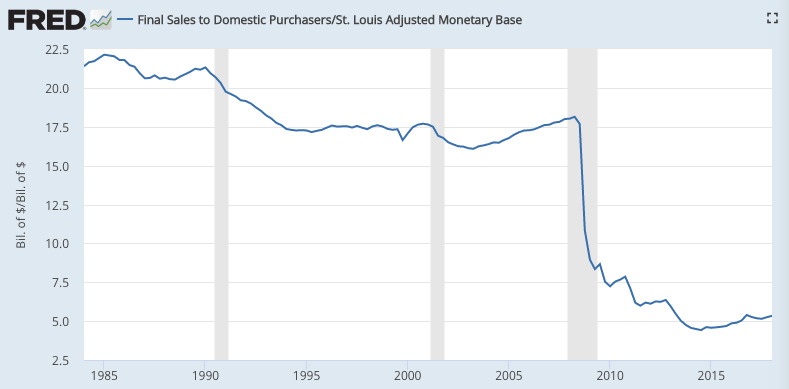

Let’s look at that for two #3 money aggregates. Here’s MB or Monetary Base (physical cash/coins plus “reserve” holdings at the Fed):

This is wildly skewed after 2008, obviously, by QE: the Fed bought a bunch of (variable-priced) bonds from the private sector, swapping Fed fixed-price reserves in return. So MB went way up. This velocity measure/ratio is dominated by that “artificial” change in the denominator, which makes it hard to deduce anything useful about changes in the numerator — spending.

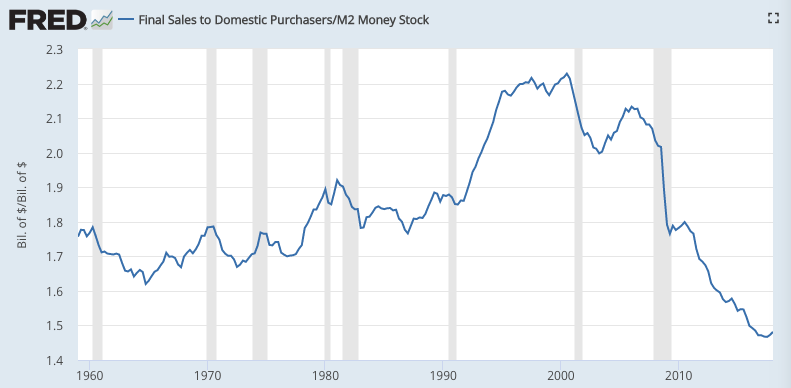

How about M2 — a broad measure of currency in circulation plus checking, saving, and money-market account holdings? (It doesn’t include Fed reserve balances, or — much less significant — banks’ physical “vault cash.”)

This velocity seems to decline before/during/after recessions, so there may be some cyclical insight here. But the pattern and its probable causes are hard to discern — long-term patterns/effects even more so. (Suggestions welcome.)

It’s not at all clear that the stock of fixed-priced instruments as the denominator of a velocity ratio is terribly revealing.

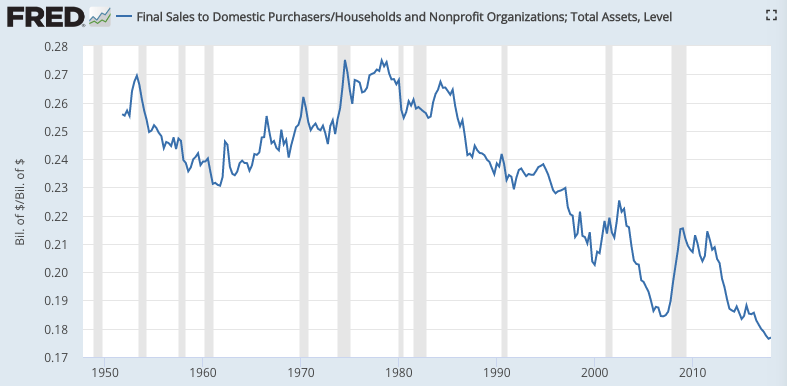

But what if we use #2 money, assets/wealth, as our measure of money hence velocity?

There’s a clear and quite massive trend here from the late 1970s/1980 to today, and it’s strikingly familiar. (Think: Inflation, interest rates, wage growth, labor share.) Does it tell us anything about spending (propensities) or other economic effects?

I’ll leave that question with my gentle readers. But whatever the economic takeaways from these measures and ratios, in each case we can clearly understand what we mean when we say “money.” Perhaps these careful definitions will be useful in clarifying economic discussions.

2018 August 4