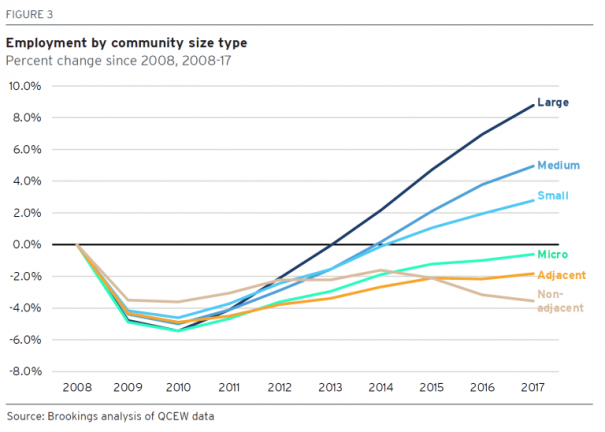

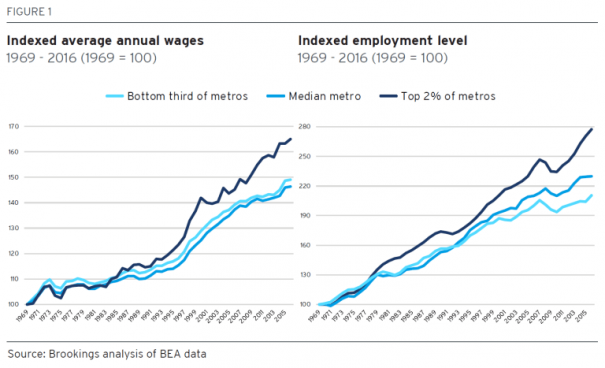

Brookings Institute points us to: Big, techy metros like San Francisco, Boston, and New York with populations over 1 million have flourished, accounting for 72 percent of the nation’s employment growth since the financial crisis. By contrast, many of the nation’s smaller cities, small towns, and rural areas have languished. Smaller metropolitan areas (those with populations between 50,000 and 250,000) have contributed less than 6 percent of the nation’s employment growth since 2010 while employment remains below pre-recession levels in many ‘micro’ towns and rural communities (those with populations less than 50,000). Two graphs demonstrate part of the geography of markets and growth. Of course even the 1 per cent metros have divergent economic trends

Topics:

Dan Crawford considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Brookings Institute points us to:

Big, techy metros like San Francisco, Boston, and New York with populations over 1 million have flourished, accounting for 72 percent of the nation’s employment growth since the financial crisis. By contrast, many of the nation’s smaller cities, small towns, and rural areas have languished. Smaller metropolitan areas (those with populations between 50,000 and 250,000) have contributed less than 6 percent of the nation’s employment growth since 2010 while employment remains below pre-recession levels in many ‘micro’ towns and rural communities (those with populations less than 50,000).

Two graphs demonstrate part of the geography of markets and growth. Of course even the 1 per cent metros have divergent economic trends within them. The graphs make useful visualizations for discussion. Market forces are unlikely to change this on its own even if it is considered a problem generally: