(Dan here. Spencer sends this e-mailed post): by Spencer England Real trade balance and 1st Q real GDP growth Figure 1 With the federal deficit jumping from 3.5% to 5% of GDP the US will be expanding its current account deficit by a like amount. You can see it in the January trade balance where the real trade balance has expanded from around ,000 ( real 2009 ) to around ,000 ( real 2009 ) or 16%. The real trade deficit is the flip side of the federal budget deficit as the US turns to foreign capital inflows to finance the deficit. We only have January real trade data reported so far, but it is obvious that the flip side of the Trump deficit is the plunging trade ( current account) deficit that was a major negative for 4th Q real GDP and is

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

(Dan here. Spencer sends this e-mailed post):

by Spencer England

Real trade balance and 1st Q real GDP growth

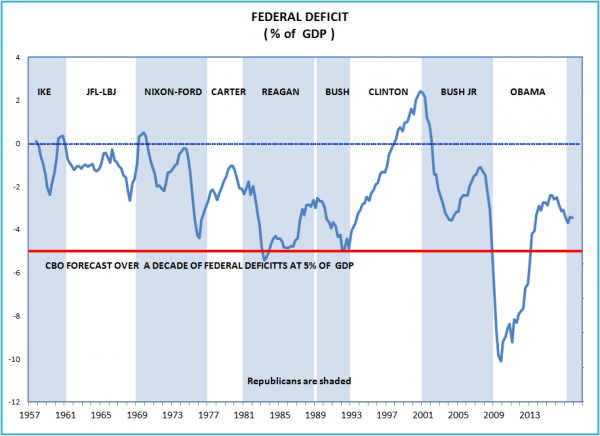

With the federal deficit jumping from 3.5% to 5% of GDP the US will be expanding its current account deficit by a like amount. You can see it in the January trade balance where the real trade balance has expanded from around $60,000 ( real 2009 ) to around $70,000 ( real 2009 ) or 16%. The real trade deficit is the flip side of the federal budget deficit as the US turns to foreign capital inflows to finance the deficit. We only have January real trade data reported so far, but it is obvious that the flip side of the Trump deficit is the plunging trade ( current account) deficit that was a major negative for 4th Q real GDP and is likely to have even a bigger negative impact on 1st Q real GDP growth than the -1.33 percentage point cut real trade had on 4th Q real GDP growth. The Atlanta Fed has already cut it 1st Q growth forecast from 3% a month ago to 1.8% currently.