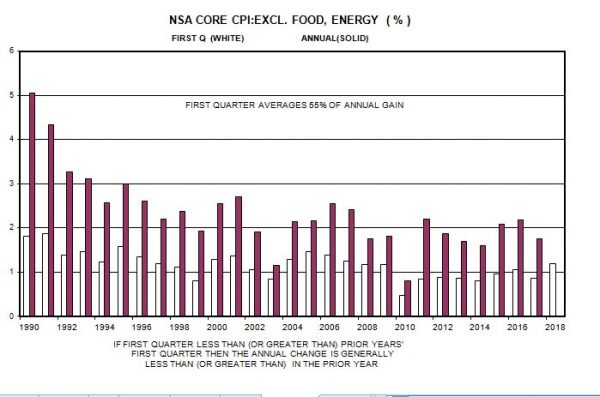

In a low inflation world firms tend to raise prices once a year — typically in the first quarter or the first quarter of their fiscal year. Consequently, over half of the annual increase in the not seasonally adjusted core CPI occurs in the first quarter and doubling the first quarter increase gives an amazingly accurate estimate of the annual rise in the core CPI. Figure 1 This year the first quarter rise in the not seasonally adjusted core CPI was 1.2% as compared to 0.9% in 2017. This implies the core CPI will be up 2.4% in 2018 versus 1.8% last year. This would be the largest annual increase in the core CPI in a decade. Figure 2

Topics:

Spencer England considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

In a low inflation world firms tend to raise prices once a year — typically in the first quarter or the first quarter of their fiscal year. Consequently, over half of the annual increase in the not seasonally adjusted core CPI occurs in the first quarter and doubling the first quarter increase gives an amazingly accurate estimate of the annual rise in the core CPI.

This year the first quarter rise in the not seasonally adjusted core CPI was 1.2% as compared to 0.9% in 2017. This implies the core CPI will be up 2.4% in 2018 versus 1.8% last year. This would be the largest annual increase in the core CPI in a decade.