Trump is blaming the Fed for the recent poor stock market performance. For once, he may be right. The recent market plunge took the stock market PE from the top of my fair value band through the bottom. The last observation is the 14 December close. The fitted PE has is a function of both short and long term yields. This approach implies that the market is now cheap, but that does not necessarily mean that it is a buy. Figure 1 Maybe you would prefer a leading indicator approach. In this case real MZM growth ( zero maturity money= M1 +money market accounts). It is obvious that MZM growth is still weakening and signalling that the market PE should contito fall. It is just the simple theory that stock market liquidity and movement are driven largely by

Topics:

Spencer England considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Trump is blaming the Fed for the recent poor stock market performance. For once, he may be right.

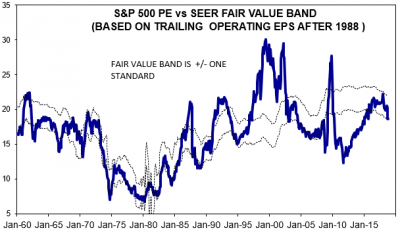

The recent market plunge took the stock market PE from the top of my fair value band through the bottom. The last observation is the 14 December close. The fitted PE has is a function of both short and long term yields. This approach implies that the market is now cheap, but that does not necessarily mean that it is a buy.

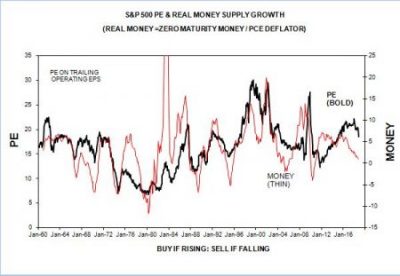

Maybe you would prefer a leading indicator approach. In this case real MZM growth ( zero maturity money= M1 +money market accounts). It is obvious that MZM growth is still weakening and signalling that the market PE should contito fall. It is just the simple theory that stock market liquidity and movement are driven largely by monetary policy and right now monetary policy is tight enough to drive the market below the fair value band. Moreover, since MZM growth is still weakening it implies that the market downdraft is not over.