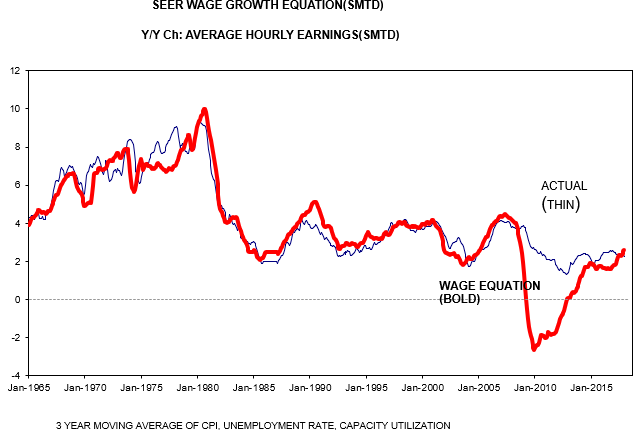

For the first time since the Great Recession my wage equation says average hourly earnings growth should be higher than the actual data shows. Moreover, the fitted value is rising sharply. Each of the three variables in the equation — the unemployment rate, capacity utilization and inflation expectations — is now pushing the fitted value higher. This is the first time since that the fitted value is both above the actual growth of average hourly earnings the Great Recession and rising sharply. Rising wages should contribute to higher nominal income growth and this in turn is a major determinate of bond yields. Figure 1

Topics:

Spencer England considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

For the first time since the Great Recession my wage equation says average hourly earnings growth should be higher than the actual data shows. Moreover, the fitted value is rising sharply. Each of the three variables in the equation — the unemployment rate, capacity utilization and inflation expectations — is now pushing the fitted value higher. This is the first time since that the fitted value is both above the actual growth of average hourly earnings the Great Recession and rising sharply. Rising wages should contribute to higher nominal income growth and this in turn is a major determinate of bond yields.