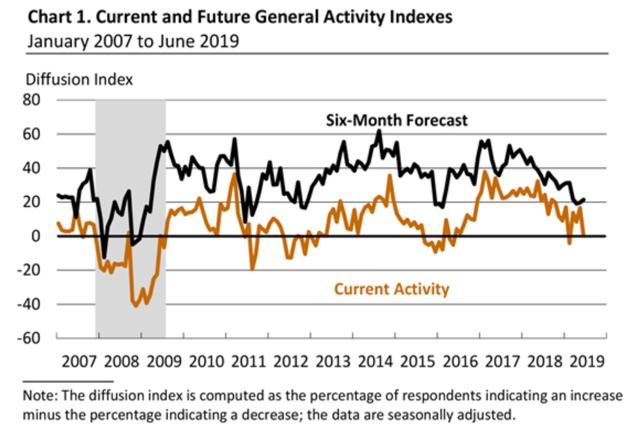

Regional Fed indexes confirm that manufacturing is flat [A reminder: this week I’m on vacation, so light posting is the rule.] Earlier this week the Empire State Manufacturing Index went negative. This morning the Philly Index just barely avoided the same, reported at up +0.3 for June: The more leading new orders index declined to +8.3. This means the average of NY and Philly is a little below -1, while the average of all five regional Fed indexes as of their last reports is +0.8. Last week I pointed out that the average manufacturing work week had fallen to a point consistent with an oncoming recession, and based on past patterns, I expect layoffs to follow. This week’s two regional indexes show that the leading manufacturing sector, as of the most

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Regional Fed indexes confirm that manufacturing is flat

[A reminder: this week I’m on vacation, so light posting is the rule.]

Earlier this week the Empire State Manufacturing Index went negative. This morning the Philly Index just barely avoided the same, reported at up +0.3 for June:

This means the average of NY and Philly is a little below -1, while the average of all five regional Fed indexes as of their last reports is +0.8.

Last week I pointed out that the average manufacturing work week had fallen to a point consistent with an oncoming recession, and based on past patterns, I expect layoffs to follow. This week’s two regional indexes show that the leading manufacturing sector, as of the most recent readings, is not in decline, but on the other hand, it is almost exactly flat.