Despite all the recent stock market volatility the actual S&P 500 PE on trailing operating earnings is almost exactly where my model says it should be. The biggest problem is that the market PE is about 19 and bond yields are under 2%. The quick and dirty rule of thumb is that a 100 basis point change in yields should generate a 100 basis point change in the S&P 500 PE. With bond yields already under 2% the upside potential for the market PE is under 200 basis points — driving the PE to the upper limit of the fair value band. Consequently, further market increases are almost completely dependent on earnings growth. But currently, unit labor cost are rising faster than prices as measured by the non-farm business deflator and world economic growth

Topics:

Spencer England considers the following as important: Uncategorized, US EConomics

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

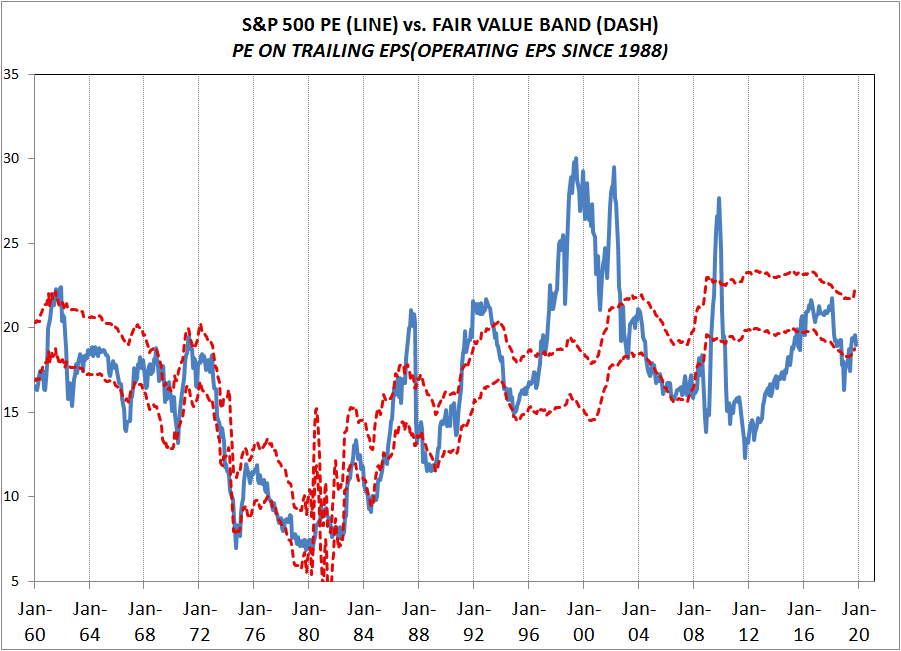

Despite all the recent stock market volatility the actual S&P 500 PE on trailing operating earnings is almost exactly where my model says it should be.

The biggest problem is that the market PE is about 19 and bond yields are under 2%. The quick and dirty rule of thumb is that a 100 basis point change in yields should generate a 100 basis point change in the S&P 500 PE. With bond yields already under 2% the upside potential for the market PE is under 200 basis points — driving the PE to the upper limit of the fair value band.

The biggest problem is that the market PE is about 19 and bond yields are under 2%. The quick and dirty rule of thumb is that a 100 basis point change in yields should generate a 100 basis point change in the S&P 500 PE. With bond yields already under 2% the upside potential for the market PE is under 200 basis points — driving the PE to the upper limit of the fair value band.

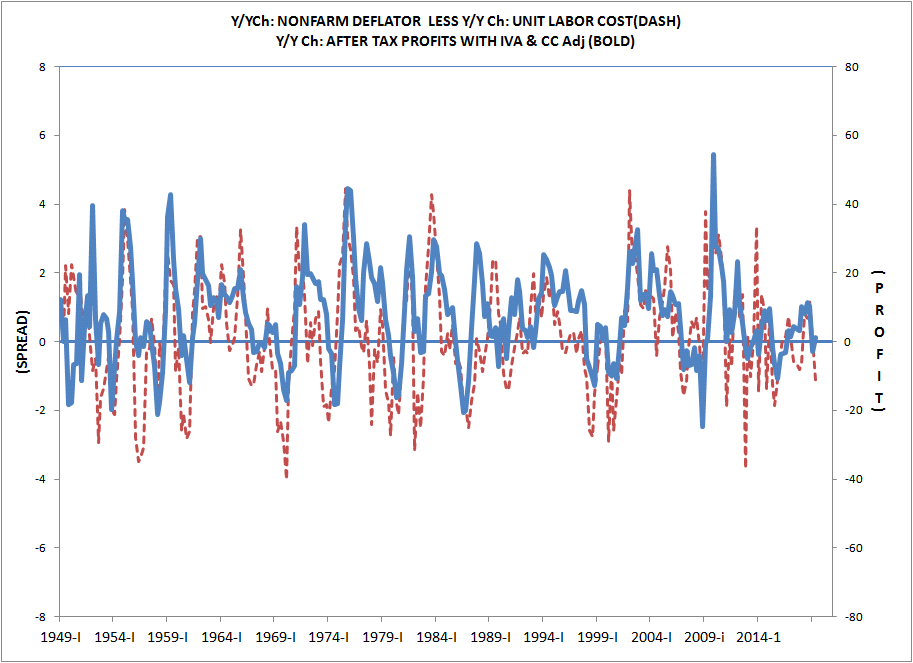

Consequently, further market increases are almost completely dependent on earnings growth. But currently, unit labor cost are rising faster than prices as measured by the non-farm business deflator and world economic growth remains very weak. While this spread is a powerful determinate of earnings growth you have to be careful with it as the most recent observations are subject to significant revisions.

Consequently, further market increases are almost completely dependent on earnings growth. But currently, unit labor cost are rising faster than prices as measured by the non-farm business deflator and world economic growth remains very weak. While this spread is a powerful determinate of earnings growth you have to be careful with it as the most recent observations are subject to significant revisions.

Given these conditions the stock market downside risks clearly looks larger than the upside potential.