Summary:

Congress has been busily working on a much-needed way to improve Middle Class savings and growth over the span of their employment to boost their retirement. Dueling bills to restructure IRAs and 401ks appear to be redundant. Better known as the “Setting Every Community Up for Retirement Act” (SECURE Act) H.R.1994 and the Senate has a similar bill, the “Retirement Enhancements and Savings Act” S.792 (RESA). Both bills were passed with bipartisan support. For the ultra rich? A major outcome of the Trump tax bill were tax breaks for the wealthy and corporations. Besides much of the resulting income increases going to 1% of the household taxpayers, the same 1% were given the ability to shelter large amounts of income in gifts to their heirs. It is a great

Topics:

run75441 considers the following as important: politics, Taxes/regulation, Uncategorized, US EConomics, wage growth

This could be interesting, too:

Congress has been busily working on a much-needed way to improve Middle Class savings and growth over the span of their employment to boost their retirement.

Dueling bills to restructure IRAs and 401ks appear to be redundant. Better known as the “Setting Every Community Up for Retirement Act” (SECURE Act) H.R.1994 and the Senate has a similar bill, the “Retirement Enhancements and Savings Act” S.792 (RESA). Both bills were passed with bipartisan support.

For the ultra rich? A major outcome of the Trump tax bill were tax breaks for the wealthy and corporations. Besides much of the resulting income increases going to 1% of the household taxpayers, the same 1% were given the ability to shelter large amounts of income in gifts to their heirs. It is a great time to be rich in income and have the ability to shelter it by making gifts of it to your heirs’ tax free!

A little history on why Congress might take this up

From 1979 to 2017, the average annual income for the 1% of the household taxpayers has increased 156%, the top 1 hundredth of 1% income increased 343%, and the average American’s income did not increase at all. In spite of increased education from 1970 when half of Americans 25 years and older had a high school degree compared to today when the proportion of Americans having a college degree tripled, income has been stagnant for much of America. Even with the increased education, as Nick Hanauer in a recent Atlantic on this topic stated, the “Education is Not Enough” or was not enough to build to build a vibrant middle class. Nick is reiterating what Tom Hertz said in 2006 in his article; “Understanding Mobility in America.”

“The first aspect is the question of intergenerational mobility, or the degree to which the economic success of children is independent of the economic status of their parents. The second aspect is the short-term question of the amount by which family incomes change from year to year. One very clear conclusion is children from low-income families have only a 1 percent chance of reaching the top 5 percent of the income distribution versus children of the rich who have about a 22 percent chance.”

All the education in the world may not make a bit of difference in upward mobility as Nick and Tom Hertz concluded unless the income and the status is already there. A successful middle class with good income has to be present.

The House passed the SECURE Act with an almost unanimous bipartisan 2nd vote. Prior to the first vote, Republican NC Representative Patrick McHenry made a motion for an affirmative vote (page H4147) stating they stand together against the anti-Semitic BDS movement. How this applies to the average citizen’s IRA is beyond me. It is a tagalong to the SECURE Act with the hope it would pass. It lost with 222 in opposition.

A few things about the House “Setting Every Community Up for Retirement Act (SECURE).

Congress has been busily working on a much-needed way to improve Middle Class savings and growth over the span of their employment to boost their retirement. Dueling bills to restructure IRAs and 401ks appear to be redundant. Better known as the “Setting Every Community Up for Retirement Act” (SECURE Act) H.R.1994 and the Senate has a similar bill, the “Retirement Enhancements and Savings Act” S.792 (RESA). Both bills were passed with bipartisan support. For the ultra rich? A major outcome of the Trump tax bill were tax breaks for the wealthy and corporations. Besides much of the resulting income increases going to 1% of the household taxpayers, the same 1% were given the ability to shelter large amounts of income in gifts to their heirs. It is a great

Topics:

run75441 considers the following as important: politics, Taxes/regulation, Uncategorized, US EConomics, wage growth

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

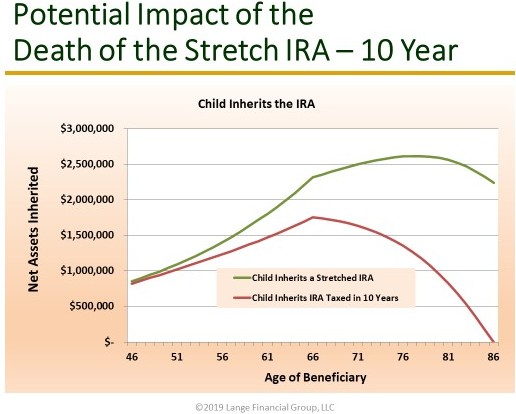

• It lengthens the amount of time a person can contribute to an IRA beyond 70.5 years of age. • Raised the required minimum distribution (RMD) age to 72 from 70 1/2 years old. • Increased the Safe Harbor percent from 10 to 15%. • Allowed long-term, part-time employees to contribute. • Put in place an small employer tax credit for enrollment. • Revised how benefits are paid out to a non spousal from 5 to 10 years (page H4234). • Allowed automatic enrollment. • Etc.“The House SECURE Act would eliminate the current rules allowing non-spousal IRA beneficiaries to use (stretch IRA) minimum distributions (RMDs) from an inherited account over their own lifetime (and potentially allow the funds to grow for decades). With the SECURE Act, all funds from an inherited IRA would have to be distributed to non spousal beneficiaries within 10 years of the IRA owner’s death (The rule would apply to inherited funds in a 401(k) account or other defined contribution plan, too.).” Other than the elimination of the Stretch IRA, these changes were needed and they will improve the amounts accumulated for retirement. As I mentioned earlier, much of America has not incurred the same income increases as the 1% or the 1 tenth of 1% of the household taxpayers. Pre-inflation YOY income growth for non supervisory Labor has been ~3%. Subtract out inflation of 2% and income has grown by 1% for much of America not leaving a lot to put into a 401k. I am waiting for the next shoe to drop of increasing the age of when people can take SS. The Senate bill is similar in content except for a provision buried in it taking aim at the Middle Class. [caption id="attachment_157787" align="alignnone" width="516"]

Source: CPA/Attorney James Lange[/caption]

The Senate’s RESA Act shortens the time period for withdrawals for non-spousal beneficiaries of anyone who has inherited an IRA with greater than $400,000 in it (IRA, Roth IRA or 401k). RESA exempts the first $400,000 inherited to a life time of withdrawals and then it forces beneficiaries to cash out over a 5-year period for any amount greater than $400,000. It could have massive tax implications if the amount over $400,000 was large or one’s income tax bracket was high.

Under today’s Stretch IRA rules, heirs of IRA owners were allowed to extend the taxable distributions of an inherited IRA over their lifetime, hence being called “stretch IRAs.” The proposed Senate bill labeled RESA—allows $400,000 of aggregated IRAs to stretch per beneficiary, but chops the cash-out period down to five years for the balance greater than $400,000.

What are the implications? As I said it affects non spousal beneficiaries of the heads of families who have accumulated money greater than $400,000 over their lifetime to pass on as inheritance to their families. Non-spousal beneficiaries on inheriting sums of money greater than $400,000 could have a substance portion of the inheritance taxed by Uncle Sam and also end up in a higher tax bracket as a result. Ok, I said it enough times.

Similar would hold true for the House bill which eliminates the stretch IRA, does not have an exemption for 400,000 of inheritance, and forces a beneficiary to use up inheritance funds in 10 years rather than a lifetime or RESA’s 5 years. The proposed Acts do not impact spousal beneficiaries or minor children named as beneficiaries until pf a majority age, children with disabilities, etc.

The forced 5 year annual distribution of these savings and retirement plans by beneficiaries is the primary revenue vehicle (taxes) of RESA and I assume RESA. Senate Finance Committee Chairman Chuck Grassley, (R-Iowa), who proposed the bill, said on the Senate floor recently that the RESA bill “is paid for” by this provision (as he takes his agricultural benefits resulting from tariffs).

Back to the 1-percenters, Trump’s Tax Overhaul law doubles the estate-tax exemption to $22 million a couple and possibly avoiding taxes in dynasty trusts. The new law doubles the amount that can be passed to heirs without worrying about estate and gift taxes, to about $22 million for a married couple (redundant, I know). But the thresholds are in place only until 2025, and the ultra-rich are turning to a key tool—the dynasty trust—to secure the financial futures of their children, grandchildren, great-grandchildren, and beyond.

Assured wealth and income giving descendants a place on the ladder of mobility as called out as being necessary to move upwards on that same ladder by Tom Hertz and Nick Hanaeur.

Source: CPA/Attorney James Lange[/caption]

The Senate’s RESA Act shortens the time period for withdrawals for non-spousal beneficiaries of anyone who has inherited an IRA with greater than $400,000 in it (IRA, Roth IRA or 401k). RESA exempts the first $400,000 inherited to a life time of withdrawals and then it forces beneficiaries to cash out over a 5-year period for any amount greater than $400,000. It could have massive tax implications if the amount over $400,000 was large or one’s income tax bracket was high.

Under today’s Stretch IRA rules, heirs of IRA owners were allowed to extend the taxable distributions of an inherited IRA over their lifetime, hence being called “stretch IRAs.” The proposed Senate bill labeled RESA—allows $400,000 of aggregated IRAs to stretch per beneficiary, but chops the cash-out period down to five years for the balance greater than $400,000.

What are the implications? As I said it affects non spousal beneficiaries of the heads of families who have accumulated money greater than $400,000 over their lifetime to pass on as inheritance to their families. Non-spousal beneficiaries on inheriting sums of money greater than $400,000 could have a substance portion of the inheritance taxed by Uncle Sam and also end up in a higher tax bracket as a result. Ok, I said it enough times.

Similar would hold true for the House bill which eliminates the stretch IRA, does not have an exemption for 400,000 of inheritance, and forces a beneficiary to use up inheritance funds in 10 years rather than a lifetime or RESA’s 5 years. The proposed Acts do not impact spousal beneficiaries or minor children named as beneficiaries until pf a majority age, children with disabilities, etc.

The forced 5 year annual distribution of these savings and retirement plans by beneficiaries is the primary revenue vehicle (taxes) of RESA and I assume RESA. Senate Finance Committee Chairman Chuck Grassley, (R-Iowa), who proposed the bill, said on the Senate floor recently that the RESA bill “is paid for” by this provision (as he takes his agricultural benefits resulting from tariffs).

Back to the 1-percenters, Trump’s Tax Overhaul law doubles the estate-tax exemption to $22 million a couple and possibly avoiding taxes in dynasty trusts. The new law doubles the amount that can be passed to heirs without worrying about estate and gift taxes, to about $22 million for a married couple (redundant, I know). But the thresholds are in place only until 2025, and the ultra-rich are turning to a key tool—the dynasty trust—to secure the financial futures of their children, grandchildren, great-grandchildren, and beyond.

Assured wealth and income giving descendants a place on the ladder of mobility as called out as being necessary to move upwards on that same ladder by Tom Hertz and Nick Hanaeur.