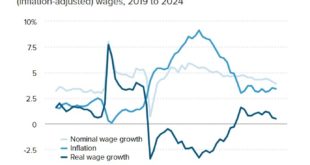

by Elise Gould EPI Average hourly wage growth has exceeded inflation for 12 straight months, according to new Bureau of Labor Statistics data released this morning. This real (or inflation-adjusted) wage growth is a key indicator of how well the average worker’s wage can improve their standard of living. As inflation continues to normalize, I’m optimistic more workers will experience real gains in their purchasing power. The dark blue line...

Read More »A comment on median vs. mean, and job-stratified wage growth

A comment on median vs. mean, and job-stratified wage growth – by New Deal democrat Before today’s avalanche of data, I wanted to comment briefly on the Employment Cost Index for Q4 that was reported yesterday. This index has the advantage of weighting for type of employment. If low wage workers gain a disproportionate number of jobs, that will tend to hold down *average* wages. But the ECI hold the weighting of low, medium, and high wage...

Read More »American plutocracy in two simple graphs; plus, when will wage growth bottom?

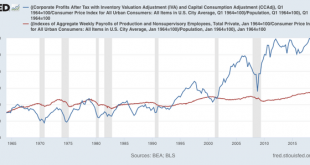

American plutocracy in two simple graphs; plus, when will wage growth bottom? The JOLTS report for February comes out later this morning; I may post on it later or tomorrow. In the meantime, here are updates on several graphs I used to run during the last expansion in order to examine how shared out (or not) economic growth was. First, here is a graph comparing corporate profits adjusted for inflation, and total nonsupervisory wages, also...

Read More »Desirable incentive effects of income taxation V

Fifth and last. Not relevant to the USA. Back in the day when US unions weren’t totally feeble, MacDonald and Solow wrote a brilliant paper on collective bargaining and tax based incomes policy. Imagine a world in which firms must negotiation with unions (for example imagine Europe). The unions have two aims — they want high wages and they want high employment in the sector they represent. This means that a GM&UAW right to manage contract...

Read More »Desirable incentive effects of income taxation V

Fifth and last. Not relevant to the USA. Back in the day when US unions weren’t totally feeble, MacDonald and Solow wrote a brilliant paper on collective bargaining and tax based incomes policy. Imagine a world in which firms must negotiation with unions (for example imagine Europe). The unions have two aims — they want high wages and they want high employment in the sector they represent. This means that a GM&UAW right to manage contract...

Read More »Desirable Incentive Effects of Income Taxation III

This is the third post in a series. I will discuss advantages of income taxation different from the obvious advantage that taking from people with high income hurts them less than taking from people with low income. Here again, I will assume that, in equilibrium, income tax is returned to the people who pay it as a lump sum. I do this to focus on the incentive effects of income taxation. The first two posts are here and here. In standard...

Read More »Rescuing Disposable Time from Oblivion

Two hundred years ago this February, Charles Wentworth Dilke anonymously published a pamphlet titled The Source and Remedy of the National Difficulties, deduced from principles of political economy. Four decades later, Karl Marx would describe the pamphlet in his notes as an “important advance on Ricardo.” In his preface to volume two of Capital, Friedrich Engels described the pamphlet as the “farthest outpost of an entire literature which in the...

Read More »Wages and The Market

In the 19th century, employers stove off employee demands by bringing in immigrants willing to work under existing conditions. In the 20th Century, consequent the Great Depression, prohibition of child labor, immigration reform, … it was no longer so easy for employers to ignore workers demands. Unions took root and membership grew and so did the workers’ wages and benefits; welcome: the end of child labor, the 40 hour week, living wages, and paid...

Read More »To Do I, II, & III

The COVID-19 Pandemic, the inadequate response thereto, and the incompetency of the Trump Presidency in general, combined, have exposed our nation’s weaknesses and failings to an extent unknown since at least the Great Depression. This is likely a do or die moment for America. Recovery will be difficult. Improbable unless we are careful in our choice of goals and daring in our efforts to achieve them. The margins for error do not allow for dawdling....

Read More »Tone Deaf

Working-class Black and Latino Americans, more likely to be paid lower wages, less likely to own significant assets; feel that they are being deprived of a fair share; see this as a consequence of white privilege. Meanwhile, white working-class American’s see themselves as less than privileged, barely hanging on; feel that such demands by Blacks and Latinos amount to a threat to their meager share, their livelihood. Neither group is the other group’s...

Read More » Heterodox

Heterodox