A note about the weekly and monthly economic data For the past month or so, with the exception of the weekly catastrophe of new jobless claims it hasn’t been very important to keep track of the economic data. Now that it is May, that will start to change with the weekly data as of next week (reporting on this week). The monthly data fo May, of course, won’t be reported for until June starts. That’s because the month of April was fully involved in the pandemic crisis. So with the month over month May data we will be able to see if the economy is beginning to stabilize at a lower level, sink even further as more second-order effects ripple out from the epicenter, or perhaps even rebound. With the exception of finding out what happened to wages during

Topics:

NewDealdemocrat considers the following as important: Healthcare

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes RFK Jr. blames the victims

Joel Eissenberg writes The branding of Medicaid

Bill Haskell writes Why Healthcare Costs So Much . . .

A note about the weekly and monthly economic data

For the past month or so, with the exception of the weekly catastrophe of new jobless claims it hasn’t been very important to keep track of the economic data. Now that it is May, that will start to change with the weekly data as of next week (reporting on this week). The monthly data fo May, of course, won’t be reported for until June starts.

That’s because the month of April was fully involved in the pandemic crisis. So with the month over month May data we will be able to see if the economy is beginning to stabilize at a lower level, sink even further as more second-order effects ripple out from the epicenter, or perhaps even rebound.

With the exception of finding out what happened to wages during April (because of all of the reports of wage cuts), even this Friday’s employment report, while surely catastrophic, won’t be that important looking forward.

The only monthly data from April that has been reported recently of note is that comparing personal income and spending (which was released last Thursday).

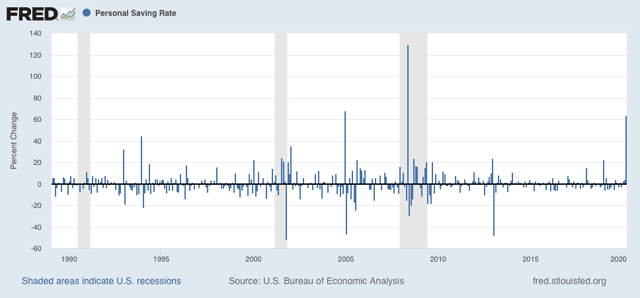

The personal saving rate skyrocketed by over 60% compared with February:

Figure 1

Figure 1

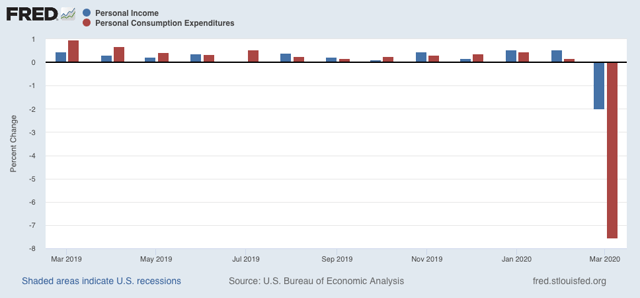

That’s because, while personal income declined by -2.0%, personal spending declined even more, by -7.5%:

Part of that was simply that staying home, and the closure of dining and entertainment venues meant less opportunity to spend. But part was also the desire to hold onto savings in view of the dire short-term economic outlook. This is Keynes’s “paradox of thrift” in action. Wanting to insulate oneself from economic harm makes sense. But when everyone does it at once, as frequently happens during recessions, it necessarily means a downturn in consumer demand. And it is consumer demand which drives most of the economy.

We are going to find out this month in those States which have “reopened” their economies, is the answer to “if you open it, will they come?” I strongly suspect that the answer to that is “no,” but we will see.