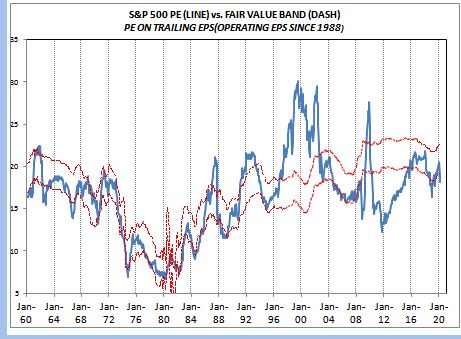

As of the market close on 11 March 2020 the S&P 500 PE had fallen to 18.2. This makes the market cheap in my valuation model as it has fallen below my fair value band. Moreover, with interest rates still falling to new record lows the fair value band is also rising. In the chart the fair value band is based on February data while the last PE observation is based on the 11 March 2020 close. But with yields approaching the zero lower band it becomes questionable whether or not even lower rates can generate a significant rebound in the market PE and the market. On the other hand the PE has room to move significantly higher just by rebounding to the top, or above, the existing fair value band. On Wall Street the consensus still is forecasting a significant

Topics:

Spencer England considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

As of the market close on 11 March 2020 the S&P 500 PE had fallen to 18.2. This makes the market cheap in my valuation model as it has fallen below my fair value band.

Moreover, with interest rates still falling to new record lows the fair value band is also rising. In the chart the fair value band is based on February data while the last PE observation is based on the 11 March 2020 close. But with yields approaching the zero lower band it becomes questionable whether or not even lower rates can generate a significant rebound in the market PE and the market. On the other hand the PE has room to move significantly higher just by rebounding to the top, or above, the existing fair value band.

Moreover, with interest rates still falling to new record lows the fair value band is also rising. In the chart the fair value band is based on February data while the last PE observation is based on the 11 March 2020 close. But with yields approaching the zero lower band it becomes questionable whether or not even lower rates can generate a significant rebound in the market PE and the market. On the other hand the PE has room to move significantly higher just by rebounding to the top, or above, the existing fair value band.

On Wall Street the consensus still is forecasting a significant rebound in 2020 earnings. But if the Coronavirus does have a significant economic impact, 2020 earnings are more likely to fall rather than rise. That appears to be what this market correction is starting to discount even though company managements are not yet revising their guidance. Consequently, bottoms up analysts are also probably still too optimistic. With the market now cheap, it has room for falling earnings to drive the PE on trailing earnings back up to within or above the fair value band. Thus, we could see the market having a very muted reaction to further easing by the Fed but rebound nicely when company managements and analysts cut their 2020 earnings estimates.