The idea I have is not to be surprised. I am a careful patient who asks a lot of questions and also advocate for myself. I have refused treatment when they use drugs which may threaten my health further (Heparin). I am also not well liked by the bloodsuckers who come in to draw blood and stab me through the vein for two weeks and destroyed my left arm in the process. Ask them questions and do not be so willing to accept treatment (if cognizant) until they answer your questions and then get their name. Take names and dates. It is ok to be a forceful advocate for yourself. When all is said and done, the bill will come to you alone. If you are on Medicare, do not stay for observation unless you have a Plan G or Plan F. If you are on Plan N Supplemental to

Topics:

run75441 considers the following as important: Healthcare, Hot Topics, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

The idea I have is not to be surprised. I am a careful patient who asks a lot of questions and also advocate for myself. I have refused treatment when they use drugs which may threaten my health further (Heparin). I am also not well liked by the bloodsuckers who come in to draw blood and stab me through the vein for two weeks and destroyed my left arm in the process. Ask them questions and do not be so willing to accept treatment (if cognizant) until they answer your questions and then get their name. Take names and dates. It is ok to be a forceful advocate for yourself. When all is said and done, the bill will come to you alone.

If you are on Medicare, do not stay for observation unless you have a Plan G or Plan F. If you are on Plan N Supplemental to Medicare or lower, the plan will NOT pay 100% for Observation. You have to be admitted. You can go anywhere with Medicare for treatment.

Medicare Advantage? You had better be in network or have some type of alternative program within your plan.

There are good points to this article which is why I “C and P-ed” it here per their request.

As taken from Preventing Debt from Surprise Medical Bills, Bankrate, Madison Blancaflor. July 19, 2019

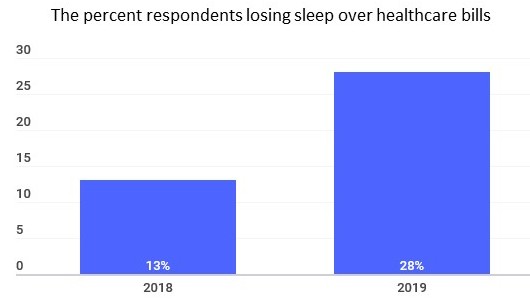

The cost of healthcare has become a hot topic in American politics in recent years, and with good reason. A recent survey found that 22 percent of Americans are losing sleep over healthcare or insurance costs, up from 13 percent just one year ago.

One aspect in particular has even gained attention from both Congress and the President within the past two months: surprise medical bills.

One aspect in particular has even gained attention from both Congress and the President within the past two months: surprise medical bills.

Congress has proposed bi-partisan legislation that sets up consumer protections against surprise billing in certain situations. President Trump also issued an executive order in June that calls for hospitals to be more transparent upfront about prices for common tests and procedures, a measure that should go into effect later this year. (While the House took out the 10 year exclusivities for Biologic drugs in the NAFTA Bill, similar ended up in the Budget bill giving exclusivity for 12 years on new biologics. As I have pointed out repeatedly, risk adjusted R & D costs are recouped in a median period of 3- 5 years. It is another give-away to pharma which adds to costs.)

Past the leap, causes and prevention of Surprise Billing.

The cause of surprise billing

Unexpected medical bills, often outrageously expensive, can catch patients by surprise if they see a doctor who is not within their insurance network. It’s a common issue, with the Wall Street Journal reporting that an estimated 51 percent of ambulance rides, 22 percent of ER visits and 9 percent of elective cases lead to surprise medical costs.

What often happens is that while the hospital or clinic might be considered in-network, a specific doctor might not be in-network (or vise versa). The legislation proposed by the Senate includes cost protections for situations such as these, plus scenarios where patients receive emergency care or follow-up care at an out-of-network facility due to travel restrictions.

While the new legislation and executive action may help patients and their families, surprise billing will persist in situations outside the purview of these new protections. (The proposed prevention of surprise billing did not make it through the Senate this time for reasons I am not aware of today. More later.)

Preventing surprise healthcare bills

The best way to combat surprise billing is to prevent it whenever possible. This requires staying up-to-date on your insurance policies and looking at your options when scheduling appointments.

Know the details of your insurance policy

The first step is understanding your specific insurance policy. Check with your provider for a list of in-network hospitals, specialists and primary care physicians in your area so you can know ahead of time where you’ll have coverage. If you have an upcoming appointment, it’s worth calling your provider to double-check whether the facility and doctor you’re seeing are in-network and covered.

Your provider may also require prior authorization before an appointment in order to cover some healthcare services or prescriptions, especially when visiting specialists.

Ask about costs upfront

Whether you’re visiting a new primary care physician, seeing a specialist or have a planned procedure coming up, call ahead to see what out-of-pocket costs you will be responsible for paying. If you find that the facility or physician is out-of-network, you can request a referral to a facility or physician that is in-network.

For planned visits, you can also ask about the billing codes for the tests or procedures you’ll be having so that you can confirm that your insurer will cover them. While many standard preventative procedures like a basic cardiac stress test or mammogram are covered by insurance policies, more advanced screenings such as a 3D mammogram may be billed under a different code that is not covered by your insurance.

Make an emergency plan

While it’s impossible to predict when emergencies will happen, you can make a plan to help you prepare. If you know which emergency care providers are covered by your insurance plan, you can have an idea of where to go. While it requires some research on the front-end, you can save some stress and a lot of money in the long-run.

Understand your rights

In addition to new federal protections, many states have additional regulations regarding “balance billing,” when patients are billed for out-of-network providers at an in-network facility. Don’t be afraid to negotiate with hospital billing managers or doctors who billed you when you are balance billed, and keep your insurance company in the loop on the situation. Knowing your state’s specific protections can help you get fees waived or lowered in these cases.

Combating debt from surprise medical bills

Unfortunately, it’s impossible to entirely prevent surprise medical bills — especially in the case of emergency services. In an emergency room, you have little to no control over which physicians you see and what tests are run. You also don’t always have time to call ahead to check prices or request transfers to in-network facilities.

While it might not be possible to prevent some surprise healthcare costs, there are still steps you can take to combat debt in these cases.

1. Double check itemized medical bills.

Mistakes happen. Sometimes patients are billed for tests, procedures or medications that they didn’t actually receive. Ask for an itemized bill, and ensure that you are only being charged for services received. If you find a mistake in your bill, talk to the hospital’s billing department and the service provider.

In the case that a procedure or service on your bill should have been covered by your insurance provider, ask about the specific billing code the hospital used. It’s possible that while the insurance provider covers a basic or general service, the billing code used may not fall under the billing code your insurance company lists as covered. Talk with both the hospital billing department and your insurance provider to see what can be done.

2. Avoid using credit cards whenever possible

Credit cards average around a 17 percent interest rate, meaning they are less-than-ideal for covering high medical costs. There are medical credit cards out there that offer short and long term financing plans to cover medical expenses with minimal interest, which is an option for those who can realistically pay off the debt within the specified time period.

When using a credit card is unavoidable, consider a credit card that offers a long intro period to help you save on interest charges, such as well known Platinum Visa Card might offer. If you end up with bills spread across multiple credit cards, a balance transfer credit card can also help you eliminate debt and save money on interest charges.

Just keep in mind that for all of these credit options, it’s imperative that you can pay off the debt within the 0% interest offer period. Otherwise, you’ll be subject to high interest rates that can cause even more financial stress.

For larger medical bills or debts, consider a personal loan (which offer lower, fixed interest rates) to help cover the cost.

3. Protect your credit score

If for any reason you are unable to pay your medical bills on time, it’s important to take steps to protect your credit score. When you go more than 90-180 days without paying a medical debt, it could become an unpaid collection account, which can show up on your credit report and negatively affect your score. Luckily, newer credit score models such as the VantageScore 4.0 and FICO Score 9 often reduce the impact of these types of collection accounts.

If you know you’ll be unable to pay medical bills, be open and honest with the hospital or provider. You might be able to set up a plan that better fits your budget. At the very least, you can explain the situation, pay as much as you can at the moment and potentially prevent them from writing off your debt as a loss and selling it to a collection agency.

4. Open a savings account for unplanned medical costs

While you can’t predict unplanned medical costs, you can prepare for them by saving money for a rainy day. One option is contributing to a Healthcare Savings Account (HSA), which allows you to add pre-tax/tax-deductible money into a savings account that you can use for approved healthcare costs.

You can also set up a savings account with any bank to be used for healthcare costs. While these accounts may not be tax-exempt, you can often get a better interest rate and avoid regulations on what medical expenses you can and can’t cover with the account.

Even if you only contribute $20 a month, it will add up over time and can help offset costs to make medical expenses more affordable.

The Bottom Line

While it’s promising that both Congress and the President are making strides towards eliminating surprise medical bills and helping lower overall healthcare costs, sometimes surprise billing is unavoidable. These tips can help you prevent these charges or combat excessive debt that can often result from unplanned medical expenses.