As the Senate decides whether to send an additional 00 to US residents, there are two macroeconomic policy issues. One is whether aggregate demand stimulus would be useful. The other is whether we should be concerned about the budget deficit. I think that the case for fiscal stimulus is medium strong and the case for higher Federal Debt is very strong. Thus I agree with Donald Trump and Bernie Sanders and disagree with Larry Summers. The case for stimulus is only medium strong. Unemployment is fairly high, but part of this is an efficient response to the risk of Covid Transmission. There are two ways to argue that demand is undesirably slack. One is below peak employment in sectors which are not especially directly affected by Covid 19

Topics:

Robert Waldmann considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As the Senate decides whether to send an additional $1400 to US residents, there are two macroeconomic policy issues. One is whether aggregate demand stimulus would be useful. The other is whether we should be concerned about the budget deficit.

I think that the case for fiscal stimulus is medium strong and the case for higher Federal Debt is very strong. Thus I agree with Donald Trump and Bernie Sanders and disagree with Larry Summers.

The case for stimulus is only medium strong. Unemployment is fairly high, but part of this is an efficient response to the risk of Covid Transmission. There are two ways to argue that demand is undesirably slack. One is below peak employment in sectors which are not especially directly affected by Covid 19 such as construction. The other is that core inflation is below target and falling. Both are enough to convince me that general stimulus is OK.

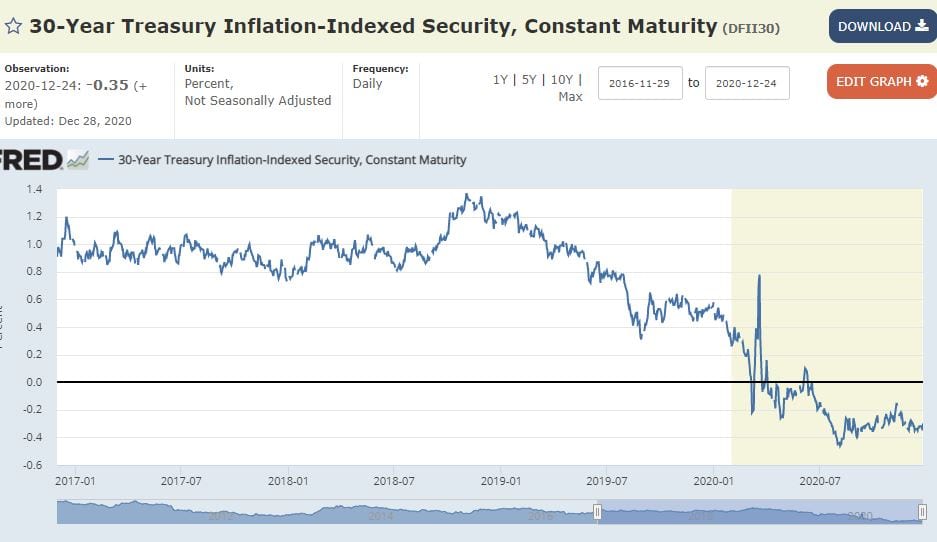

But mostly the amazing fact is that the 30 year TIPS real interest rate is negative. This means that investors are willing to pay the US Federal Government to store their wealth safely. Given this, I think there is a very strong case for selling more long term bills and giving the money to residents. The interest rates assert that the US Federal Government intertemporal budget constraint is slack. This can’t be Pareto efficient.

I anticipate the concern that interest rates might rise. That is why I graphed the 30 year rate, which is locked in now. If interest rates rise, investors will lose money, but it won’t create a new problem for the Treasury. Also these are real rates (paid in multiples of the consumer price index) so deflation wouldn’t be a problem for the Treasury (although it would be a catastrophe for the economy).

Given the market interest rate, the ration of the debt to GDP should fall roughly in half over the life of the bonds. If the rates lasted, rolling over the debt would be a source of income indefinitely. The argument is absurdly simple. It is also valid.

The only concern is that public debt might crowd out private investment. This could cause higher returns on capital and lower wages with undesirable distributive effects. This problem can be managed by shifting taxation from labor to capital.

I am convinced that raising the subsidy to $2000 is an improvement.

That does not mean it is optimal policy. It would be even better to increase and extend the additional unemployment insurance. The fear that people would turn down jobs if (temporary) unemployment insurance paid more than a permanent job, was contradicted by the empirical evidence. Also people staying home and collecting checks will continue to make sense as a public health measure, until the Covid 19 vaccines are no longer in short supply.

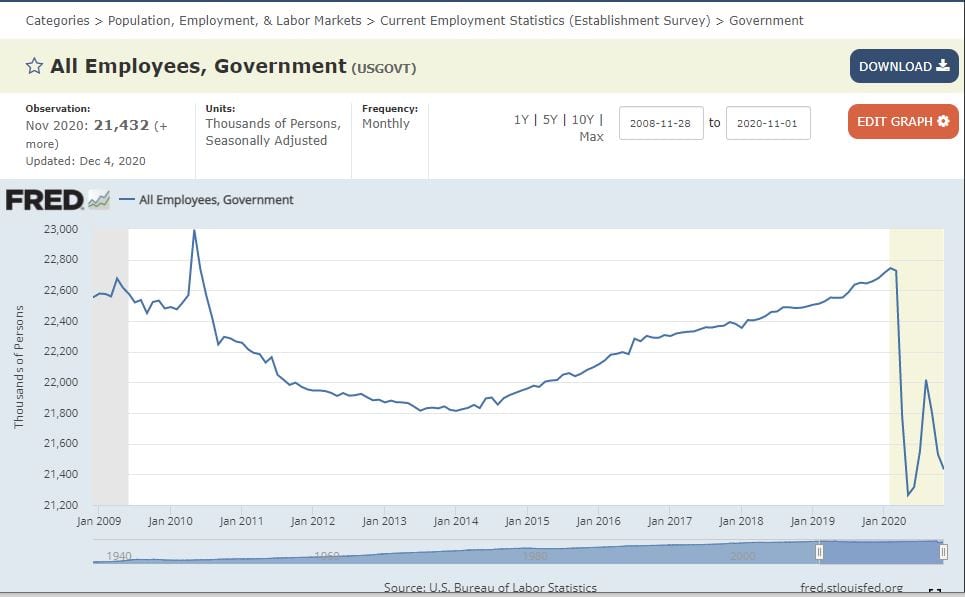

Also aid to state and local government is urgently needed (and politically impossible). There has already been a second decline in government employment. This makes no economic sense — it is the result of State Constitutions and GOP ideology.