Some State AGs Take Action Seventeen State Attorney Generals signed and sent a letter to Congressional leadership (Schumer, Pelosi, McConnell, McCarthy) calling on Congress (Friday February 19) to pressure President Joe Biden to cancel up to ,000 in federal student load debt for borrowers as a part of pandemic relief. The AGs write: “As the Attorneys General of Massachusetts, New York, Connecticut, Delaware, the District of Columbia, Hawaii, Illinois, Maryland, Minnesota, Nevada, New Mexico, New Jersey, Oregon, Virginia, Washington and Wisconsin, we write to express our strongest support for Senate Resolution 46 and House Resolution 100 calling on President Biden to use executive authority under the Higher Education Act to cancel up to

Topics:

run75441 considers the following as important: Alan Collinge, history, law, politics, student loans, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Some State AGs Take Action

Seventeen State Attorney Generals signed and sent a letter to Congressional leadership (Schumer, Pelosi, McConnell, McCarthy) calling on Congress (Friday February 19) to pressure President Joe Biden to cancel up to $50,000 in federal student load debt for borrowers as a part of pandemic relief. The AGs write:

“As the Attorneys General of Massachusetts, New York, Connecticut, Delaware, the District of Columbia, Hawaii, Illinois, Maryland, Minnesota, Nevada, New Mexico, New Jersey, Oregon, Virginia, Washington and Wisconsin, we write to express our strongest support for Senate Resolution 46 and House Resolution 100 calling on President Biden to use executive authority under the Higher Education Act to cancel up to $50,000 in Federal student loan debt for all Federal student loan borrowers.

Because we are responsible for enforcing our consumer protection laws, we are keenly aware of the substantial burden Federal student loan debt places on the residents of our states.”

Broad cancellation of Federal student loan debt will provide immediate relief to millions who are struggling during this pandemic and recession, and give a much-needed boost to families and our economy.

The current options for borrowers have proved to be inadequate and illusionary. For example, 2% of the borrowers applying for loan discharges under the Public Service Loan Forgiveness program have been granted a discharge. In addition, efforts by our Offices to obtain student loan discharges for defrauded students – to which students are entitled under existing law – have been stymied by the U.S. Department of Education for years.”

Just how serious is this?

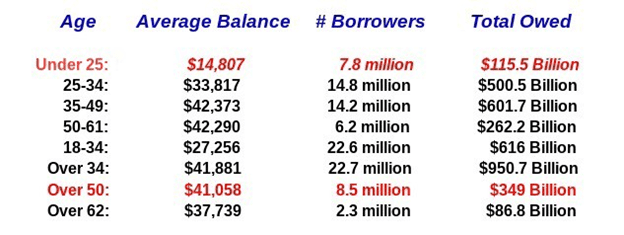

Alan Collinge of the Student loan Justice Organization did alternate calculations of student loan by age to arrive at a more definitive debt by age bracket which had not been displayed. The numbers in red represent totals (above) for the brackets he wanted to define. So it goes;

– There are ~7.8 million under 25 years of age student loan borrowers who have an average of $14,807 of student loan debt. This equates to a total of $115.5 billion

Let’s contrast this numeric to the other end of the age spectrum or those over 50 years of age.

– There are more people over the age of 50 with student loans. Approximately 8.5 million people owe on average $41,058 each. This equates to a total of $349 billion.

Older people outnumber the younger people with student loans (over 50 versus under 25) in this comparison and they owe far more. Just keep this in mind as we read further.

What Do the Politicians and Newscasters Say?

The popular meme has been, younger people have incurred student loan debt and they should pay it off in entirety like “we” did. If we look at the numbers again, most of the people over 50 have a good chance of going into retirement with student loan debt and may have their SS or SSDI supplement payments garnished.

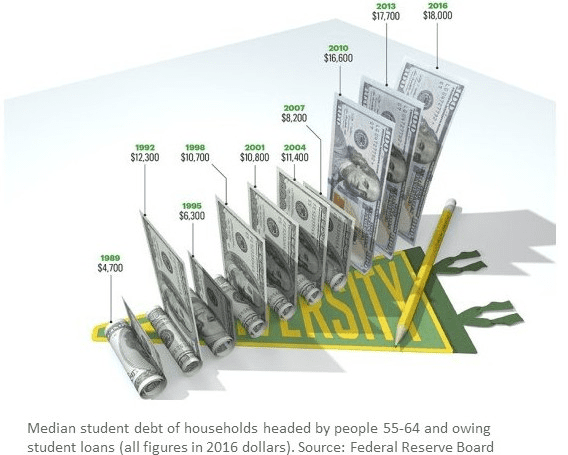

The percentage of families headed by someone 50 or older with student loan debt has more than tripled between 1989 and 2016. The AARP Public Policy Institute reports student loan debt has increased from 3.1 percent to 9.6 percent. Since 2004, student loan debt among those 60 and older has also grown the fastest of any age group. The 50-year-old adults on the brink of retirement who are carrying more debt than the 25 years-old graduates. It sure does not look like the “like-we-did crowd has done so well.

In 2018 (latest numbers I can find[see chart above]), the 55 – 64 year old cohort has a median student loan debt of $18,000 which is up from 2010.

As I said above, Social Security benefits and Social Security Disability Insurance (SSDI) payments can be garnished to pay child support and alimony; court-ordered restitution to a crime victim; back taxes; and non-tax debt owed to a federal agency, such as student loans or some federally funded home loans. The garnishment rate for defaulted student loans is also 15 percent. The only caveat being student loan debt garnishment, unlike tax garnishment, can not leave you with less than $750 in benefits a month.

What Is the Impact?

I think I searched many different places over the internet to see if I can find sources for the number of people having their Social Security or income garnished. The only data is from 2015 which I thought is kind of odd. I can believe higher numbers exist and are not being publicized. This is the data I could find:

In fiscal year 2015 almost 114,000 borrowers age 50 and older had portions of their Social Security benefits seized to repay defaulted federal student loans, according to a 2016 GAO report. (Private student loans are not subject to Social Security garnishment.)

Called offsets, these Social Security repayments increased more for Americans 50 and older than for younger borrowers. Between 2002 and 2015, offsets jumped 407 percent among 50 to 64-year-olds and 540 percent for those 65 and older.

Most of the people who had their Social Security payments appropriated due to student loan delinquency were receiving disability benefits rather than retirement or survivor benefits (GAO).

The problems are not just confined to the younger adults as many make it out to be the issue. With this issue comes decreased economic productivity.

Delinquent student loans are the gift that keeps on giving. Their giving started with the passage of a series of laws beginning in 1972 which made it impossible for students to declare bankruptcy. Then newly elected Senator Joe Biden began working to eliminate any means of reducing debt from student loans or declaring bankruptcy.

The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act was his best effort

Walking Uphill Both Ways and Responsibility

In 2018, Joe Biden while thinking about running for the presidency had this to say to Millennials while talking to Patt Morrison of the Los Angeles Times (Newsweek print) to promote his new book.

“The younger generation now tells me how tough things are—give me a break. No, no, I have no empathy for it, give me a break. Here’s the deal, guys, we decided we were going to change the world, and we did.”

The tune changes in 2020. Here is Biden speaking to youth while accepting the nomination;

“I hear their voices and if you listen, you can hear them too. And whether it’s the existential threat posed by climate change, the daily fear of being gunned down in school, or the inability to get started in their first job — it will be the work of the next president to restore the promise of America to everyone.”

And now after winning the presidency, the thought of a $50,000 or complete loan forgiveness is slipping off of the table.

He is not the only one who has had an attitude for the issues of the younger generations and student loan debt. I went to a Garden Party in Brighton, Michigan for Senator Debbie Stabenow disguised as an old silver haired white guy (didn’t have to do much to pull this off). I had a question to ask of the Senator about student loan debt and what she was doing to help students as she sat on the Senate Financial and Banking Committee. Old white guys are safe bets to talk to, yes?

I got my chance and asked and received a litany of excuses and a reason of “not being in the majority.” Today, Dems are the majority and I intend to ask again. I also want to know why she would make a statement of their having to learn Social Responsibility by being challenged on student loan debt.

Eighteen – year-olds are signing for student loans to pay for college. They have little understanding of the legal ramifications of the loans. Many are trapped for a life time of payments with no way out. And the servicers often times do not understand the loans either. The US bankruptcy laws are unforgiving and these young adults are not like our previous president who goes through multiple bankruptcies because the law allows it.

Alan’s additional calculations (above) breaks out debt by age group. He makes a point of the age group older than 50 having more student loan debt than those 25 and under. In comparison, younger cohorts have lower debt when compared to the older cohort.

Biden and Stabenow are intent on punishing younger cohorts for debt and supposed irresponsibility. At the same time larger numbers of older people are going into retirement with higher debt which they will likely not pay off and there is no relief. If they default, they will have 15% of their skimpy Social Security benefits taken above the $750 to payoff loans. The loans accumulate penalties, additional interest, and are being collected by private collection agencies.

Political Environment Today

Biden is reneging on $50,000 loan forgiveness and is hesitant on paying off $10,000 of student loan debt which is a pittance. The $10,000 will mostly go to interest and penalties before touching principal and collection agency fees. That is the way if works for forbearance, etc. You pay all the interest and penalties first. If you are going to only do the $10,000, then kill all the penalties and accumulated interest first and apply the $10,000 to principal.

My background? As a dad, I was right there with my three plotting what schools they would go to, grants, scholarships, loans, etc. they would have including the student plus loans. The only words of wisdom I offered were; “if they are offering scholarships and grants, they want you. If they are offering Stafford loans as well as other loans, say thank you and walk on to the next school.

The entire student loan debacle is BS.

Older people outnumber younger people with student loans, and they owe far, far more. | by Alan Collinge | Medium, Alan Collinge, Student Loan Justice Org., December 25, 2020

Attorneys General Press Congress On Student Debt Cancellation, Citing ‘Defrauded Students’ | Talking Points Memo, Zoe Richards, TPM, February, 19, 2021