Latest US Oil Supply and Disposition Data from the EIA. Blogger RJS, Market Watch and Focus on Fracking Gasoline supplies at a 48 month low, distillate supplies at a 19 month low; total inventories of oil and all its products at a 79 month low US oil data from the US Energy Information Administration for the week ending November 12th showed that a big jump in our oil exports and a modest decrease in our oil production meant we had to pull oll out out of our stored commercial crude supplies to meet our needs for the second time in eight weeks and for the twenty-second time in the past thirty-three weeks….our imports of crude oil rose by an average of 83,000 barrels per day to an average of 6,191,000 barrels per day, after falling by an average of

Topics:

run75441 considers the following as important: Hot Topics, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Latest US Oil Supply and Disposition Data from the EIA. Blogger RJS, Market Watch and Focus on Fracking

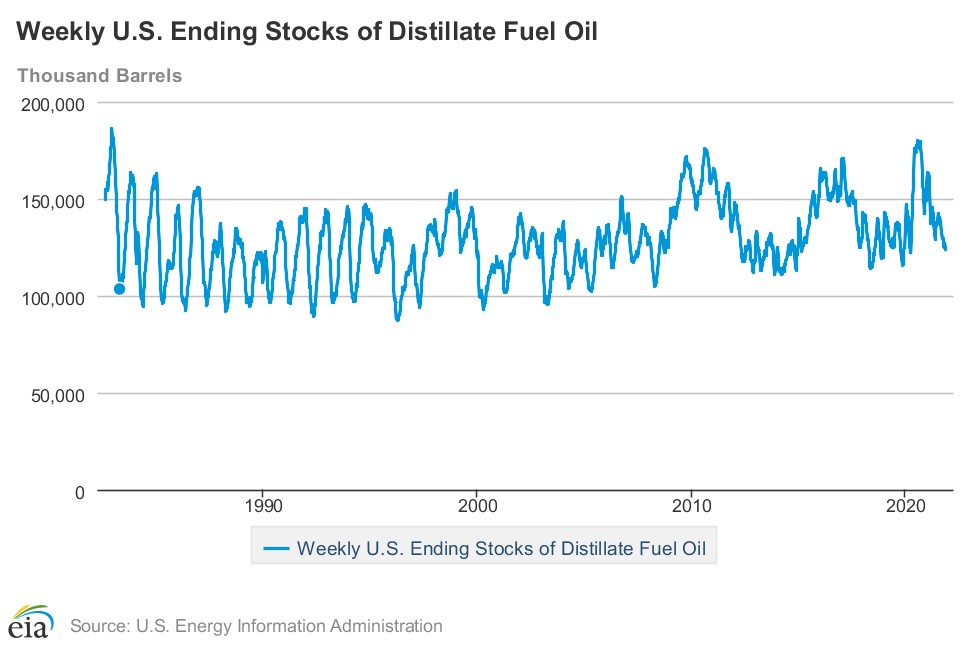

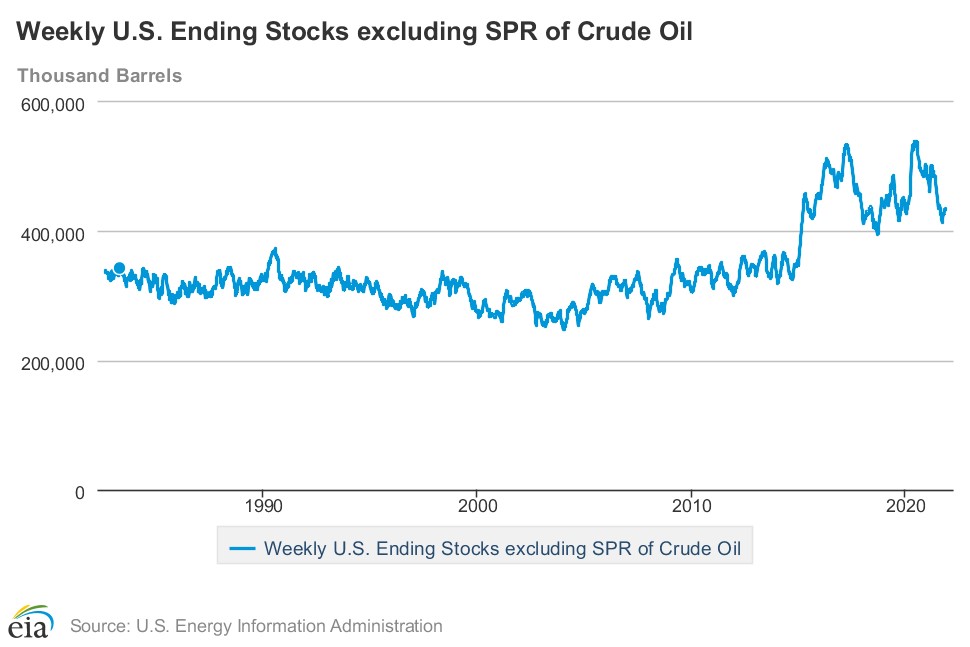

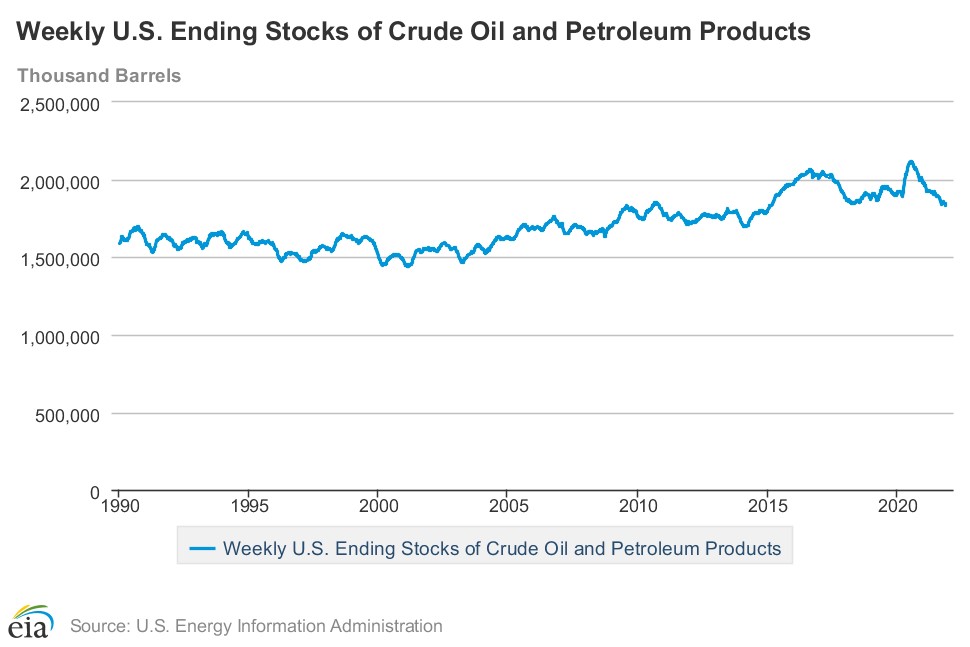

Gasoline supplies at a 48 month low, distillate supplies at a 19 month low; total inventories of oil and all its products at a 79 month low

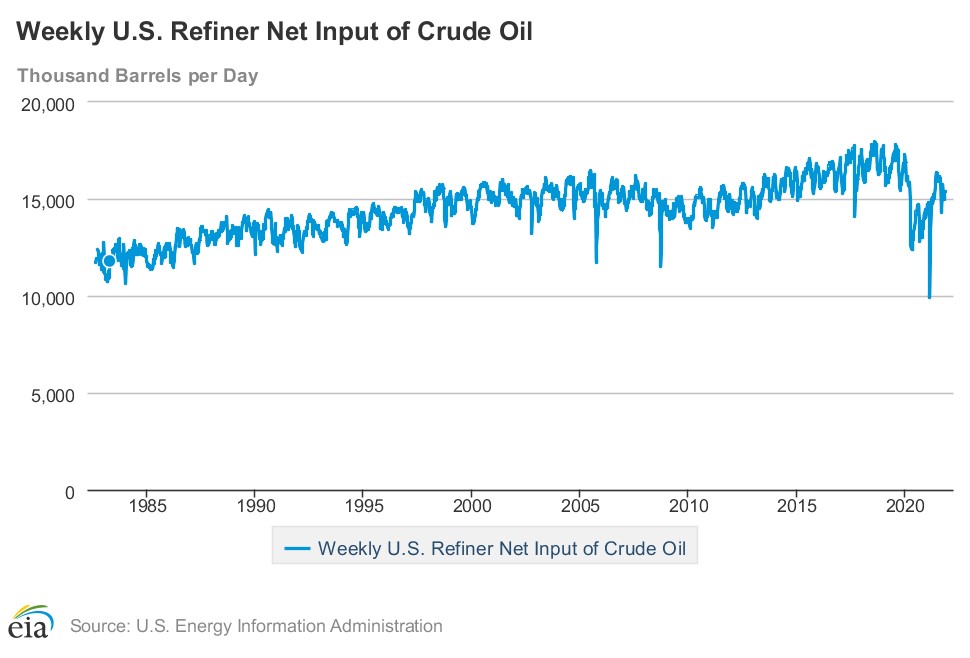

US oil data from the US Energy Information Administration for the week ending November 12th showed that a big jump in our oil exports and a modest decrease in our oil production meant we had to pull oll out out of our stored commercial crude supplies to meet our needs for the second time in eight weeks and for the twenty-second time in the past thirty-three weeks….our imports of crude oil rose by an average of 83,000 barrels per day to an average of 6,191,000 barrels per day, after falling by an average of 63,000 barrels per day during the prior week, while our exports of crude oil rose by an average of 573,000 barrels per day to an average of 3,626,000 barrels per day during the week, which together meant that our effective trade in oil worked out to a net import average of 2,565,000 barrels of per day during the week ending November 12th, 490,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude oil from US wells was reportedly 100,000 barrels per day lower at 11,400,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 13,965,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,397,000 barrels of crude per day during the week ending November 12th, an average of 32,000 more barrels per day than the amount of oil they processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 764,000 barrels of oil per day were being pulled out the supplies of oil stored in the US . . . so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from net imports, from storage, and from oilfield production was 668,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just plunked a (+668,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet to make the reported data for the daily supply of oil and the consumption of it balance out, essentially a balance sheet fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been a error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed….however, since most everyone treats these weekly EIA reports as gospel and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it’s published, and just as it’s watched & believed to be reasonably accurate by most everyone in the industry…(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,181,000 barrels per day last week, which was 15.3% more than the 5,361,000 barrel per day average that we were importing over the same four-week period last year…the 764,000 barrel per day net decrease in our crude inventories came as 300,000 barrels per day were pulled out of our commercially available stocks of crude oil and 464,000 barrels per day of oil were pulled out of our Strategic Petroleum Reserve, apparently still part of an emergency loan of oil to Exxon in the wake of hurricane Ida….this week’s crude oil production was reported to be 100,000 barrels per day lower at 11,400,000 barrels per day as the EIA’s rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day lower at 11,000,000 barrels per day, while a 1,000 barrel per day increase in Alaska’s oil production to 443,000 barrels per day had no impact on the reported rounded national production total….US crude oil production had hit a pre-pandemic record high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 13.0% below that of our pre-pandemic production peak, but 35.3% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016…

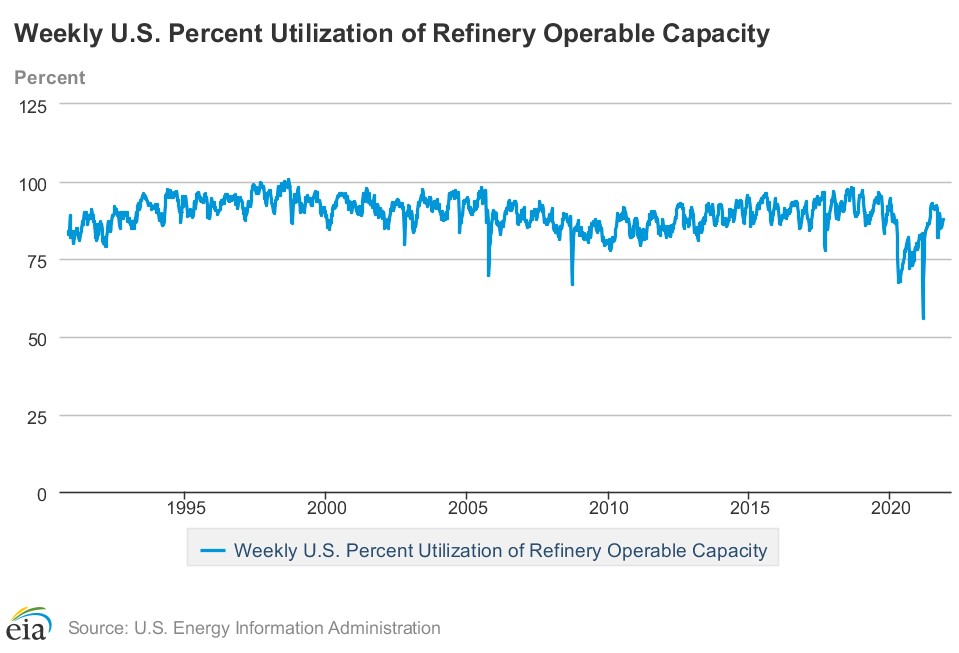

US oil refineries were operating at 87.9 of their capacity while using those 15,397,000 barrels of crude per day during the week ending November 12th, up from 86.7% of capacity the prior week, but still a little below normal utilization for mid-autumn refinery operations…the 15,397,000 barrels per day of oil that were refined this week were 11.4% more barrels than the 13,841,000 barrels of crude that were being processed daily during the pandemic impacted week ending November 13th of last year, but 6.3% less than the 16,435,000 barrels of crude that were being processed daily during the week ending November 15th, 2019, when US refineries were operating at what was then also a bit below normal 89.5% of capacity…

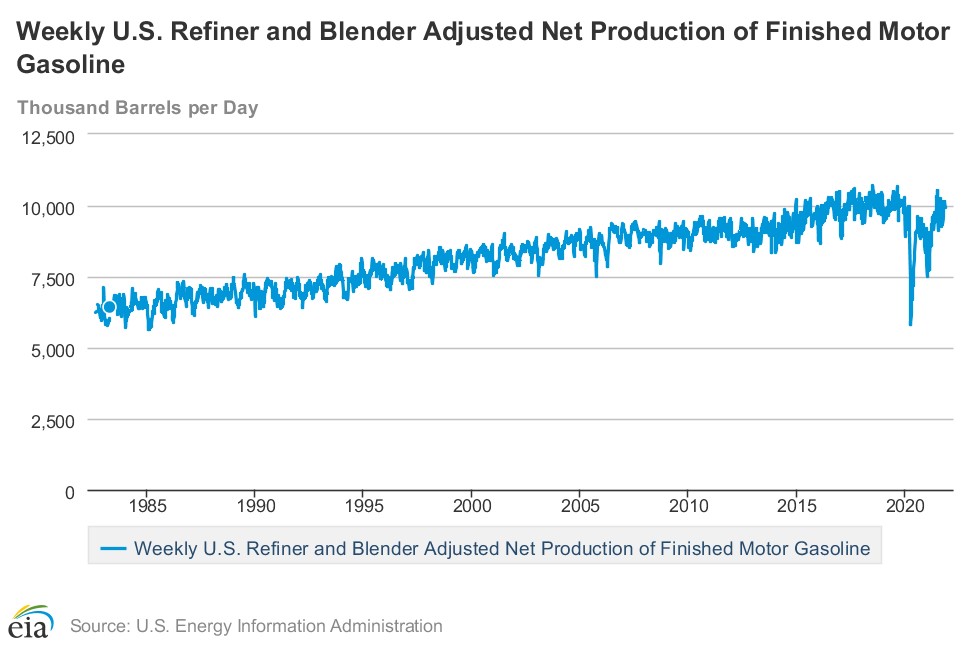

Despite the increase in the amount of oil being refined this week, the gasoline output from our refineries was somewhat lower, decreasing by 132,000 barrels per day to9,922,000 barrels per day during the week ending November 12th, after our gasoline output had decreased by 122,000 barrels per day over the prior week.…this week’s gasoline production was still 9.4% more than the 9,064,000 barrels of gasoline that were being produced daily over the same week of last year, but 1.3% less than the gasoline production of 10,053,000 barrels per day during the week ending November 15th, 2019….similarly, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 26,000 barrels per day to 4,842,000 barrels per day, after our distillates output had increased by 35,000 barrels per day over the prior week…despite the week’s decrease, our distillates output was 13.3% more than the 4,275,000 barrels of distillates that were being produced daily during the week ending November 13th, 2020, but 5.5% less than the 5,124,000 barrels of distillates that were being produced daily during the week ending November 15th, 2019..

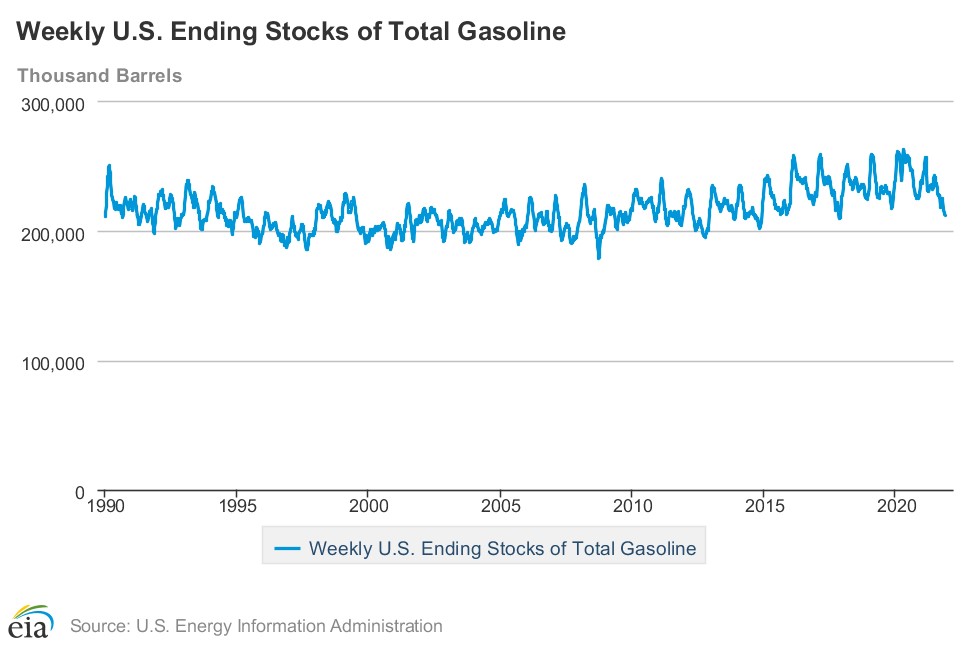

With the decrease in our gasoline production, our supplies of gasoline in storage at the end of the week decreased for the ninth time in twelve weeks, and for the eighteenth time in thirty weeks, falling by 707,000 barrels to a 48 month low of 211,996,000 barrels during the week ending November 12th, after our gasoline inventories had decreased by 1.555,000 barrels over the prior week…our gasoline supplies decreased by less this week because the amount of gasoline supplied to US users fell by 18,000 barrels per day to 9,241,000 barrels per day, and because our imports of gasoline rose by 236,000 barrels per day to 823,000 barrels per day, while our exports of gasoline fell by 2,000 barrels per day to 831,000 barrels per day…after this week’s inventory decrease, our gasoline supplies were 7.0% lower than last November 13th’s gasoline inventories of 227,967,000 barrels, and about 4% below the five year average of our gasoline supplies for this time of the year…

With the decrease in our distillates production, our supplies of distillate fuels decreased for the tenth time in twelve weeks and for the 22nd time in 32 weeks, falling by 824,000 barrels to a 19 month low of 123,685,000 barrels during the week ending November 5th, after our distillates supplies had decreased by 2,613,000 barrels during the prior week….our distillates supplies fell by less this week even though the amount of distillates supplied to US markets, an indicator of our domestic demand, rose by 70,000 barrels per day to 4,350,000 barrels per day, because our exports of distillatesfell by 390,000 barrels per day to 849,000 barrels per day while our imports of distillates fell by 39,000 barrels per day to 239,000 barrels per day….but after twenty-two inventory decreases over the past thirty-two weeks, our distillate supplies at the end of the week were 14.2% below the 144,073,000 barrels of distillates that we had in storage on November 13th, 2020, and about 5% below the five year average of distillates stocks for this time of the year…

Meanwhile, with this week’s big increase in our oil exports, our commercial supplies of crude oil in storage fell for the sixteenth time in the past twenty-five weeks and for the 32nd time in the past year, decreasing by 2,101,000 barrels over the week, from 435,104,000 barrels on November 5th to 433,003,000 barrels on November 12th, after our commercial crude supplies had increased by 1,002,000 barrels over the prior week…after this week’s decrease, our commercial crude oil inventories remained around 7% below the most recent five-year average of crude oil supplies for this time of year, but were still almost 27% above the average of our crude oil stocks as of the first weekend of November over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels….since our crude oil inventories had jumped to record highs during the Covid lockdowns of last spring and remained elevated for most of the year after that, our commercial crude oil supplies as of this November 12th were 11.5% less than the 489,475,000 barrels of oil we had in commercial storage on November 13th of 2020, and are now 3.9% less than the 450,380,000 barrels of oil that we had in storage on November 15th of 2019, and 3.1% less than the 446,908,000 barrels of oil we had in commercial storage on November 16th of 2018…

Finally, with our inventory of crude oil and our supplies of all products made from oil at multi year lows, we are continuing to track the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR….the EIA’s data shows that total oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, fell by 12,121,000 barrels this week, from 1,842,133,000 barrels on November 5th to 1,830,012,000 barrels on November 12th, which is our lowest level of total US inventories since February 13th, 2015, and are therefore at a 79 month low…