Existing home sales and prices, increase slightly; inventory declines slightly [Programming note: There will be at least 4 significant reports tomorrow (Nov: 23): jobless claims, personal income and spending, new home sales, and corporate profits for Q3. Then nothing for the rest of the week. I may or may not report on everything tomorrow. I may hold some for Wednesday or Friday. Also, I will probably put up a Coronavirus Dashboard Wednesday or Friday. There may (or may not!) be something significant happening in the Midwest, similar to something that happened last year. And I want to give an optimistic and pessimistic projection for what the winter wave will unfold like. All that being said, I suspect there will be a day or two this week’s

Topics:

NewDealdemocrat considers the following as important: existing home sales, prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Existing home sales and prices, increase slightly; inventory declines slightly

[Programming note: There will be at least 4 significant reports tomorrow (Nov: 23): jobless claims, personal income and spending, new home sales, and corporate profits for Q3. Then nothing for the rest of the week. I may or may not report on everything tomorrow. I may hold some for Wednesday or Friday. Also, I will probably put up a Coronavirus Dashboard Wednesday or Friday. There may (or may not!) be something significant happening in the Midwest, similar to something that happened last year. And I want to give an optimistic and pessimistic projection for what the winter wave will unfold like.

All that being said, I suspect there will be a day or two this week’s vacation for me!]

Meanwhile . . .

While existing home sales are about 90% of the market, they are much less important for the economic cycle than are new home sales, which will be reported tomorrow.

Last month I wrote that “I suspect new home sales will increase, since interest rates stabilized at very low rates earlier this year, and the increase in existing home sales is some confirmatory evidence.” So October’s increase of 0.8% was further confirmatory evidence.

Realtor.com doesn’t all FRED to produce data more than 12 months old, so here are the last 12 months for both new and existing home sales, seasonally adjusted and normed to 100 as of October 2020:

Both declined earlier this year, but new home sales much more deeply.

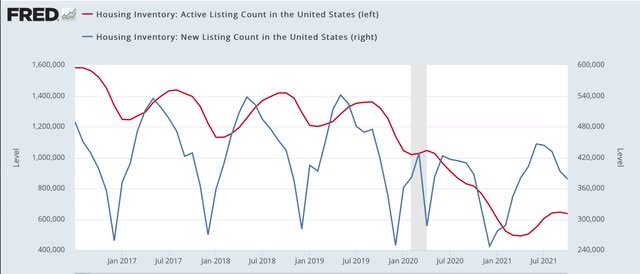

Realtor.com does provide FRED with both new and total (“active”) listing counts for the past 5+ years. Here’s what that looks like (note, new listings are on right scale):

Note that new listings declined precipitously in late 2019 even before the pandemic – and the pandemic certainly hasn’t helped.

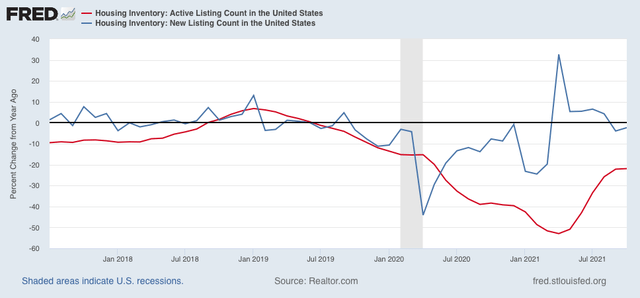

Since neither series is seasonally adjusted, comparing them YoY is more useful:

While new listings have rebounded this year, they continued slightly lower YoY in October. More importantly, they are down 10% since October 2019, which was when the big decline started, while total listings are down over 50% since then.

In the “the cure for high prices is, high prices” department, YoY median price gains have decelerated over the last 5 months:

Jun +23%

Jul +20%

Aug +15%

Sep +13%

Oct +13%

While these are not seasonally adjusted either, my rule of thumb is that a deceleration of 50% typically marks the top for any such statistic. We are 1.5% above that mark, but on the other hand, there was no change from September.

If the YoY% changes continue above 12%, that would be consistent with prices continuing to rise. If on the other hand, YoY price changes continue to decelerate, then the market is probably close to or at its peak, consistent with my rubric is that sales peak first, followed by prices.