A fundamentals-based look at the consumer indicates the expansion is in good shape for now I was going to update the Coronavirus dashboard today, but since half of the States no longer bother to report over the weekend, Monday is basically useless. There may be a few interesting things happening … but let’s wait until tomorrow. In the meantime, I see where Bill McBride posted a graph of spending on gas as a percent of total consumer spending, which brought to mind one of my “alternative” methods for forecasting (at least in the very near term) a recession.Start with oil shocks. As the graph below shows, all three of the non-pandemic recessions in the past 30 years were immediately preceded by a large jump in oil prices compared with income:

Topics:

NewDealdemocrat considers the following as important: economic expansion, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

A fundamentals-based look at the consumer indicates the expansion is in good shape for now

I was going to update the Coronavirus dashboard today, but since half of the States no longer bother to report over the weekend, Monday is basically useless. There may be a few interesting things happening … but let’s wait until tomorrow.

In the meantime, I see where Bill McBride posted a graph of spending on gas as a percent of total consumer spending, which brought to mind one of my “alternative” methods for forecasting (at least in the very near term) a recession.

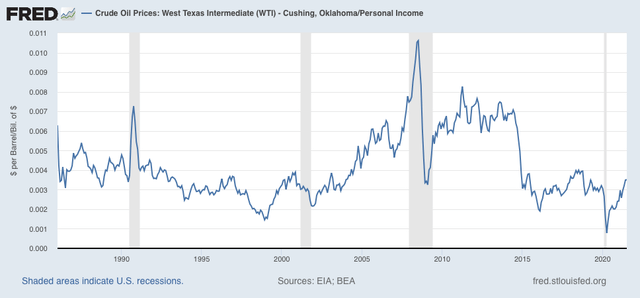

Start with oil shocks. As the graph below shows, all three of the non-pandemic recessions in the past 30 years were immediately preceded by a large jump in oil prices compared with income:

Certainly in the past year, there has been a comparable jump, but note that, *unlike* right before those recessions, the “jump” has been from very low prices to prices in line with the average over the last 10 years. A similar thing happened in late 2009, and that did not derail the recovery from the Great Recession.

Also, typically before a recession begins, consumers are unable to cash in on appreciating assets, in particular houses and stock gains.

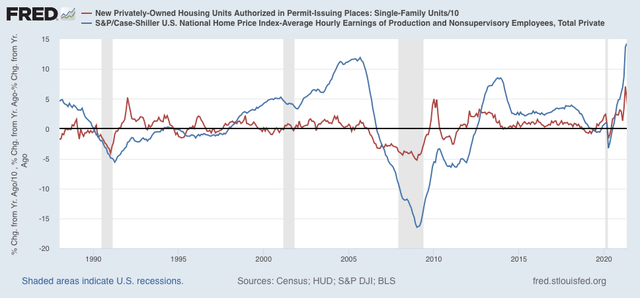

Here is the YoY% change in house prices divided by average hourly wages (blue) compared with single-family permits (red):

As I have noted many times before, permits declined first. Prior to three of the last four recessions, house prices followed suit before the onset of the recession (prior to 2001, which was not a consumer recession, house price increases stabilized).

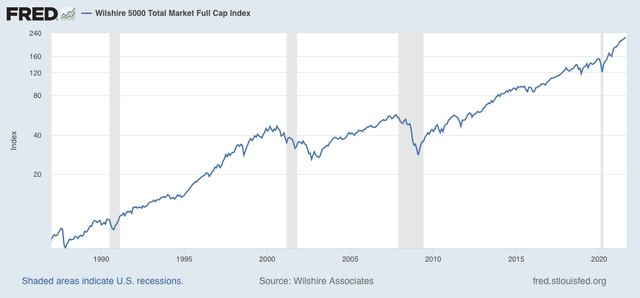

Similarly, stock prices have typically peaked shortly before the onset of a recession:

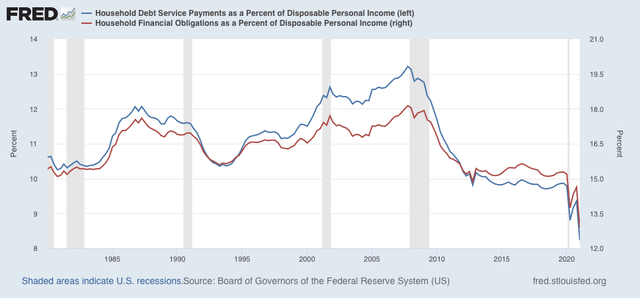

And debt service as a percent of personal income has increased:

In short, except for recessions that do not focus on the consumer, incomes are squeezed, debt service increases, and the ability to cash in on appreciating assets halts.

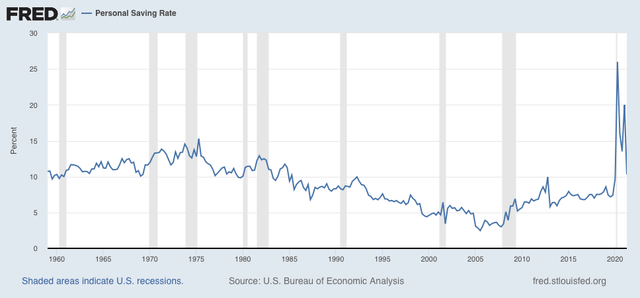

None of those conditions obtains at present. I would expect to see the cushion of savings accumulated by consumers during the recession (graph below):

decline to prior rates; and house prices to hit a wall before a consumer pullback manifests in a recession. We’re just not there.