Agri-Economist and farmer Michael Smith talking inflationary impacting crops and farmers. Higher inflation rates “will likely remain so in the coming months,” Federal Reserve Chairman Jerome Powell acknowledged today in testimony before the Senate Banking Committee. Powell has been in meeting this week discussing the persistent inflation going into next year. Powell noted the effects of inflation on the economy “have been larger and longer-lasting than anticipated,” adding, “it will abate,” and begin to fall back toward the Fed’s longer-run 2% target. As we look at CPI on the food side, we continue to see higher market prices for consumer staples. This doesn’t look to be waning any time soon. As no surprise to anyone here, this year’s

Topics:

run75441 considers the following as important: Crops, Fertilizer, Hot Topics, inflation worries, Michael Smith, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Agri-Economist and farmer Michael Smith talking inflationary impacting crops and farmers.

Higher inflation rates “will likely remain so in the coming months,” Federal Reserve Chairman Jerome Powell acknowledged today in testimony before the Senate Banking Committee. Powell has been in meeting this week discussing the persistent inflation going into next year.

Powell noted the effects of inflation on the economy “have been larger and longer-lasting than anticipated,” adding, “it will abate,” and begin to fall back toward the Fed’s longer-run 2% target.

As we look at CPI on the food side, we continue to see higher market prices for consumer staples. This doesn’t look to be waning any time soon.

As no surprise to anyone here, this year’s corn, soybean, cotton, or anything that grows and seeds, will be cleaned and then sold as seed for next year’s planting. With corn fetching $5.50 a bushel, producers are being rewarded. However, next year is the rainy day they need to hedge for. Nothing new to anyone out here.

Brownfield Ag News for America, “Higher corn seed costs expected in 2022,” (brownfieldagnews.com), Rhiannon Branch

“Ag economist Gary Schnitkey with the University of Illinois tells Brownfield Ag News:

“Over time, seed costs have risen with gross revenue for corn which is also expected to be higher in 2022.

Right now, it is projected to be higher than it was from 2013-2019. If you are looking at bids for 2021 fall delivery, they point to $4.50 corn for 2022.”

Higher corn seed costs expected in 2022 (brownfieldagnews.com)

Now, I’ve seen commodities progress over time and I would expect any futures contracts to most likely move higher as the crop yield gets modeled. This is all fine and well.

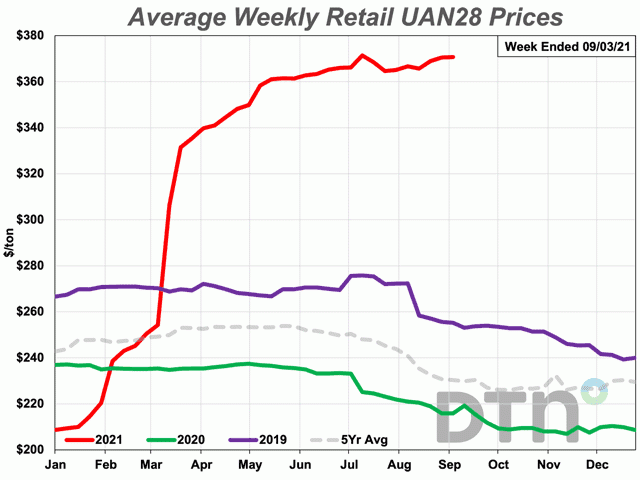

What is not fine and well is the overall inflation in the input side of things. Per DTN, we’ve got a fertilizer bubble about to hurt some folks. Evidence here:

We can see the year over year trends are dire. Anecdotally, on the equipment side, dealers aren’t budging either. I’ve been trying to negotiate an upgrade to a bigger, air conditions Kubota and they ain’t playing along. Maybe a case of beer or fresh donuts might help break the gridlock.