This post comes by way of Joel Eissenberg’s Facebook blog and is an edited recital of Juan Cole’s presentation at Informed Comment. “Stop Wall Street from Grabbing Traditional Medicare,” F. Douglas Stephenson __________ I am going to add to Joel’s depiction of the future as I too had heard of the coming attempt to force seniors into the commercial healthcare program – Medicare Advantage. This is the only time I will tie the words Medicare and Advantage together. I have written several times on Medicare and the Advantage pickpocketing of healthcare for seniors by commercial healthcare. Commercial healthcare in this form is certainly an advantage, an advantage to commercial healthcare doctors, hospitals, and clinics; commercial healthcare

Topics:

run75441 considers the following as important: Featured Stories, Healthcare, Hot Topics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes Families Struggle Paying for Child Care While Working

This post comes by way of Joel Eissenberg’s Facebook blog and is an edited recital of Juan Cole’s presentation at Informed Comment. “Stop Wall Street from Grabbing Traditional Medicare,” F. Douglas Stephenson

__________

I am going to add to Joel’s depiction of the future as I too had heard of the coming attempt to force seniors into the commercial healthcare program – Medicare Advantage. This is the only time I will tie the words Medicare and Advantage together. I have written several times on Medicare and the Advantage pickpocketing of healthcare for seniors by commercial healthcare. Commercial healthcare in this form is certainly an advantage, an advantage to commercial healthcare doctors, hospitals, and clinics; commercial healthcare insurance; and Wall Street investors.

Some History

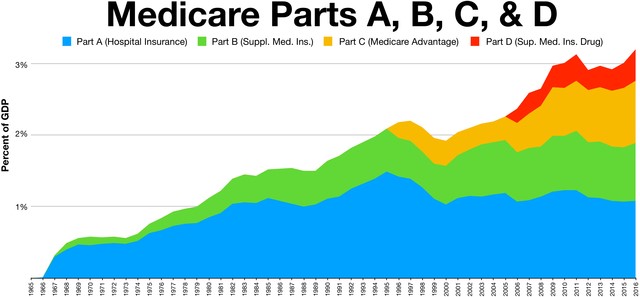

The diminishing numbers of Baby Boomers are “still” a gold mine waiting to be mined by Wall Street and the healthcare industry. The only thing standing in the way of more profits is Medicare setting the prices to be paid to hospitals, clinics, and doctors. How rich is this vein of gold? Medicare programs represent >3% of GDP as depicted in the graph below.

When you go to the doctor’s office and discover healthcare issues during the visit, they code the issues to identify them and commercial healthcare insurance pays the doctor according to the codes. The more codes a doctor can assign to a patient the higher the compensation is in both commercial healthcare plans, Advantage, and Medicare. Typically, a payment by commercial healthcare is 175 to 300% of Medicare payments. Advantage plans are less costly. Less costly only because Congress has made it this way in a giveaway to Advantage insurance companies.

Advantage has been known to code patients higher than what is necessary and if not treated the following year, will still charge CMS. A patient has to be aware of how they are coded and why. Most seniors are not aware of what service they are paying for in a visit. The current battle between Advantage and CMS is the alleged over charging of healthcare by Advantage companies to the tune of $billions. CMS has documented the issue and is “still” attempting to collect.

Advantage plans also cherry pick their patients, the less costly patients. If you are costly, you may find your fees increasing.

An Example of Coding

I have been coded having high cholesterol. Yet while having open heart surgery, my cholesterol was 104. Most recently it was 123. When I challenged the coding, the cardiologist admitted I was technically correct about not having a cholesterol problem. I do have an issue with triglycerides. Yet every time I am in the office the NPs ask about my cholesterol.

From an expert on healthcare for seniors, Nancy Altman;

“Medicare Advantage is a hustle designed to allow for-profit corporations to suck up public dollars.”

How Big is the Healthcare Market for Seniors?

The breakdown in the graph details shows the percentage of seniors in each segment of Medicare and Advantage programs as related to GDP. Note the growing percentage of Advantage plans which are known to be more convenient for seniors. A one stop shop for seniors.

Except as experienced by many seniors, once you go with Advantage plans, you may not be able to acquire a Medicare Supplemental plan if you return to Medicare. Typically, Advantage plans are tied to one healthcare organization which may be geographically limited. If you go elsewhere, you may experience higher prices. Medicare, Supplemental, and Part D can be used anywhere in the US.

Until you get older, Advantage plans “can be” less costly than Medicare.

Joel Details the Future

For now, you can choose traditional Medicare or Medicare Advantage. If you plan to remain where you are and like the healthcare in your network, Medicare Advantage may be better for you. But if you need flexibility, traditional Medicare offers more choices.

It looks like the financial investment business has its sights set on eliminating traditional Medicare by 2030 and forcing everyone onto insurance that is as bad or worse than Medicare Advantage:

“The Center for Medicare and Medicaid Services “Innovation Center” recently announced that by 2030, they will move all traditional Medicare enrollees into a “care relationship” with a 3rd party private, for profit middleman, labeled a “Direct Contracting Entity (DCE) without seniors’ knowledge or consent, and without Congressional oversight.

Every enrollee in traditional Medicare should take note of the dangers. A program titled the Global and Professional Direct Contracting model in a little-known government agency known as the Center for Medicare and Medicaid Innovation (“The Innovation Center”) is already moving them, without their knowledge or consent, to “risk-bearing,” for-profit middlemen known as Direct Contracting Entities (DCEs). The goal: to end what’s left of traditional Medicare as a public, non-profit social/health insurance program.

Simply put, it proposes that a “risk-bearing,” for-profit middleman manage health care for traditional Medicare beneficiaries, just like Medicare Advantage plans are for seniors who have signed up for Medicare Advantage plans. The difference is that while 26 million seniors have voluntarily signed up for a middleman when they chose Medicare Advantage, the 38 million seniors in traditional Medicare have not.

How do you get seniors who have specifically chosen traditional Medicare to switch to a non-traditional Medicare-Advantage-like plan with a mysterious name like “Direct Contracting Entity”?

You don’t tell them!

You lure their primary care providers to participate in a DCE by promising the doctors much better Medicare reimbursement rates and more time with their patients, and once the doctors sign up with a DCE, all their patients are automatically “aligned” by CMS with the DCE the doctor has chosen.

The DCE sends patients a letter they are likely not going to read or understand, and presto! Millions of seniors previously on traditional Medicare now belong to a DCE. That’s how DCEs leverage and monetize the doctor-patient relationship for the profit of private corporations, oligarchs and other Wall Street entities.”