Why Hospitals and Health Insurers Didn’t Want You to See Their Prices – The New York Times (nytimes.com) Sarah Kliff and Josh Katz Some Background Tipping the balance to single payer? I believe Kliff and Tucker article in the NYT Times on hospitals and insurance helps to tip the balance. It is revealing to see what different hospitals will charge for the same procedure and what various insurance companies will payout to cover the same procedures. I do not lay out all of the examples in the article; but, you will get the idea. The variance is the result of the free market commercial hospital healthcare and commercial healthcare insurance. This year 2021, all hospitals were “supposed” to start listing prices for various procedures, ER visits,

Topics:

run75441 considers the following as important: Healthcare, Hot Topics, Medicare, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Why Hospitals and Health Insurers Didn’t Want You to See Their Prices – The New York Times (nytimes.com) Sarah Kliff and Josh Katz

Some Background

Tipping the balance to single payer? I believe Kliff and Tucker article in the NYT Times on hospitals and insurance helps to tip the balance. It is revealing to see what different hospitals will charge for the same procedure and what various insurance companies will payout to cover the same procedures. I do not lay out all of the examples in the article; but, you will get the idea. The variance is the result of the free market commercial hospital healthcare and commercial healthcare insurance.

This year 2021, all hospitals were “supposed” to start listing prices for various procedures, ER visits, Imaging, MRIs, Inoculations, meds, doctors, etc. This was to be a complete list of prices or fees for services at the hospital as negotiated with healthcare insurance companies. Many did list the prices charged and many are still resisting doing so.

I am not a believer in looking at prices alone because you do not get a full picture of profit and costs. If everyone has equal prices, they may still be too high as the costs are low. One would think if prices between hospitals and insurance companies and between either separately, there would be little resistance by either to list them. Or would there be?

Not so surprisingly, hospitals did resist having price lists, and the healthcare insurance companies joined them in the resistance. The argument being . . . “looking at a handful of services will not provide a full picture of their negotiations, etc. Furthermore, the published data files are not accounting for important aspects of their contracts such as bonuses for providing high-quality care.” Value-based care is another discussion point.

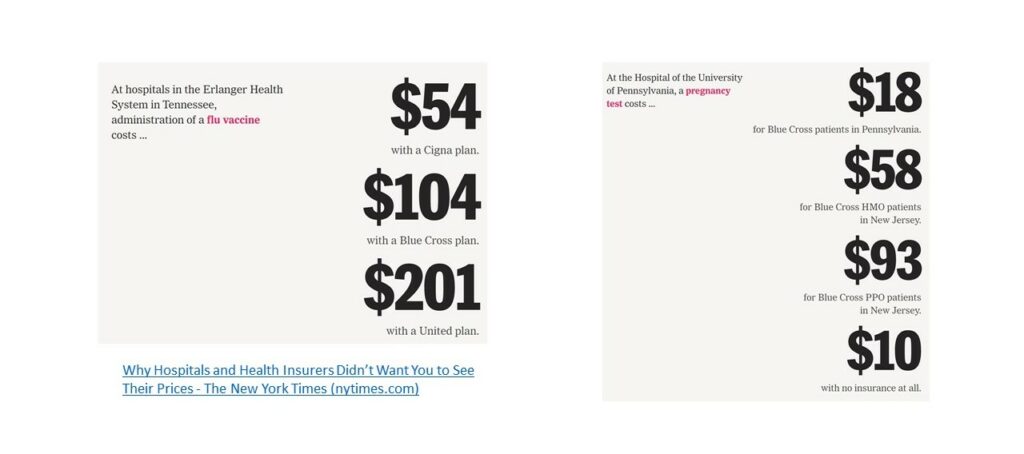

Both lost in court several times and there are differences in insurance payouts for similar care at the same hospital dependent upon what a hospital will charge different insurance companies and policies. Something as simple as a flu shot at various hospitals can have a different price at each hospital.

There is a pronounced difference between each healthcare insurance company on what they pay, what hospitals will bill healthcare insurance companies, and what individuals who like to pay cash pay.

It becomes stickier with the implementation of ACOs as they have bought up the specialties, clinics, and other hospitals in the areas in which they are located . . . lessening competition in regions. Both Phillip Longman and Paul Hewitt took up the issue of the healthcare industry consolidation “After Obamacare” and the monopolistic results. They predicted in 2014:

“A frenzy of hospital mergers could leave the typical American family spending 50 percent of its income on health care within ten years – and blaming the Democrats. The solution requires banning price discrimination by monopolistic hospitals.”

It has come to pass, many families have lesser amounts of healthcare paid for by healthcare insurance due to the healthcare industry consolidation, resulting in higher prices.

The formation of ACOs was to lead to greater efficiencies resulting in lower costs. Instead of lowering costs the opposite occurred. The ACOs consolidated access to healthcare by buying up other hospitals, services, clinics, and specialties limiting competition as evidenced by higher Herfindahl-Hirschman Index ratios. Hospital prices have been increasing along with the consolidation.

Fifty percent of the increase in healthcare costs was due solely to price increases between 1996 and 2013 (JAMA, Factors Associated With Increases in US Health Care Spending, 1996-2013.

Adjusting for inflation, “annual health care spending on inpatient, ambulatory, retail pharmaceutical, nursing facility, emergency department, and dental care increased from $1.2 trillion to $2.1 trillion or $933.5 billion between 1996 and 2013.”

Healthcare insurance companies are finding the consolidation of hospital healthcare services into regional ACOs has resulted in a shift favoring hospitals. ACOs buying up other hospitals in a region can eliminate competition and dictate what they will charge to insurance companies. ACOs and can also have different charges for each insurance company. The cost is passed on to the insured in higher premiums.

Insurance companies are not completely innocent. They will take their 15 and 20% (ACA allowed margin) cut whether the cost to them increases or not. Large Healthcare insurance margins lead to the increasing cost of healthcare.

The results are increased healthcare prices, higher insurance premiums, higher deductibles. less insurance coverage for people, and people not going to the doctor

Why the Resistance?

When you show up at a hospital ER, no one is going to negotiate a price. You need care and you get it even if it includes surprise billing. It is when you are selecting a healthcare plan the pricing knowledge comes into play with the costs of insurance, hospital, and clinic networks you may use. With multiple networks, a consumer has multiple choices from which to choose and little information from which to decide. How do you decide if the service prices are kept secret?

You trust even though you do not know. You decide by trusting the medical service you are getting at the price you are paying is the best it can be. The same applies to healthcare insurance. Deck Shifflet in the Rainmaker.

“Great Benefit’s (insurance) is like a bad slot machine – it never pays off!”

It is not that bad as Healthcare Insurance does pay off; if you can afford it and many people can not afford the plans which will pay off more. Keeping the public in the dark over healthcare insurance, which one is favored by a hospital/ACO, and what a hospital charges maximizes profits.

The resistance to publicizing healthcare prices is also supported by maintaining the secrecy of pricing agreements during negotiations between hospitals, now ACOs, and healthcare insurance companies. When asked for prices, some healthcare insurance companies claim they signed documents of secrecy. The secrecy makes it easier to set prices to the insured and minimizes the need for competition with other healthcare insurance companies. The secrecy also makes it easier to have prices that are not competitive for hospitals and healthcare insurance companies.

If you were to go to one hospital and the price was 25% to 50% higher than the hospital a few miles away, would you go to the lower-cost one? In cases of emergency, you might go to the lower cost one and never know their prices were lower.

Healthcare insurance companies claim people go to particular hospitals to be in certain medical networks of which their policy may be a part. If an insurance company does not have the hospital as a part of their network, the patient arriving for emergency care can be stuck with out-of-network charges or higher prices as their insurance company did not or could not negotiate better pricing.

Healthcare Insurance companies may not know at the time what the best price can be and what a competitor negotiated. They may know a year later after prices become known. Hence, the new requirement of a list of prices exposes the prices each hospital charges at the current time, what a Healthcare Insurance company pays to the hospital, and a comparison.

Healthcare insurance companies are supposed to negotiate the best price, lowest price, etc.? They do advertise the best service and prices as a name brand. If you were a healthcare insurance company, would you care if there was no way an individual can find out prices? The higher the price, the greater the profit margin at 20% for individuals and 15% for groups.

What do we think about institutions that were implemented to protect us, when these same institutions in a free-market system of profit can all too easily be corrupted and harmful?

The Niles Files: Health Care Reform Then and Now: Francis Ford Coppola’s “The Rainmaker” (1997) (nilesfilmfiles.blogspot.com)

The secrecy allows for higher pricing without being challenged.

What does a Price List Do?

For the moment it sets a price for one period of time. For it to be useful, a potential patient would have to gather prices for each hospital as broken out by healthcare insurance companies and type of policy (HMO, PPO, etc.). Advocating such information is an effort for transparency; but, what are you going to do with it?

The requirement to publish prices is a rare bipartisan effort: a Trump-era initiative that the Biden administration supports. But the data has been difficult to draw meaning from, especially for consumers.

This year in 2021, the federal government ordered hospitals to begin publishing a prized secret: a complete list of the prices they negotiate with private insurers.

The insurers’ trade association had called the rule unconstitutional and said it would “undermine competitive negotiations.” Four hospital associations jointly sued the government to block it, and appealed when they lost.

They lost again, and seven months later, many hospitals are simply ignoring the requirement and posting nothing.

But data from the hospitals that have complied hints at why the powerful industries wanted this information to remain hidden.

Why Hospitals and Health Insurers Didn’t Want You to See Their Prices – The New York Times (nytimes.com)

Patients had no way of knowing before they get the bill what they would be charged by the hospital and what the healthcare insurance company would be paying. They still do not know even with the lists of prices for some hospitals. Too much detail and the care may change during treatment.

Some healthcare insurance companies will not tell an individual or the companies what they will pay either. If you asked the doctor, they will say they do not know (I tried that route. The only thing I was told was the office would have a charge as well as the hospital [double whammy] for the EKG machine).

The secrecy surrounding pricing contracts allows hospitals, medical clinics, doctors, and alike to claim discounts from list prices for patients without providing the information. If you have the wrong healthcare insurance, an un-preferred one to the hospital, you probably will end up paying a higher price.

In the end, a hospital’s price list does nothing unless you can compare it to something else.

A Comparison

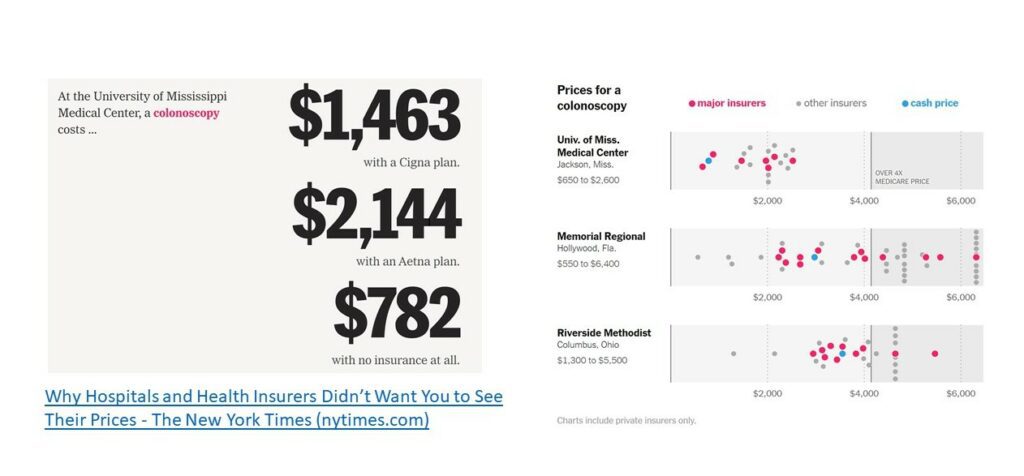

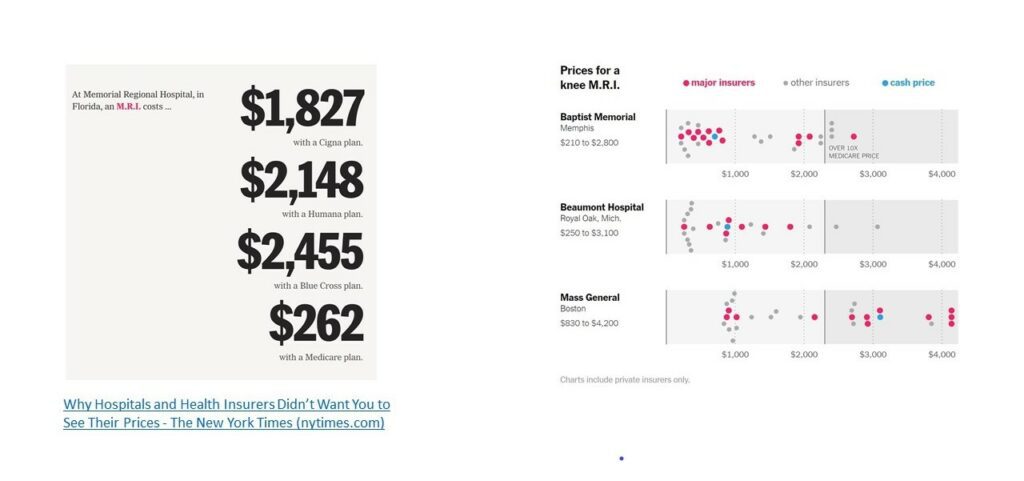

What are those prices and what do insurance companies pay hospitals? Within the NYT exposé, there is a comparison between insurance company payments to hospitals, pricing between different hospitals, and cash payments. I am going to link a few as examples.

To the left of each chart are what various insurance companies will pay to the one hospital mentioned. To the right side is a scatter diagram showing major insurers(red) and other insurers (gray) prices and cash (blue) prices for various hospitals. Cash payment may not get you the lowest price.

“Major health plans pay more than four times the Medicare rate for a routine colonoscopy.”

“For an M.R.I. scan, some Insurance is paying more than 10 times what the federal government is willing to pay.”

For an M.R.I. scan, some are paying more than 10 times what Medicare/Medicaid will pay.

Prices vary for each hospital and healthcare insurance company. It is really a mixed bag. In one instance you may have the lowest price and in another, your price may be the highest based upon the healthcare insurance policy. And this is just for two procedures.

“Major health plans pay more than four times the Medicare rate for a routine colonoscopy.”

Any wonder now why healthcare insurance companies and hospitals do not want prices listed?

The Results of a Mixed Bag of Pricing?

Patients often struggle to afford those bills. Sixteen percent of insured families currently have medical debt, with a median amount of $2,000.

Why Hospitals and Health Insurers Didn’t Want You to See Their Prices – The New York Times (nytimes.com)

People get high deductibles, go without insurance, skip treatment, etc.