Housing and car sales, oh my! [If last week was a slow week for economic data, this week is a virtual wasteland until Thursday, so I took yesterday off.] Last month I wrote that typically it has taken at least a 20% decline in housing construction to be consistent with an oncoming recession and that we weren’t there yet. As of the most recent housing permits report, single-family permits were down 17% from their recent peak: One of the most persuasive fundamentals-based models of economic cycles, by Prof. Edward Leamer, with decades of proof ever since World War 2, posits that housing is the most leading harbinger, turning down about 7 quarters before a recession, followed by motor vehicles, followed by producer durable goods,

Topics:

NewDealdemocrat considers the following as important: Housing and car sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Housing and car sales, oh my!

[If last week was a slow week for economic data, this week is a virtual wasteland until Thursday, so I took yesterday off.]

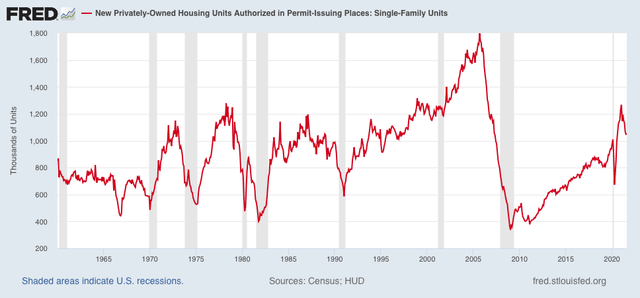

Last month I wrote that typically it has taken at least a 20% decline in housing construction to be consistent with an oncoming recession and that we weren’t there yet.

As of the most recent housing permits report, single-family permits were down 17% from their recent peak:

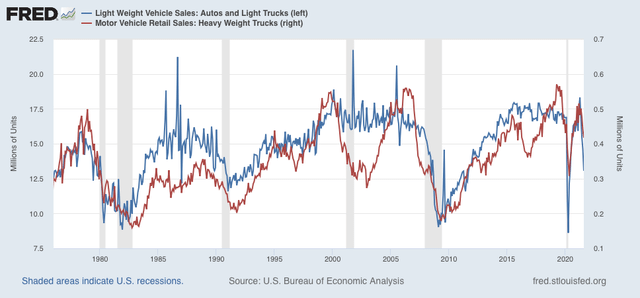

One of the most persuasive fundamentals-based models of economic cycles, by Prof. Edward Leamer, with decades of proof ever since World War 2, posits that housing is the most leading harbinger, turning down about 7 quarters before a recession, followed by motor vehicles, followed by producer durable goods, followed by consumer durable goods.

So, the most recent report on motor vehicle sales is not very encouraging. I have stopped following the private manufacturer reports, because most producers have cut back to quarterly rather than monthly reports, so the monthly numbers are mainly estimates. But the BEA issues its own report with a one month delay, and the most recent report for August, just released, showed a decline of over 10% for that month alone, and a total decline of 28% since April (blue in the graph below). Meanwhile, the more leading heavy trucks segment also declined 5% for the month, and a total decline of 19% since March (red):

Outside of the 1970 recession, heavy truck sales have declined at least 23% (and usually much more than that) before a recession began. Light vehicles, including cars, have typically declined at least 10%.

So heavy truck sales have not quite hit the point of being consistent with an oncoming recession, although cars and light trucks have.

It is important to note that our current situation is sui genesis compared with the past 70 years because there has been no significant increase in either short or long term interest rates. Demand remains intact.

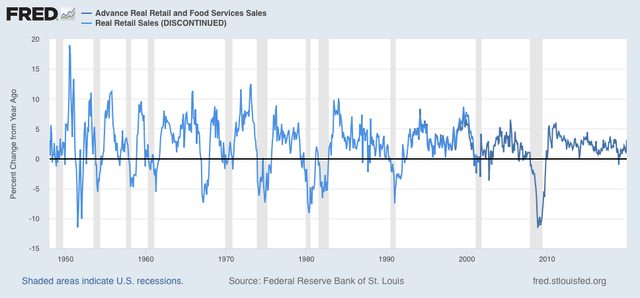

This is entirely a supply bottleneck, which has driven prices for finished goods higher. A close analogy would be the oil shocks of the 1970s, at least one of which was an artificially caused supply shortage (the Arab Oil Embargo). The big difference here is that there is no wage-price inflationary spiral because there are no unions able to obtain automatic “cost of living” wage increases. We have seen wages increase sharply in many places due to the pandemic, but with all emergency benefits ended, that has or shortly will almost certainly cease. If the supply shortages do not ease shortly, then the next thing to watch out for is whether more broad durable goods spending by both producers and consumers stalls. In particular, real retail sales per capita has almost always turned negative YoY shortly before the onset of recessions in the past 70 years:

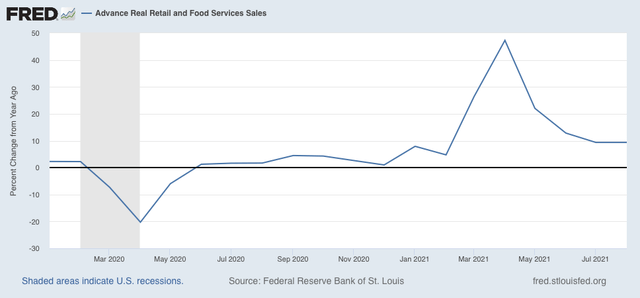

By contrast, at present YoY real retail sales are up almost 10%:

If that number were to suddenly plummet close to 0, I would be much more concerned that the supply bottleneck was on the verge of creating a recession.