Housing construction continues to stabilize, but with record bottleneck in starts Last month I highlighted that housing constructions were stabilizing, following the stabilization in interest rates. This month continued that trend. In October, housing starts (green in the graphs below) decreased -0.7% m/m, while the more leading total permits (blue) increased 4.0%. The less volatile single-family permits (red) increased 2.7%. As a result, the overall trend for all three metrics for the past several months is generally flat: On a YoY% basis, starts are up 3.5%, permits barely up 0.4%, and single family permits down -6.3%: The YoY increase in starts continues to be noteworthy because it highlights an unusual event which has taken place over

Topics:

NewDealdemocrat considers the following as important: housing construction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Housing construction continues to stabilize, but with record bottleneck in starts

Last month I highlighted that housing constructions were stabilizing, following the stabilization in interest rates. This month continued that trend.

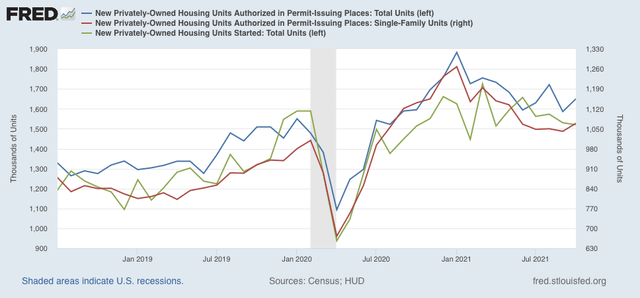

In October, housing starts (green in the graphs below) decreased -0.7% m/m, while the more leading total permits (blue) increased 4.0%. The less volatile single-family permits (red) increased 2.7%. As a result, the overall trend for all three metrics for the past several months is generally flat:

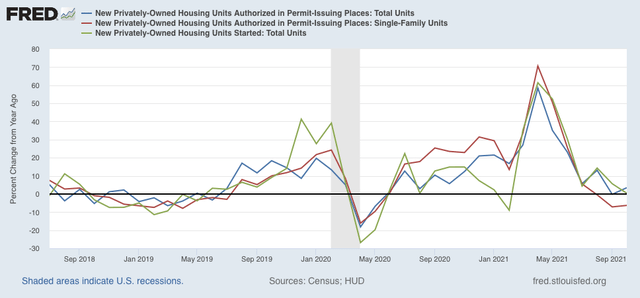

On a YoY% basis, starts are up 3.5%, permits barely up 0.4%, and single family permits down -6.3%:

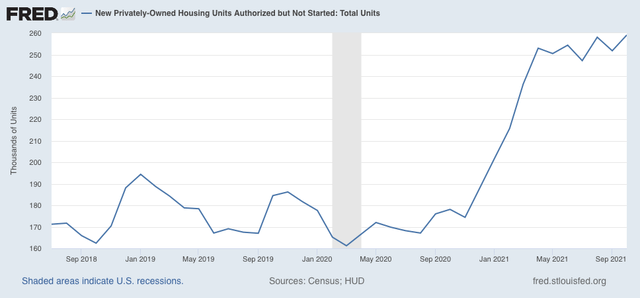

The YoY increase in starts continues to be noteworthy because it highlights an unusual event which has taken place over the past year; namely, a record number of permits were issued for houses that were not promptly started. Here’s a graph of such housing for the past 3 years:

The current level is the highest since the 1970s (not shown).

In other words, the actual on-the-ground economic activity in housing construction hasn’t declined that much, presumably because housing materials at reasonable prices constrained the actual building of houses authorized by permits. On a rolling 3-month average basis, housing starts are only down -4.4% from their year-end 2020 peak. This suggests much less of a real economic downdraft than would otherwise be the case, as typically it has taken a downturn of about -20% to be consistent with a recession.

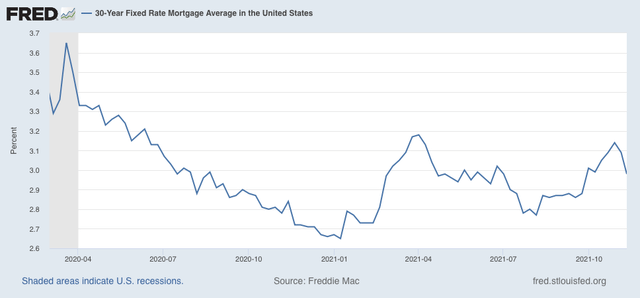

As I have repeated many times, interest rates lead housing construction. And the evidence from mortgage rates is that housing should be (and is) stabilizing. In the past 6 months rates have stabilized between the 2.75%-3.15%:

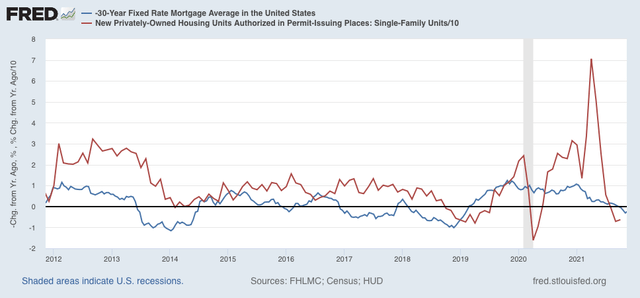

As a result, I would expect stabilization or a moderate increasing trend in response. This is shown when we compare the YoY% changes in mortgage rates (inverted) and single-family housing permits over the past 10+ years:

In October, Mortgage rates only were increased 0.14% YoY, and for all intents and purposes have been flat YoY for the past 4 months.

Since housing construction is a long leading indicator, this series continues to suggest that the economy, after a period of cooling early next year, will also stabilize later on.Posted by