Oil in longest losing streak since 2019; global oil shortage at 2,540,000 barrels per day; DUC well backlog at 7.1 months, Focus on Fracking, Commenter and Blogger, R,J.S. Thursday of last week saw the release of OPEC’s August Oil Market Report, which covers OPEC & global oil data for July, and hence it gives us a picture of the global oil supply & demand situation for the third month of the modest output easing policy initiated by OPEC and other producers at their early April meeting, which was actually the fourth production quota policy reset they’ve made over the past year, all in response to the pandemic-related slowdown and subsequent recovery . . . but before we start in, we want to again caution that the oil demand estimates made by OPEC

Topics:

run75441 considers the following as important: Focus on Fracking, Hot Topics, politics, RJS, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Oil in longest losing streak since 2019; global oil shortage at 2,540,000 barrels per day; DUC well backlog at 7.1 months, Focus on Fracking, Commenter and Blogger, R,J.S.

Thursday of last week saw the release of OPEC’s August Oil Market Report, which covers OPEC & global oil data for July, and hence it gives us a picture of the global oil supply & demand situation for the third month of the modest output easing policy initiated by OPEC and other producers at their early April meeting, which was actually the fourth production quota policy reset they’ve made over the past year, all in response to the pandemic-related slowdown and subsequent recovery . . . but before we start in, we want to again caution that the oil demand estimates made by OPEC herein, while the course of the Covid-19 pandemic still remains uncertain in most countries around the globe, should be considered as having a much larger margin of error than we’d expect from this report during stable and hence more predictable periods..

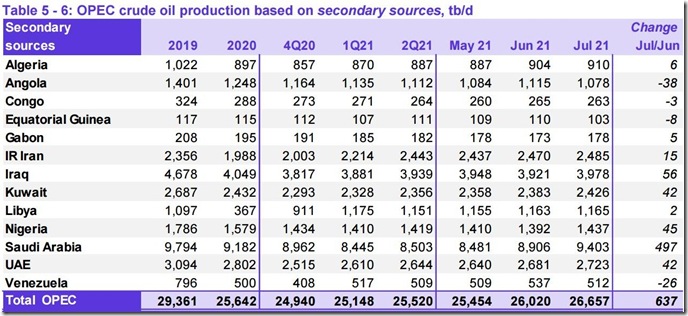

The first table from this monthly report that we’ll check is from the page numbered 49 of this month’s report (pdf page 59), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate . . . for all their official production measurements, OPEC uses an average of estimates from six “secondary sources”, namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures…

As we can see on the bottom line of the above table, OPEC’s oil output increased by 637,000 barrels per day to 26,657,000 barrels per day during July, up from their revised June production total of 26,020,000 barrels per day…however, that June output figure was originally reported as 26,034,000 barrels per day, which therefore means that OPEC’s June production was revised 14,000 barrels per day lower with this report, and hence OPEC’s July production was, in effect, a 623,000 barrel per day increase from the previously reported OPEC production figure (for your reference, here is the table of the official June OPEC output figures as reported a month ago, before this month’s revision)…

From the above table, we can see that a production increase of 497,000 barrels per day from the Saudis was the major factor in OPEC’s July output increase; the reason for that increase is that the Saudis had unilaterally committed to cut their own production by a million barrels per day during February, March and then later during April of this year, and that they are now unwinding that voluntary output decrease, having previously increased their production by 345,000 barrrels per day in May and by 425,000 barrels per day in June . . . recall that last year’s original oil producer’s agreement was to cut production by 9.7 million barrels per day from an October 2018 baseline for just two months early in the pandemic, during May and June of last year, but that agreement had been extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020 . . . then, in a subsequent meeting in July of last year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August and subsequent months, which was thus the agreement that covered OPEC’s output for the rest of 2020…the OPEC+ agreement for January’s production, which was later extended to include February and March and then April’s output, was to further ease their supply cuts by 500,000 barrels per day to 7.2 million barrels per day from that original baseline . . . then, during a difficult meeting on April 1st of this year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher over the next three months, which is the agreement which governed OPEC’s July’s production that you see above…

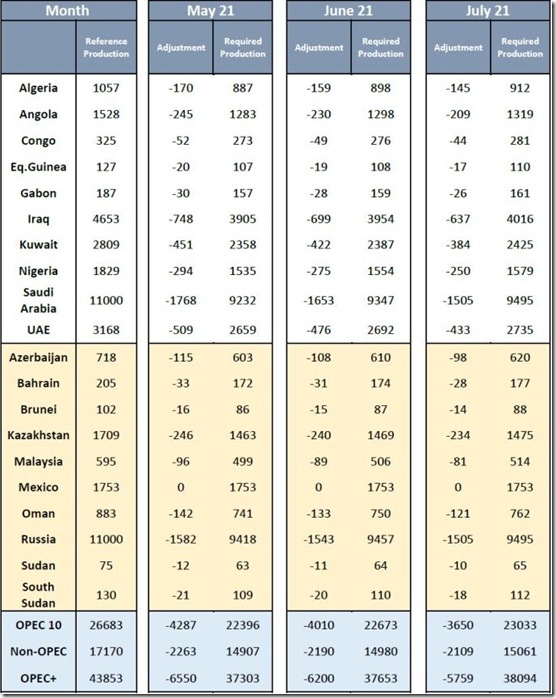

Hence, to determine if all the OPEC members continued to adhere to the production cuts they had committed to during May, we’ll include a copy of the production adjustments table that was provided as a downloadable attachment with the OPEC press release following their April 1st meeting with other oil producers . . .

The above table was included with the press release following the 15th OPEC and non-OPEC Ministerial Meeting on April 1st of this year, and it includes the reference production and expected production levels for the 10 members of OPEC that are expected to make cuts, as well as the same information for the other major oil producers who are party to what the press calls the “OPEC + agreement” . . . the first column in the above table shows the reference oil production baseline, in thousands of barrel per day, from which each of the oil producers was to cut their production from, a figure which is based on each of the oil producer’s October 2018 oil output, ie., a date before last year’s and the prior year’s output cuts took effect, and coincidently the highest monthly production of the era for most of the producers who are party to these cuts . . . the remaining columns show the adjustment, or cut, that each is expected to make from that reference production level, and then the oil output allowed for each producer under the April agreement for the months of May, June and July…

OPEC arrived at these figures by repeatedly adjusting the original 23%, or 9.7 million barrel per day cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was actually raised to an 8.2 million barrel per day reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during February, March, and then later during April of this year . . . under the prior agreement, OPEC’s production cut in April was at 4,564,000 barrels per day from the October 2018 baseline; as you see above, their cut for July was lowered to 3,650,000 barrels per day from the baseline with the latest agreement . . . note that war torn Libya, and US sanctioned producers Iran and Venezuela, are exempt from the production cuts that the cartel imposes on its other members, and hence the 22,495,000 barrel per day production of the other ten members in July remained below the 23,033,000 barrel per day quota for July they set at the April 1st meeting. …