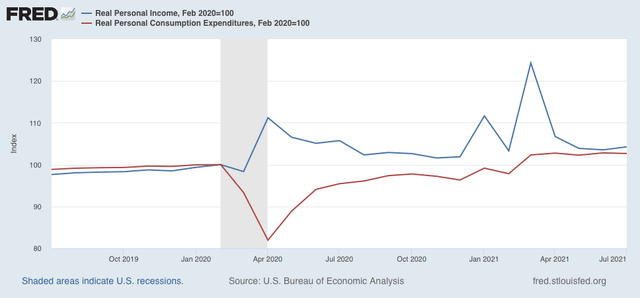

July personal income and spending return to normalcy. Normalcy is good How well personal income and spending held up throughout the pandemic is one of the best things about the government response. That has continued to be the case as of this morning’s report for July. Real personal income (blue) increased 0.7%, and is 4.2% above where it was in February 2020. Real personal spending (red) decreased -0.1%, but is still 2.7% above its immediate pre-pandemic level: Further, the “cushion” in personal savings due to the emergency pandemic programs continues, as the savings rate remains significantly above where it was before the pandemic (the below graph subtracts 7.0%, which was the lowest level in the immediate few years before 2020,

Topics:

NewDealdemocrat considers the following as important: personal spending and income, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

July personal income and spending return to normalcy. Normalcy is good

How well personal income and spending held up throughout the pandemic is one of the best things about the government response. That has continued to be the case as of this morning’s report for July.

Real personal income (blue) increased 0.7%, and is 4.2% above where it was in February 2020. Real personal spending (red) decreased -0.1%, but is still 2.7% above its immediate pre-pandemic level:

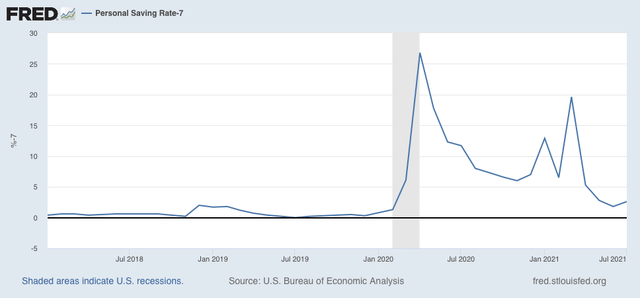

Further, the “cushion” in personal savings due to the emergency pandemic programs continues, as the savings rate remains significantly above where it was before the pandemic (the below graph subtracts 7.0%, which was the lowest level in the immediate few years before 2020, better to show this):

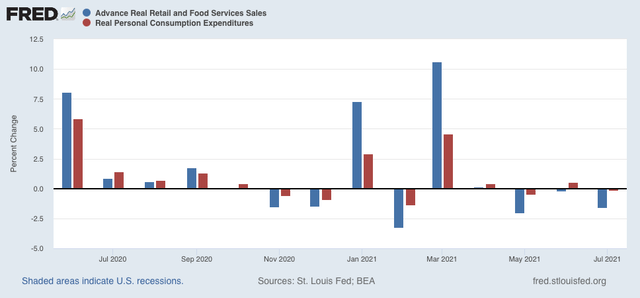

Real personal spending is basically the other side of the coin compared with real retail sales since they cover the seller and buyer of consumer transactions, which is over 2/3’s of the entire economy:

Both of these have returned to basically normal levels m/m. While the stimulus has abated, spending hasn’t crashed, although sales have declined relatively modestly in the past few months. At this point in the pandemic, normalcy is good.