Existing vs. new home sales: sales have peaked, expect prices to soon peak I normally don’t pay much attention to existing home sales. Even though they constitute about 90% of the housing market, they have much less impact on the economy overall than new home sales (because all of the economic activity involved in building the house, and then landscaping the outside and furnishing the inside). But they can be a comparison with new home sales, particularly as they are a competing product. And the procession of data is the same: interest rates lead sales, which in turn lead prices, which in turn lead inventory. Existing home sales for April confirmed what we have already seen with new home sales: the market peaked at the turn of the year.

Topics:

NewDealdemocrat considers the following as important: new and existing home sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Existing vs. new home sales: sales have peaked, expect prices to soon peak

I normally don’t pay much attention to existing home sales. Even though they constitute about 90% of the housing market, they have much less impact on the economy overall than new home sales (because all of the economic activity involved in building the house, and then landscaping the outside and furnishing the inside).

But they can be a comparison with new home sales, particularly as they are a competing product. And the procession of data is the same: interest rates lead sales, which in turn lead prices, which in turn lead inventory.

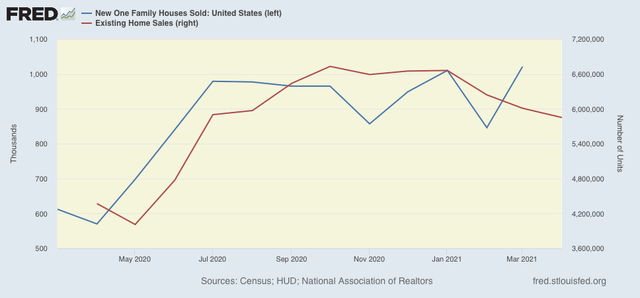

Existing home sales for April confirmed what we have already seen with new home sales: the market peaked at the turn of the year. Sales declined 2.7%, seasonally adjusted, compared with March, to 5.85 million units annualized. That is the lowest number since last July’s 5.90 million. It is about -12% below the January peak of 6.66 million. Below I show both new (blue) and existing (red) home sales for the past year:

Earlier this week we saw that housing permits and starts are both also off of their highest point of December and January.

Median prices, however, continued to climb to a new all time high of $341,600, a YoY gain of 19.1%, the highest YoY gain on record. Inventory continued to decline, to less than 2 months’.

I fully expect prices to reverse in the coming months, and I also expect inventory to increase.