Scenes from last week’s June employment report With no significant economic data today, let’s take a look at some of the more salient numbers from the June employment report released one week ago. Starting with the headline employment numbers, both the Establishment Survey and the Household Survey, while diverging in any given month, are in close agreement about the extent of the comeback from the worst of the pandemic, down -4.4% and -4.5% from February 2020, respectively: This is about a 70% recovery from the bottom. Comparing goods producing vs. service providing jobs, we see that the former are down -3.7% since February 2020, while the latter are down -4.6%: Breaking jobs down further, comparing the less affected sectors

Topics:

NewDealdemocrat considers the following as important: employment reprt, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Scenes from last week’s June employment report

With no significant economic data today, let’s take a look at some of the more salient numbers from the June employment report released one week ago.

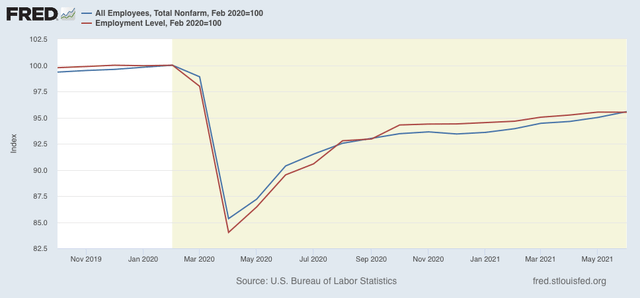

Starting with the headline employment numbers, both the Establishment Survey and the Household Survey, while diverging in any given month, are in close agreement about the extent of the comeback from the worst of the pandemic, down -4.4% and -4.5% from February 2020, respectively:

This is about a 70% recovery from the bottom.

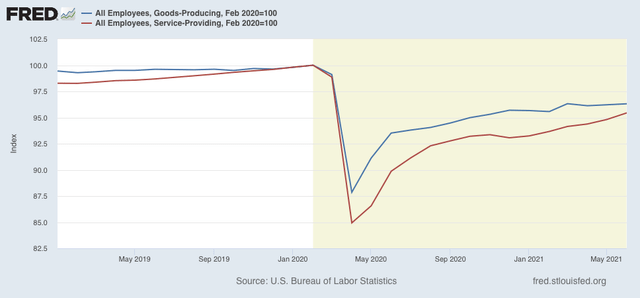

Comparing goods producing vs. service providing jobs, we see that the former are down -3.7% since February 2020, while the latter are down -4.6%:

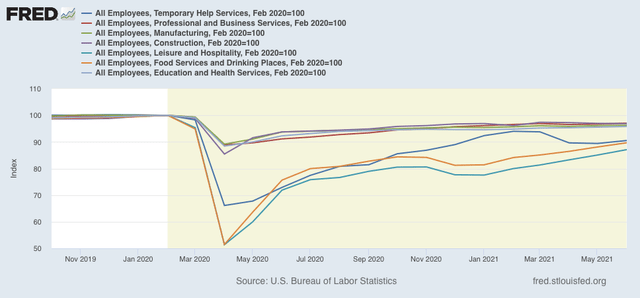

Breaking jobs down further, comparing the less affected sectors of construction, manufacturing, professional services and education and health services all show modest recoveries, while the more severely affected temporary help, leisure and hospitality, and food and drink sectors have recovered more strongly – but are still lagging:

Jobs in the leisure and hospitality sector are still down -12.9% since February 2020.

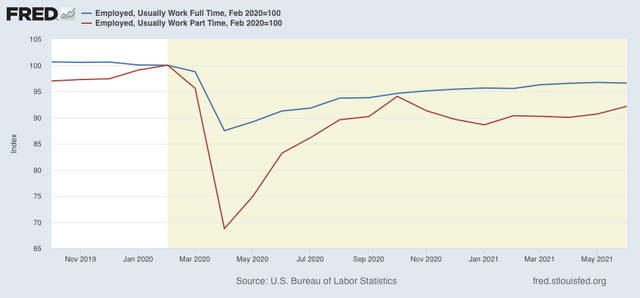

Turning to the household report, we see that those who usually work part time were by far the hardest hit, and while they have recovered considerably, still lag full-time workers:

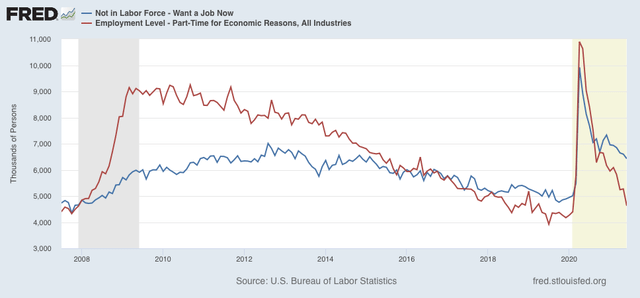

On the other hand, those who are working part-time involuntarily (red in the graph below) have declined to near full-recovery levels. The number of those who are out of the labor force but want a job (blue) has declined but is still near its previous record levels of 2012 and 2013:

This is about 2.5 million people who aren’t in the labor force at all, but would be in more normal times. It will take a further recovery of job prospects to draw them back into applying for jobs.

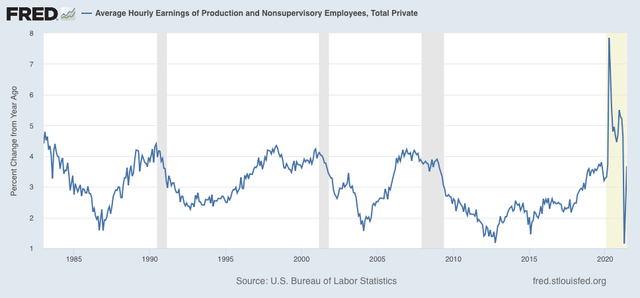

Finally, turning to pay, the YoY% gain for ordinary non-supervisory workers has risen back to 3.7%, which is in line with some of its best gains over the past 45 years:

This is good news since in the past few months many workers in typically low wage occupations have been rehired.

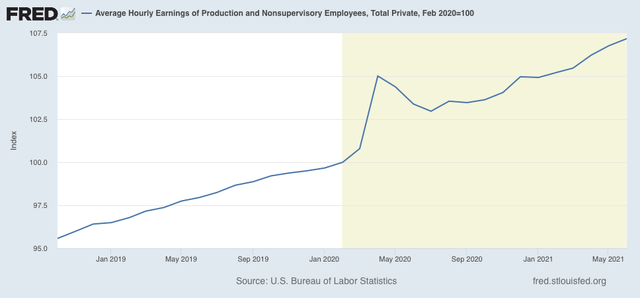

Another way of looking at this is comparing the 16 months just before the pandemic with the 16 months since. In the 16 months before the pandemic, wages rose 4.4% (or 3.3% annually). In the 16 months since wages have risen 7.2% (or 5.4% annually):

Whether these kinds of gains will survive the further re-opening of the economy, particularly as emergency pandemic benefits end, is very much an open question.