I think it is now possible to look back on the debate on the effectiveness of non-standard monetary policy at the (near) zero lower bound. I will now “mark my beliefs to market” – J B DeLong. I think it is also a mildly worthwhile exercise, because it is relevant to the current debate about fiscal policy. A key argument for massive fiscal stimulus, well greater than any estimated output gap, is that making predictions, especially about the future, is harder than usual. This strengthens the usual argument that, as the Federal Funds rate is near zero, it is better for fiscal policy to be too stimulatory, because interest rates can be raised if the economy overheats but can’t be cut if it underheats. Given the huge uncertainty, there is a case

Topics:

Robert Waldmann considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

I think it is now possible to look back on the debate on the effectiveness of non-standard monetary policy at the (near) zero lower bound. I will now “mark my beliefs to market” – J B DeLong.

I think it is also a mildly worthwhile exercise, because it is relevant to the current debate about fiscal policy. A key argument for massive fiscal stimulus, well greater than any estimated output gap, is that making predictions, especially about the future, is harder than usual. This strengthens the usual argument that, as the Federal Funds rate is near zero, it is better for fiscal policy to be too stimulatory, because interest rates can be raised if the economy overheats but can’t be cut if it underheats. Given the huge uncertainty, there is a case for huge stimulus — maybe even more than the American Rescue Plan (as in maybe it’s time for an infrastructure bill and a family assistance bill). This argument would be invalid if stimulatory monetary policy were effective at the lower bound.

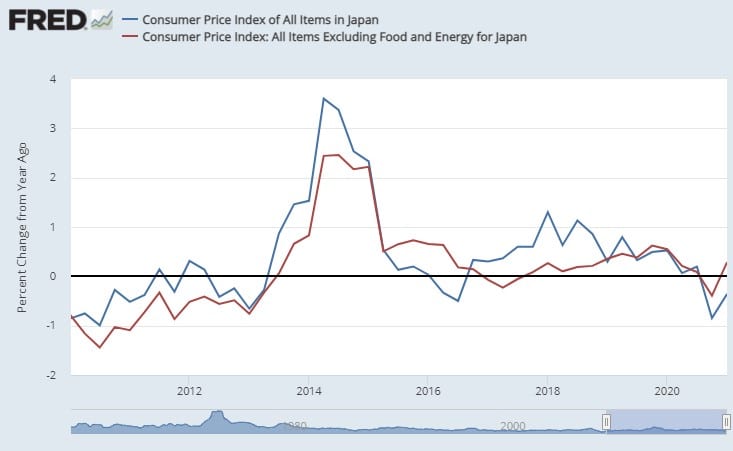

So was it ? The generally agreed extreme case of aggressive non standard monetary policy was Japan, where Haruhiko Kuroda vowed to do “Whatever it takes” to boost inflation. The Bank of Japan (BOJ) did things which the Fed absolutely is not allowed to d; it purchased stock (owning about 7% of market capitalization) . It declared a 2% inflation target which was explicitly a floor not a ceiling.

Of course it did not achieve this target. The only period of on target inflation was due to a 2014 3% increase in VAT which was in fact added to consumer prices. The declaration by PM Abe that he was really going to do this also caused an increase in expected inflation at the time Abe appointed Kuroda. This shows the power of fiscal policy *the VAT increase was followed by a recession).

Similarly annualized quarterly real GDP growth shows that “Whatever it Takes” March 2013 was followed by negative GDP growth in two quarters, then the sharpest downturn after the 2008 crash and before Covid 19 in four quarters. I don’t see how there could be stronger evidence that Fiscal policy trumps monetary policy when interest rates are at teh zero lower bound.

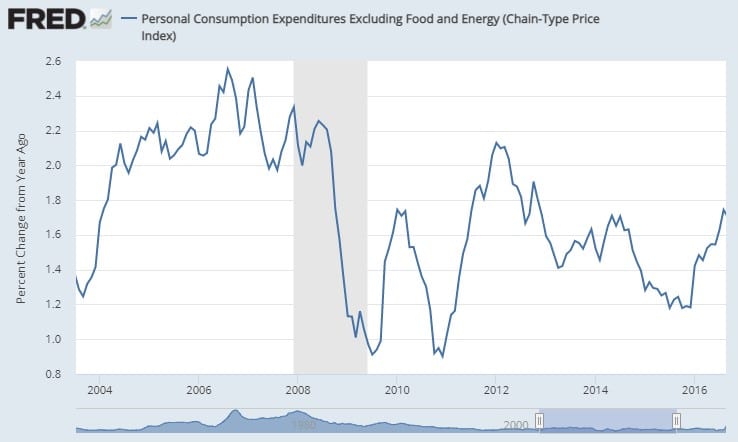

The evidence from the USA is similar

The evidence that QE works always includes QE 1 which consisted of purchases of mortgage backed bonds which no one else was buying and therefore at a price much higher than the market clearing price. This was a bailout during a panic (it was also hugely profitable and not just a gift). It doesn’t mean that purchases of safe assets (Treasury notes as in QE 2) would stimulate. It does not mean that issuing high powered money when the economy is in a liquidity trap and investors are not panicking (QE 2 and QE 3) would stimulate. It is not relevant to the US post 2009 (including 2020).

In spite of open market operations which dwarfed all previous open market operations put together, the Fed did not reach its 2% inflation target.

The way in which QE is supposed to affect the economy is through medium real interest rates. If it works by changing portfolio balance with the Fed bearing maturity risk, then medium term interest rates fall. If it signals higher target inflation, then it implies lower nominal interest rates given inflation and, by arithmetic lower real rates. QE 2 and QE 3 do not appear in the graph of the 5 year TIPS (inflation indexed bond) rate. The only dramatic shift after 2009 and before 2020 is the 2013 “Taper Tantrum” which might or might not have been triggered by Fed Open Market committee discussion of tapering QE in the future. Notably, the taper tantrum does not seem to have had a detectable effect on investment. This is nor surprising, a 1% change in interest rates generally doesn’t. The fact that I had to divide the percent change in real gross private investment by 10 to get it on the same scale as the TIPS rate is a hint that the changes in interest rates which got so much attention were small.

Kids these days just don’t know what effective monetary policy looks like. Volcker played with GDP like a yo yo. He didn’t do that with 1% shifts in interest rates.

you will notice that I didn’t really have to divide the percent change in investment by 10 to get it on the same graph. In 1980 Volcker cut the Federal Funds rate by 8.5% trying to stop Reagan (and convincing me that he really was a Democrat) Poweell will not be able to do something like that if it is needed to stop Trump. And he knows this.