February JOLTS report: the game of musical chairs in the jobs market goes on This morning (Tuesday) the Census Bureau JOLTS report for February shows that the game of musical job chairs continues. As a refresher, several months ago I introduced the idea of a game similar to musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there are several million fewer players trying to sit in those chairs, leaving many empty. As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in empty chairs. This pattern has continued, indicating if anything a general plateauing of all the numbers. Layoffs and

Topics:

NewDealdemocrat considers the following as important: jobs market, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

February JOLTS report: the game of musical chairs in the jobs market goes on

This morning (Tuesday) the Census Bureau JOLTS report for February shows that the game of musical job chairs continues.

As a refresher, several months ago I introduced the idea of a game similar to musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there are several million fewer players trying to sit in those chairs, leaving many empty. As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in empty chairs. This pattern has continued, indicating if anything a general plateauing of all the numbers.

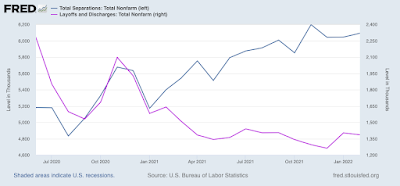

Layoffs and discharges (violet, right scale in the graph below) declined 17,000 to 1.386 million, slightly above their record low of 1.262 in December. Total separations (blue) rose 48,000 to 6.092 million (graph starts in June 2020 for reasons of scale):

Layoffs continue to be extremely rare.

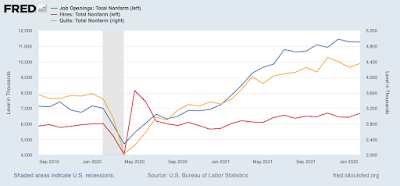

Meanwhile, job openings (blue in the graph below) declined 17,000 to 11.266 million, a small decline from their record peak of 11.448 million in December. Openings had been gradually increasing to repeated record highs in the previous 6 months, but now appear to have leveled off. Voluntary quits (the “great resignation,” gold, right scale) rose 94,000 to 4.352 million, 158,000 below November’s record high, and again, possibly leveling off. Actual hires (red) rose 263,000, to 6.689 million, only 16,000 below November’s record high of 6.705 million:

In summary, we continue to have near-record high job openings, hires, and quits, together with near-record low layoffs – but we now see evidence that the numbers are no longer increasing or decreasing. Little progress is being made towards establishing a new equilibrium, but on the other hand, the situation is not getting more *out* of equilibrium.

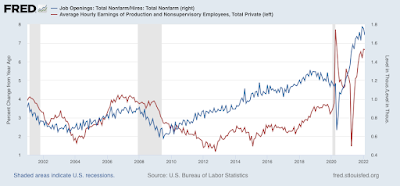

Finally – again as I have been pointing out for the last few months – because of the continuing yawning gap in job-takers vs. job openings, wages have continued to soar. Below is a graph of job openings divided by actual hires (blue, right scale). This gives the rate at which openings are above or below hires, where 1.0 represents the level at which the number of openings and hires are equal. As you can see, this rate increases as expansions go on, and in the last 18 months has repeatedly made new all-time high, the last of which was in December.

YoY wage gains for non-managerial workers (red, left scale) are a “long lagging” indicator, typically turning up well after an expansion is underway, and typically when the U-6 underemployment rate falls below about 9.0% (currently at 7.2%, the lowest except for the year 2000 at the end of the tech boom, the last 8 months before the pandemic, and in February):

In short, wage growth has responded to the favorable game of employment musical chairs by spiking to 6.7% YoY. I expect wages to continue to rise at this strong rate until potential employers can no longer make any profit from hiring potential employees.

I expect strong wage gains to continue until we see a *significant* decline in the ratio of openings to hires; and at the same time, or shortly thereafter, a significant decline in voluntary quits. As indicated above, while the situation is no longer getting more extreme, it isn’t getting any less extreme yet either.

So the game of musical chairs in the jobs market continues.