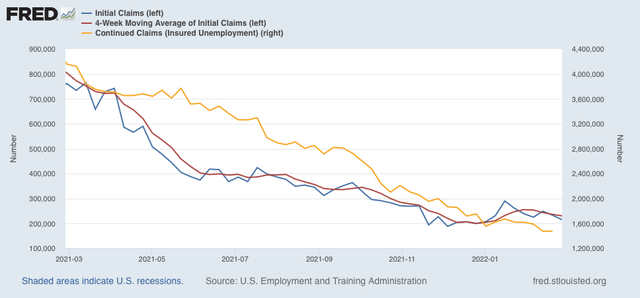

Continuing claims continue near 50 year lows as the Omicron tsunami continues to recede, NDd [Programming note: Hopefully I’ll put up a coronavirus update later today.]Initial claims (blue) declined 18,000 to 215,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 6,000 to 230,500 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) increased 2,000 to 1,476,000, (vs. 1,474,000 last week, which was the lowest number in over 50 years): The Omicron tsunami has continued to recede, and with it the recent increase in initial claims. I still suspect we have seen the lows in initial claims for this expansion. The decline in continuing claims to a 50 year+ low means that

Topics:

NewDealdemocrat considers the following as important: continuing claims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Continuing claims continue near 50 year lows as the Omicron tsunami continues to recede, NDd

[Programming note: Hopefully I’ll put up a coronavirus update later today.]

Initial claims (blue) declined 18,000 to 215,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 6,000 to 230,500 (vs. the pandemic low of 199,750 on December 25).

Continuing claims (gold, right scale) increased 2,000 to 1,476,000, (vs. 1,474,000 last week, which was the lowest number in over 50 years):

The Omicron tsunami has continued to recede, and with it the recent increase in initial claims. I still suspect we have seen the lows in initial claims for this expansion.

The decline in continuing claims to a 50 year+ low means that the record tightness in the jobs market isn’t going away anytime fast. There will be continuing upward pressure on wages.

I don’t think this has any particular ramifications for tomorrow’s jobs report, but in general I am expecting monthly job gains to slow over the coming few months.