Sharp downturn in June housing starts confirms earlier negative signals from permits, sales, and mortgage applications For the last few months, I have highlighted the record number of housing units that had permits but had not yet been started, pointing out that it distorts the economic signal. Last month I closed with the statement: “The conundrum is whether the 50-year high backlog in units not yet started will delay the downturn until it clears – which might take another 6 to 12 months. Since starts are the actual economic activity, until I see an unequivocal downturn there, the massive negative signal from permits, mortgage rates, and mortgage applications remains open to question.” I would say that today we got the signal. Both permits

Topics:

NewDealdemocrat considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Sharp downturn in June housing starts confirms earlier negative signals from permits, sales, and mortgage applications

For the last few months, I have highlighted the record number of housing units that had permits but had not yet been started, pointing out that it distorts the economic signal. Last month I closed with the statement:

“The conundrum is whether the 50-year high backlog in units not yet started will delay the downturn until it clears – which might take another 6 to 12 months. Since starts are the actual economic activity, until I see an unequivocal downturn there, the massive negative signal from permits, mortgage rates, and mortgage applications remains open to question.”

I would say that today we got the signal. Both permits for single-family units and total starts turned down sharply. In the month of June single-family permits declined -8.0% to a 2 year low – a little more than a 20% total decline from their January 2021 peak (red in the graph below); and starts declined -2.0%, tying their one year low at 14% below their peak in April of this year. Since monthly starts are noisy, the quarterly average is a much better signal, and in Q2 starts did decline -4.0% (blue). The quarterly average for single-family permits (gold) also declined by over -12.0% (gold):

In other words, with permits continuing to fall, and starts now also in decline, we have a verified leading signal.

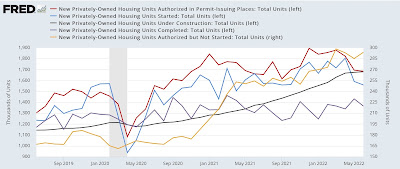

What about housing under construction? To put that in perspective, the below graph shows housing data as it “moves through the belly of the beast;” including total permits (red), units permitted but not yet started (gold), starts (blue), units under construction (black), and housing completions (gray), for the past 3 years:

Both permits and starts have peaked. Further, it appears that units not yet started also peaked several months ago. Housing under construction appears to be peaking now. Completions still appear to be in a slight uptrend.

Housing under construction is the ultimate coincident marker of housing economic activity. Once that begins going down, housing’s contribution to the economy is negative in real time. We are probably only a month or two from that point. In other words, the leading indicators will be joined by the coincident indicator.

Not to be totally Doomish, let me show you the same information as in the first graph above, for the period of time when the 2000s housing boom turned into a bust:

In that case, permits were down about 33%, and starts down 25%, at the point when the Great Recession began. In other words, this downturn to date is only about half as bad as the one that presaged the Great Recession.

The final housing domino to fall will be prices. We’ll get a very important read on them tomorrow when existing home sales are published.