I think I have this initial chart big enough so you can see it. I should not have to explain this as it is apparent what is happening with ACA (PPACA) healthcare insurance. The pricing decrease and stability shown is due to Joe Biden’s ARPA enhancing subsidies. The ARPA lower cost results are also increasing enrollment 21% from last year. The premiums will remain in place for three-years. And this too is inflationary as everyone spends money to get healthcare insurance. Joe Biden economic programs put money in the hands of citizens. An unfortunate necessity due to the Senator from Aetna Joe Liebermann blocking a better plan called the public option in 2009. Couple this with healthcare and insurance industry resistance and politicians in the

Topics:

run75441 considers the following as important: ACA, ARPA, Healthcare, KFF, politics, xpostfactoid

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

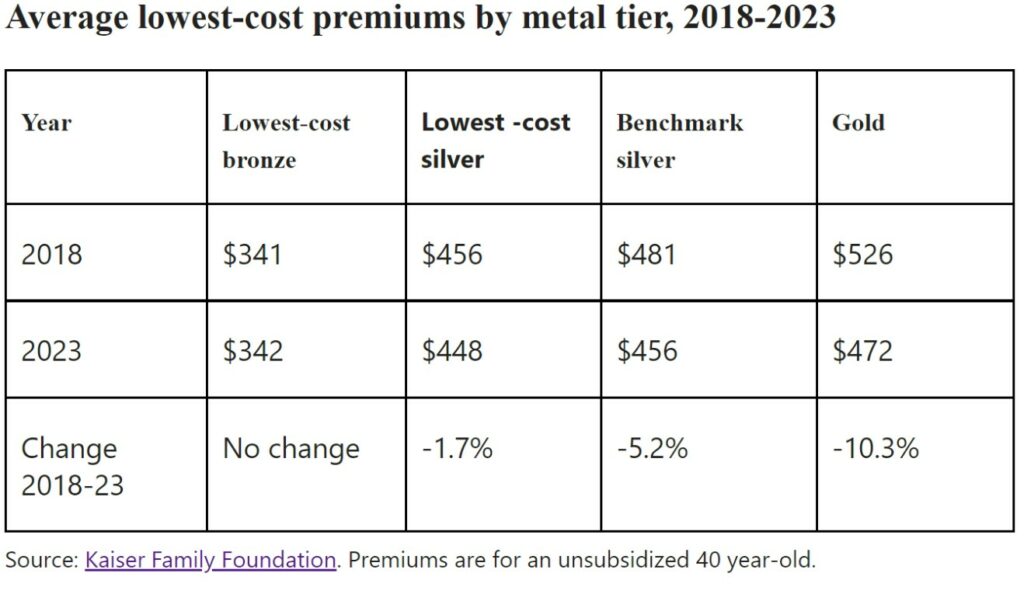

I think I have this initial chart big enough so you can see it. I should not have to explain this as it is apparent what is happening with ACA (PPACA) healthcare insurance. The pricing decrease and stability shown is due to Joe Biden’s ARPA enhancing subsidies. The ARPA lower cost results are also increasing enrollment 21% from last year. The premiums will remain in place for three-years.

And this too is inflationary as everyone spends money to get healthcare insurance. Joe Biden economic programs put money in the hands of citizens. An unfortunate necessity due to the Senator from Aetna Joe Liebermann blocking a better plan called the public option in 2009. Couple this with healthcare and insurance industry resistance and politicians in the pocket of industry.

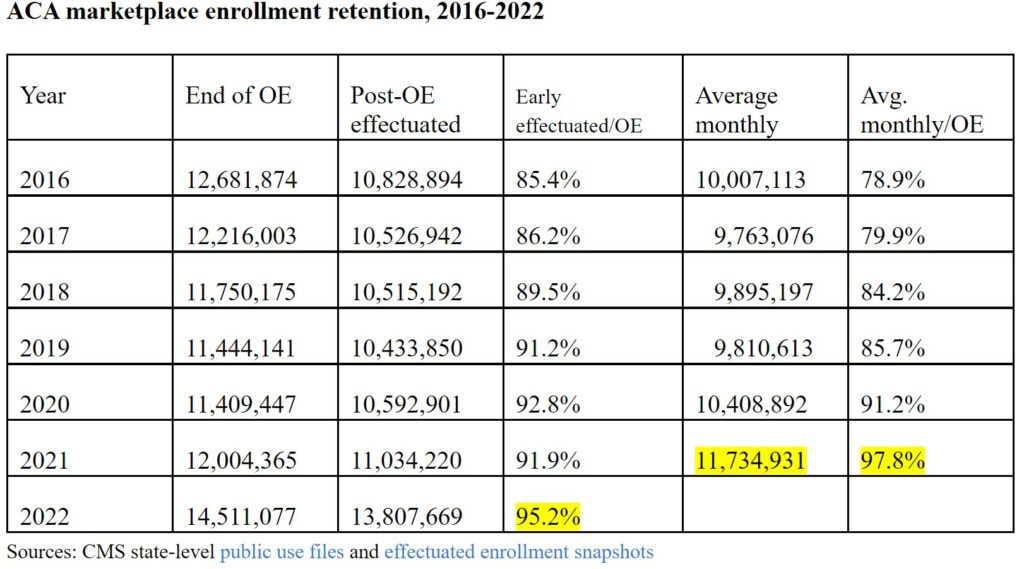

Things may change if Repubs control the Senate and the House. Anywho, enrollment is up in 2022; retention was also good at least through the first payment. The retention was boosted by the lower subsidized premiums (95% of those who selected plans in Open Enrollment had effectuated enrollment in February. Lots of inflation being caused here . . .

The retention rate increased as (at least through first payments) a result of the lower (see table above) subsidized premiums. Ninety-five percent (see Table below) of those who selected plans in Open Enrollment (OE) had effectuated enrollment in February).

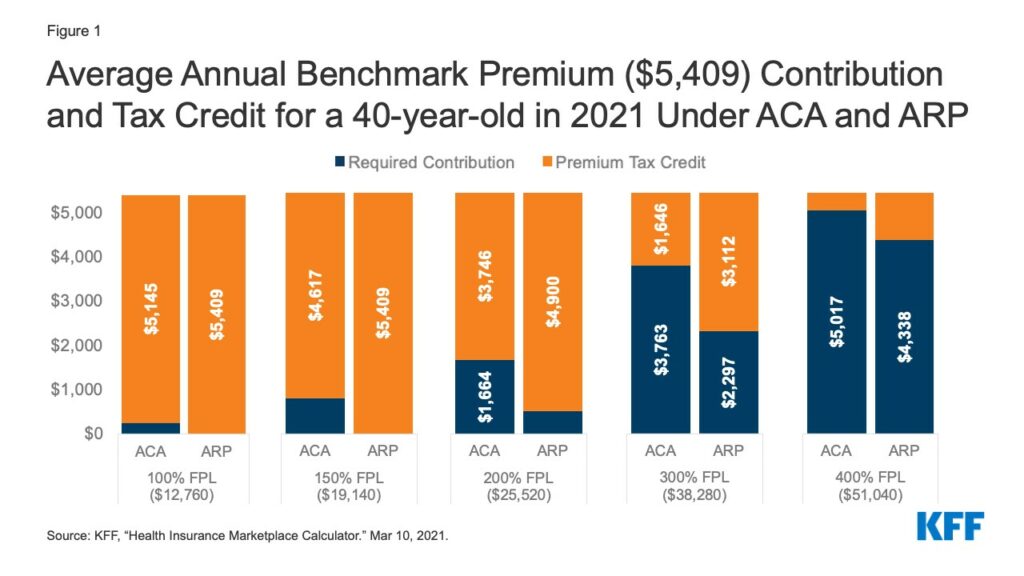

Gold plans become more affordable to more enrollees than ever this year. This is a boon to higher-income enrollees not qualifying for the strong Cost Sharing Reduction. Aggressively subsidized Silver plans are available up to at incomes up to 200% of the Federal Poverty Level (FPL).

People up to 150% FPL can obtain silver plans for zero premium with low deductibles. Rather than talk the talk, I am going to offer up a KFF chart getting the point across. See below and move left to right on each example. First column of each example shows what it was.

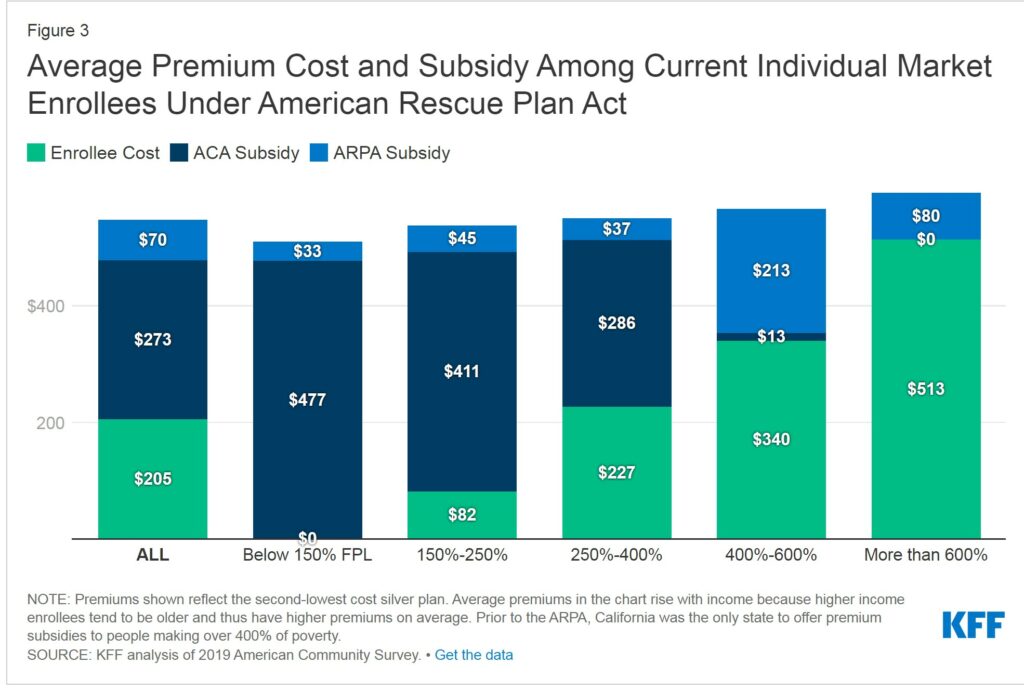

This next chart shows the income levels by FPL. Where subsidies stopped at 400% FPL, it now goes to greater than 600% of FPL. This s by $dollars.

Under the ARPA, Marketplace shoppers with higher incomes will still be liable for a larger share of their premium than people with lower incomes. On average, current individual market enrollees staying or entering the Marketplace will pay $205 per month for a benchmark silver plan. Prices ranging from $0 per month for people with incomes below 150% of poverty to an average of $513 per month for people with incomes over 600% of poverty. Keep in mind subsidies used to stop at 400% FPL. Now it stops at 600% FPL and the average i$513 per month for people with incomes over 600% of poverty. The ARPA eliminated the cliff.

There were issues in some states which did not expand with the ACA. The cut off for Medicaid was 100% FPL or in some cases less. The ARPA eliminated this issue. There is much good which came out of this expansion.

“Three cheer(ing) facts about the ACA marketplace for 2023′”, xpostfactoid, Andrew Sprung.

“Total individual market enrollment in health insurance may (finally) be at an all-time ACA-era high,” xpostfactoid, Andrew Sprung.

“How the American Rescue Plan Will Improve Affordability of Private Health Coverage,” KFF, Karen Pollitz,